Pan Corporation paid $577,500 cash for a 70 percent interest in Sir Corporation's outstanding common stock on

Question:

Pan Corporation paid $577,500 cash for a 70 percent interest in Sir Corporation's outstanding common stock on January 2, 2011, when the equity of Sir consisted of $500,000 common stock and $300,000 retained earnings. The excess fair value is due to goodwill.

In December 2011, Sir sold inventory items to Pan at a gross profit of $50,000 (selling price $120,000 and cost $70,000), and all these items were included in Pan's inventory at December 31, 2011.

Sir paid dividends of $50,000 in 2011, and an 80 percent dividends-received deduction is applicable.

A flat 34 percent income tax rate is applicable to both companies.

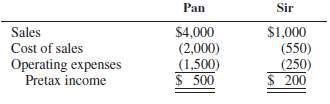

Separate pretax incomes of Pan and Sir for 2011 are as follows (in thousands):

REQUIRED1. Determine 2011 income tax currently payable and income tax expense for Pan and Sir.2. Calculate Pan's income from Sir for 2011.3. Prepare a consolidated income statement for Pan and Sir for 2011.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Consolidated Income Statement

When talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith