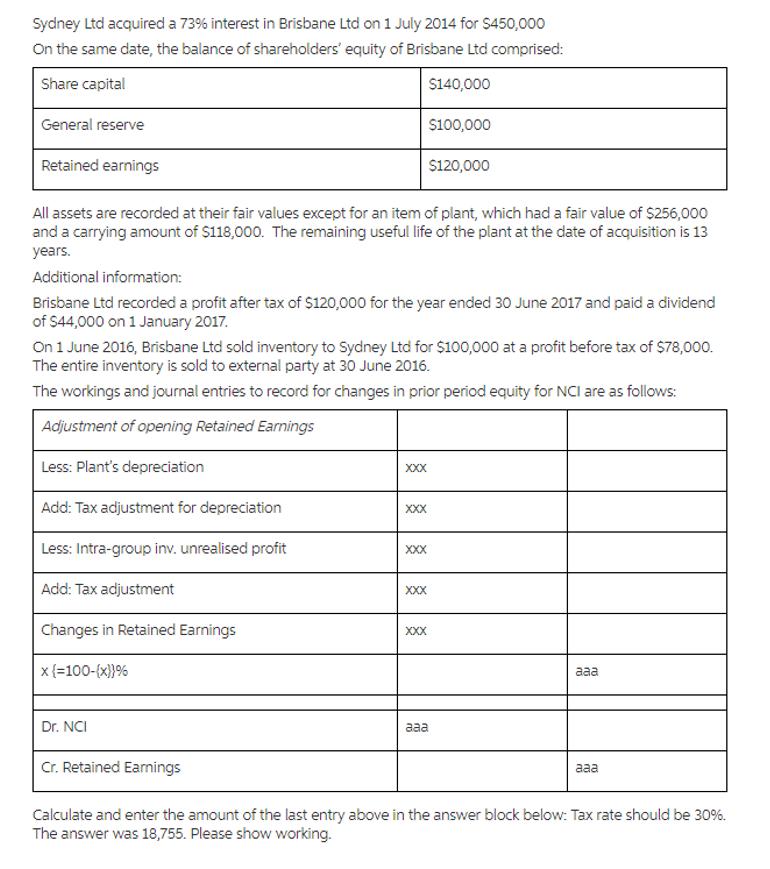

Question: Sydney Ltd acquired a 73% interest in Brisbane Ltd on 1 July 2014 for $450,000 On the same date, the balance of shareholders' equity

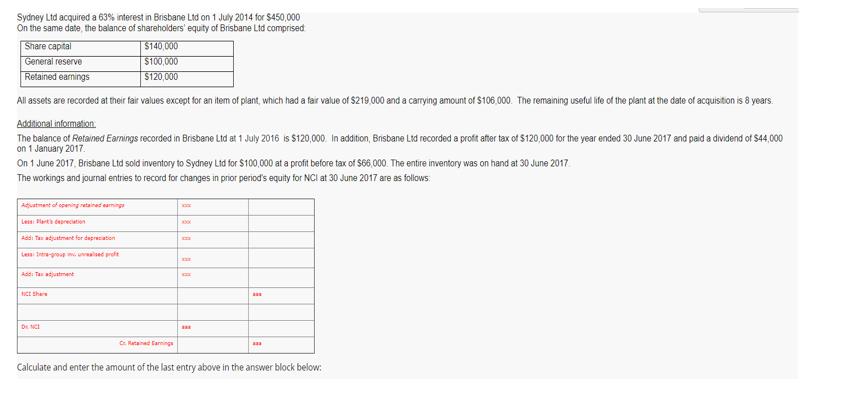

Sydney Ltd acquired a 73% interest in Brisbane Ltd on 1 July 2014 for $450,000 On the same date, the balance of shareholders' equity of Brisbane Ltd comprised: Share capital $140,000 General reserve Retained earnings All assets are recorded at their fair values except for an item of plant, which had a fair value of $256,000 and a carrying amount of $118,000. The remaining useful life of the plant at the date of acquisition is 13 years. Additional information: Brisbane Ltd recorded a profit after tax of $120,000 for the year ended 30 June 2017 and paid a dividend of $44,000 on 1 January 2017. Add: Tax adjustment for depreciation Less: Intra-group inv. unrealised profit Add: Tax adjustment Changes in Retained Earnings x {=100-(x)} % On 1 June 2016, Brisbane Ltd sold inventory to Sydney Ltd for $100,000 at a profit before tax of $78,000. The entire inventory is sold to external party at 30 June 2016. The workings and journal entries to record for changes in prior period equity for NCI are as follows: Adjustment of opening Retained Earnings Less: Plant's depreciation Dr. NCI Cr. Retained Earnings XXX XXX $100,000 XXX $120,000 XXX XXX aaa aaa aaa Calculate and enter the amount of the last entry above in the answer block below: Tax rate should be 30%. The answer was 18,755. Please show working. Sydney Ltd acquired a 63% interest in Brisbane Ltd on 1 July 2014 for $450,000 On the same date, the balance of shareholders' equity of Brisbane Ltd comprised Share capital General reserve Retained earnings All assets are recorded at their fair values except for an item of plant, which had a fair value of $219,000 and a carrying amount of $106.000. The remaining useful life of the plant at the date of acquisition is 8 years. Additional information: The balance of Retained Earnings recorded in Brisbane Ltd at 1 July 2016 is $120,000. In addition, Brisbane Ltd recorded a profit after tax of $120,000 for the year ended 30 June 2017 and paid a dividend of $44,000 on 1 January 2017. On 1 June 2017, Brisbane Ltd sold inventory to Sydney Ltd for $100,000 at a profit before tax of $66,000. The entire inventory was on hand at 30 June 2017 The workings and journal entries to record for changes in prior period's equity for NCI at 30 June 2017 are as follows: Adjustment of opening retained earnings Add Tax adjustment for depreciation Les In-group mualsed profe Add: T fict the DINC $140,000 $100,000 $120,000 Craigs B 33 Calculate and enter the amount of the last entry above in the answer block below:

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

To calculate the amount for the last entry in the journal entries for changes in prior period equity for NCI at 30 June 2017 we need to consider the g... View full answer

Get step-by-step solutions from verified subject matter experts