Question: Question 1 Question 2 PLEASE GIVE ME A CALCULATION. The following table shows the initial balance sheet of a hypothetical bank. There are no reserves

Question 1

Question 2

PLEASE GIVE ME A CALCULATION.

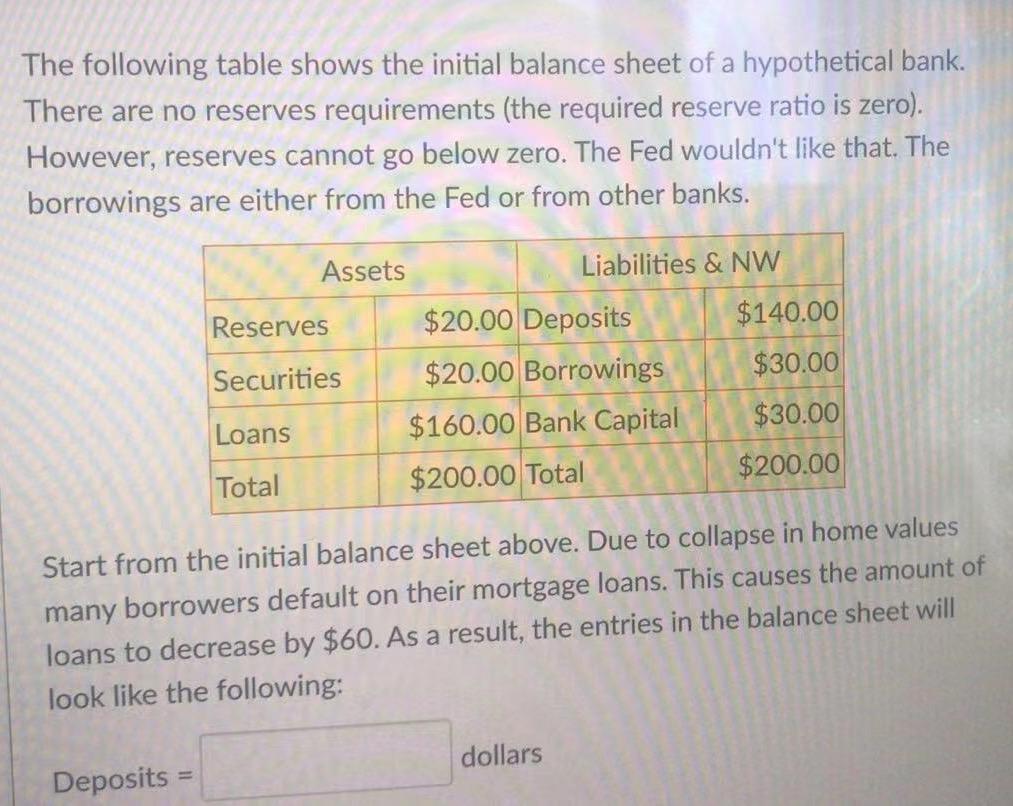

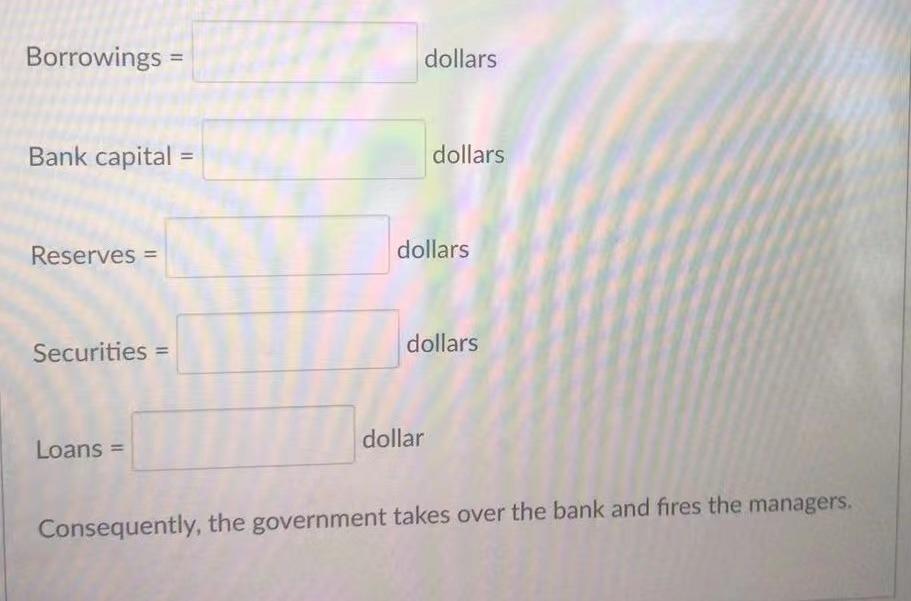

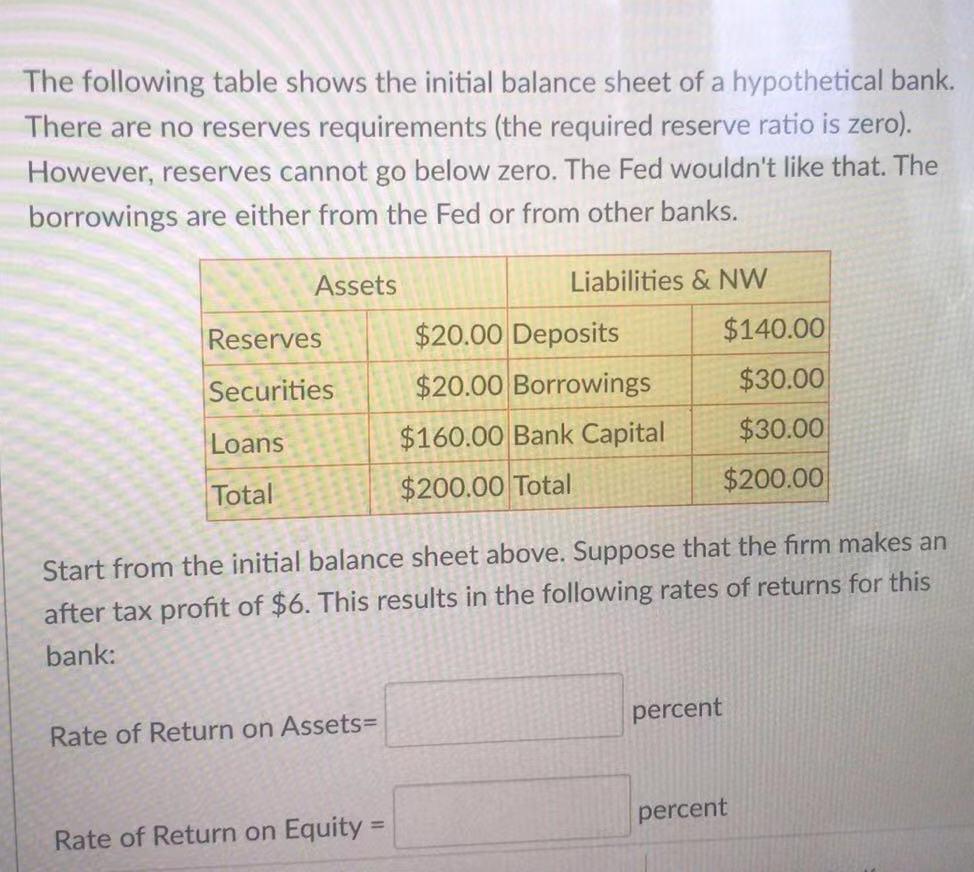

The following table shows the initial balance sheet of a hypothetical bank. There are no reserves requirements (the required reserve ratio is zero). However, reserves cannot go below zero. The Fed wouldn't like that. The borrowings are either from the Fed or from other banks. Assets Liabilities & NW Reserves $20.00 Deposits $140.00 Securities $20.00 Borrowings $30.00 Loans $160.00 Bank Capital $30.00 Total $200.00 Total $200.00 Start from the initial balance sheet above. Due to collapse in home values many borrowers default on their mortgage loans. This causes the amount of loans to decrease by $60. As a result, the entries in the balance sheet will look like the following: dollars Deposits Borrowings = dollars Bank capital = dollars Reserves = dollars dollars Securities = Loans = dollar Consequently, the government takes over the bank and fires the managers. The following table shows the initial balance sheet of a hypothetical bank. There are no reserves requirements (the required reserve ratio is zero). However, reserves cannot go below zero. The Fed wouldn't like that. The borrowings are either from the Fed or from other banks. Assets Liabilities & NW Reserves $20.00 Deposits $140.00 Securities $20.00 Borrowings $30.00 Loans $160.00 Bank Capital $30.00 Total $200.00 Total $200.00 Start from the initial balance sheet above. Suppose that the firm makes an after tax profit of $6. This results in the following rates of returns for this bank: percent Rate of Return on Assets= percent Rate of Return on Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts