Question: 61 11. (MLC Sample Structural Question #10) Your company issues special single premium 3- year endowment insurances. You are given: (i) The death benefit is

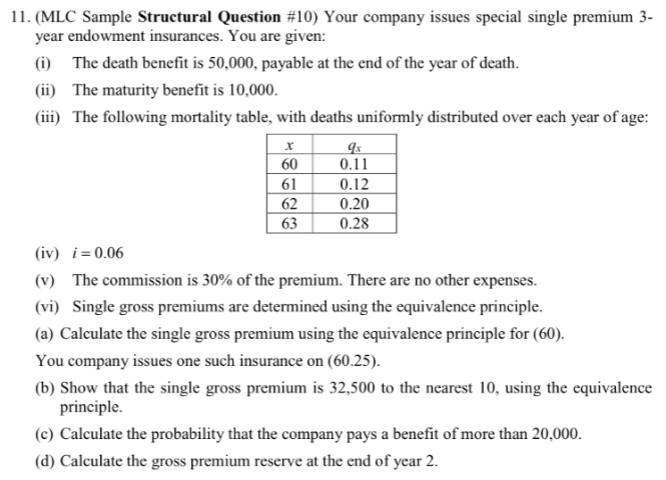

61 11. (MLC Sample Structural Question #10) Your company issues special single premium 3- year endowment insurances. You are given: (i) The death benefit is 50,000, payable at the end of the year of death. (ii) The maturity benefit is 10,000. (iii) The following mortality table, with deaths uniformly distributed over each year of age: r qx 60 0.11 0.12 62 0.20 63 0.28 (iv) i = 0.06 (v) The commission is 30% of the premium. There are no other expenses. (vi) Single gross premiums are determined using the equivalence principle. (a) Calculate the single gross premium using the equivalence principle for (60). You company issues one such insurance on (60.25). (b) Show that the single gross premium is 32,500 to the nearest 10, using the equivalence principle. (c) Calculate the probability that the company pays a benefit of more than 20,000. (d) Calculate the gross premium reserve at the end of year 2. 61 11. (MLC Sample Structural Question #10) Your company issues special single premium 3- year endowment insurances. You are given: (i) The death benefit is 50,000, payable at the end of the year of death. (ii) The maturity benefit is 10,000. (iii) The following mortality table, with deaths uniformly distributed over each year of age: r qx 60 0.11 0.12 62 0.20 63 0.28 (iv) i = 0.06 (v) The commission is 30% of the premium. There are no other expenses. (vi) Single gross premiums are determined using the equivalence principle. (a) Calculate the single gross premium using the equivalence principle for (60). You company issues one such insurance on (60.25). (b) Show that the single gross premium is 32,500 to the nearest 10, using the equivalence principle. (c) Calculate the probability that the company pays a benefit of more than 20,000. (d) Calculate the gross premium reserve at the end of year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts