Question: solve in 25 mins i will give thumb up. write final answer at end of solution separately The following table shows the initial balance sheet

solve in 25 mins i will give thumb up. write final answer at end of solution separately

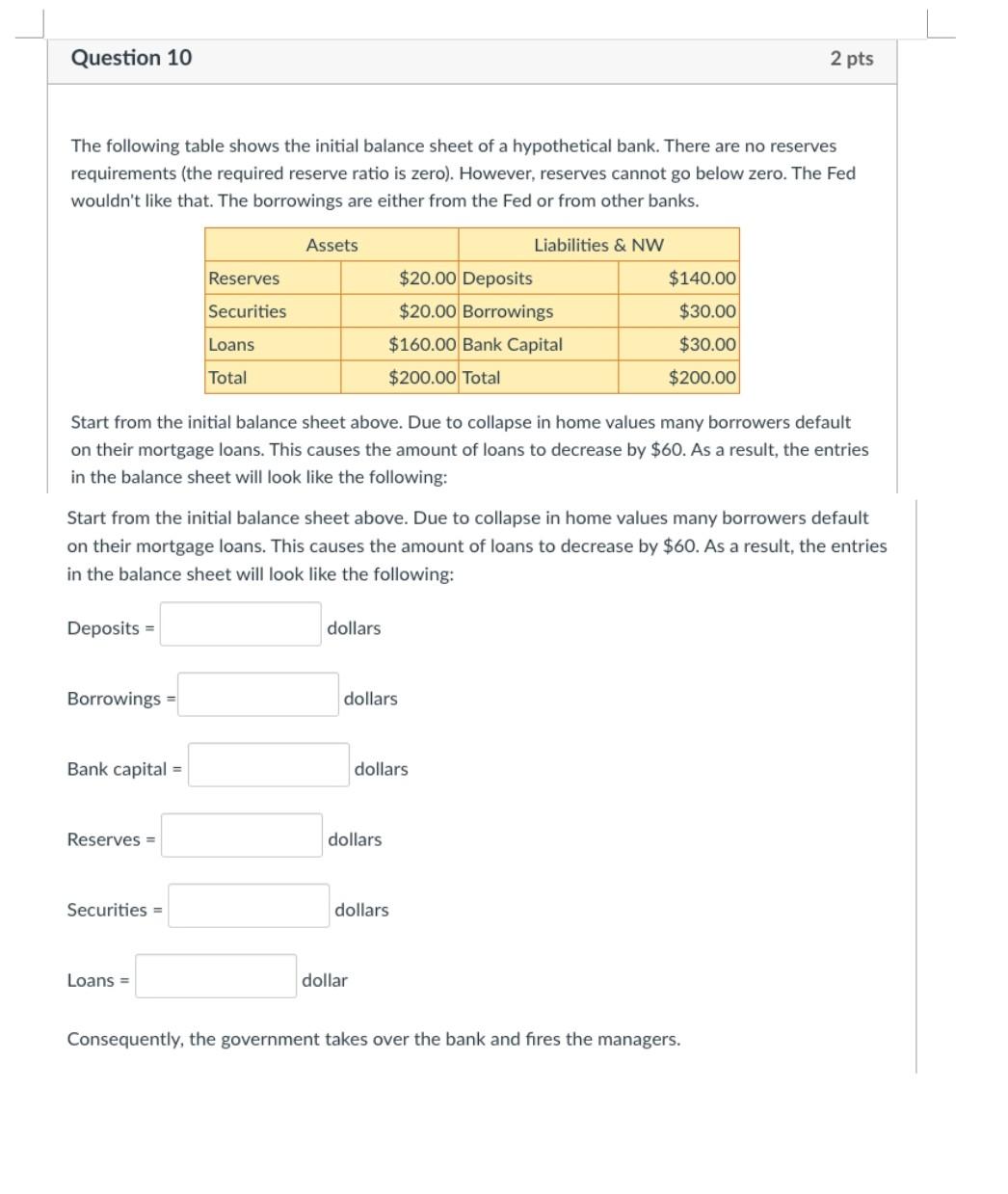

The following table shows the initial balance sheet of a hypothetical bank. There are no reserves requirements (the required reserve ratio is zero). However, reserves cannot go below zero. The Fed wouldn't like that. The borrowings are either from the Fed or from other banks. Start from the initial balance sheet above. Due to collapse in home values many borrowers default on their mortgage loans. This causes the amount of loans to decrease by $60. As a result, the entries in the balance sheet will look like the following: Start from the initial balance sheet above. Due to collapse in home values many borrowers default on their mortgage loans. This causes the amount of loans to decrease by $60. As a result, the entries in the balance sheet will look like the following: Deposits = dollars Borrowings=Bankcapital=Reserves=Securities=Loans=dodollarsdollarsdollar Consequently, the government takes over the bank and fires the managers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts