Question: Question 1: Question 2: American Express is thinking to do a customer acquisition campaign, in which they plan to offer $500 to anyone who open

Question 1:

Question 2: American Express is thinking to do a customer acquisition campaign, in which they plan to offer $500 to anyone who open a new Platinum card account. Does it make sense for the company to spend so much money on luring new customers? Yes or No?

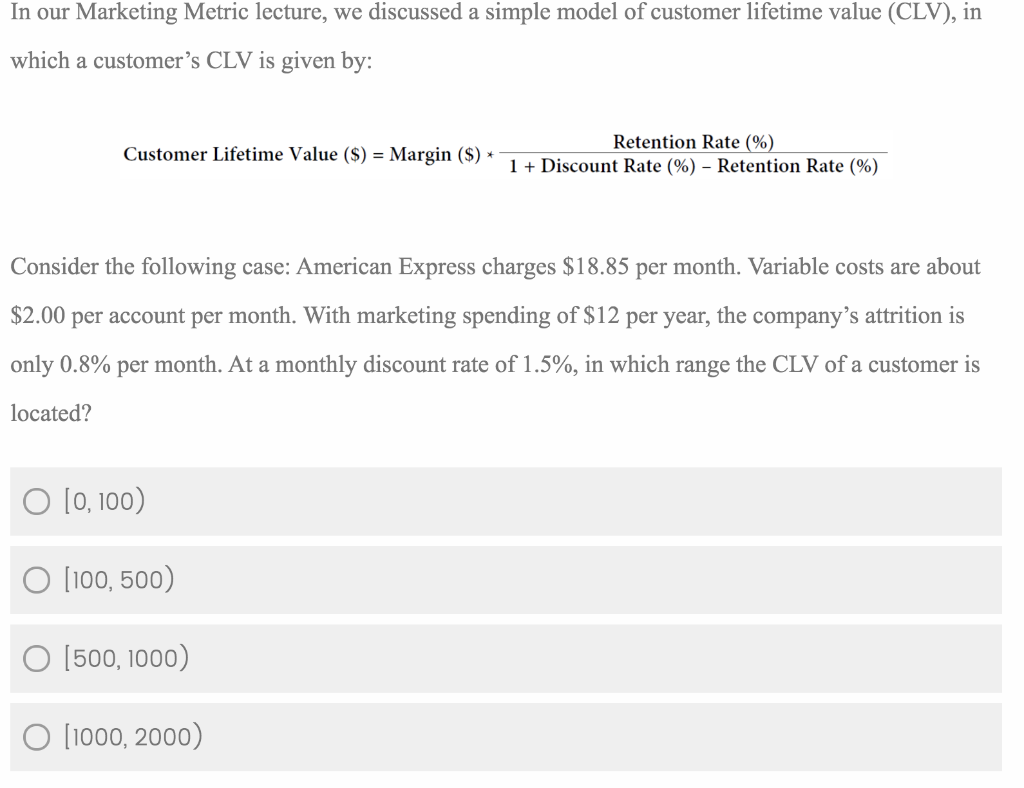

In our Marketing Metric lecture, we discussed a simple model of customer lifetime value (CLV), in which a customer's CLV is given by: Customer Lifetime Value ($) = Margin ($) * Retention Rate (%) 1 + Discount Rate (%) - Retention Rate (%) Consider the following case: American Express charges $18.85 per month. Variable costs are about $2.00 per account per month. With marketing spending of $12 per year, the company's attrition is only 0.8% per month. At a monthly discount rate of 1.5%, in which range the CLV of a customer is located? O [0, 100) O (100, 500) O (500, 1000) O (1000, 2000) In our Marketing Metric lecture, we discussed a simple model of customer lifetime value (CLV), in which a customer's CLV is given by: Customer Lifetime Value ($) = Margin ($) * Retention Rate (%) 1 + Discount Rate (%) - Retention Rate (%) Consider the following case: American Express charges $18.85 per month. Variable costs are about $2.00 per account per month. With marketing spending of $12 per year, the company's attrition is only 0.8% per month. At a monthly discount rate of 1.5%, in which range the CLV of a customer is located? O [0, 100) O (100, 500) O (500, 1000) O (1000, 2000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts