Question: question 1) question 2) question 3: a) b) c) d) e) The Supplies account is: Multiple Choice reported on the Income Statement and has a

question 1)

question 2)

question 3: a)

b)

c)

d)

e)

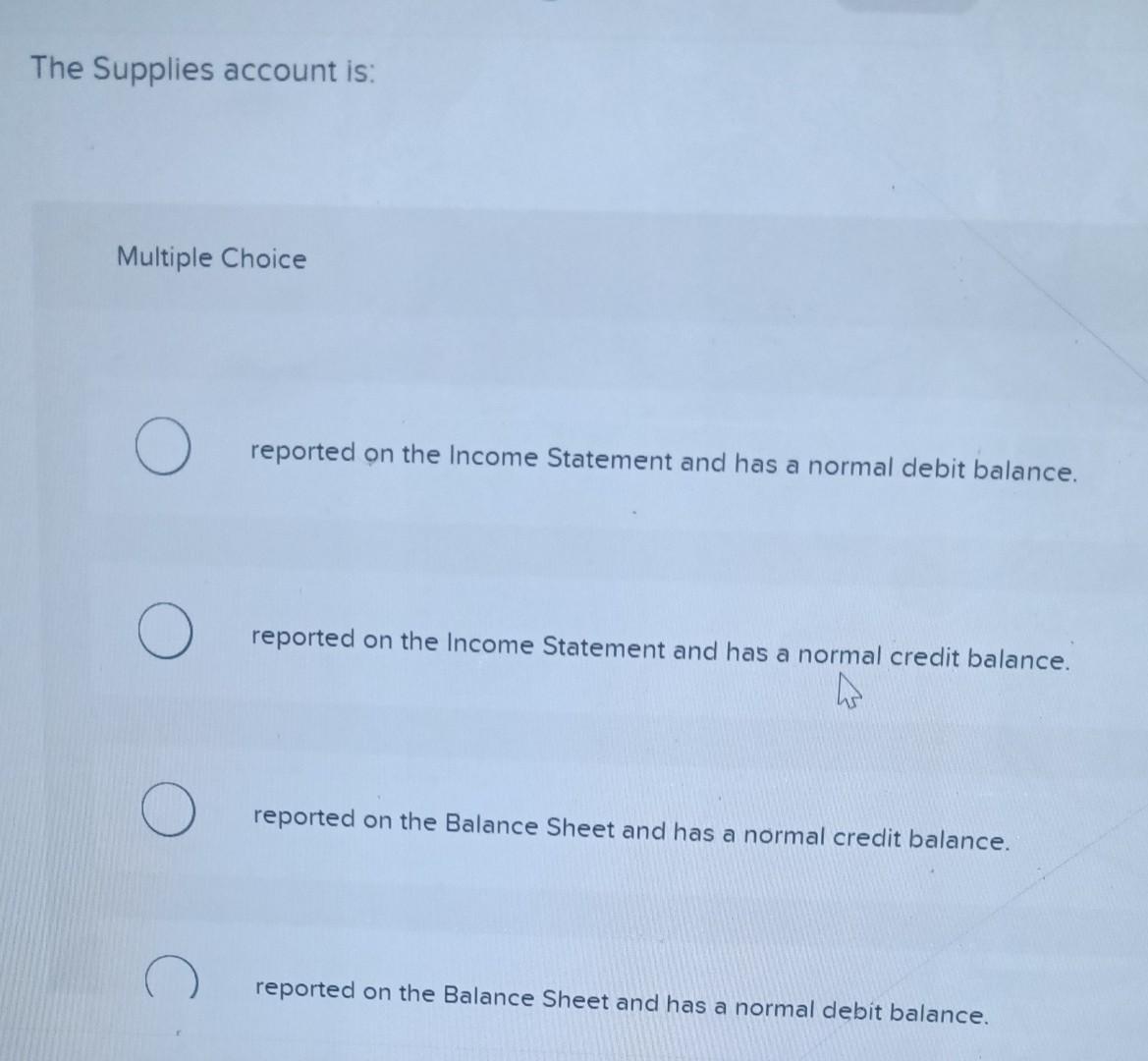

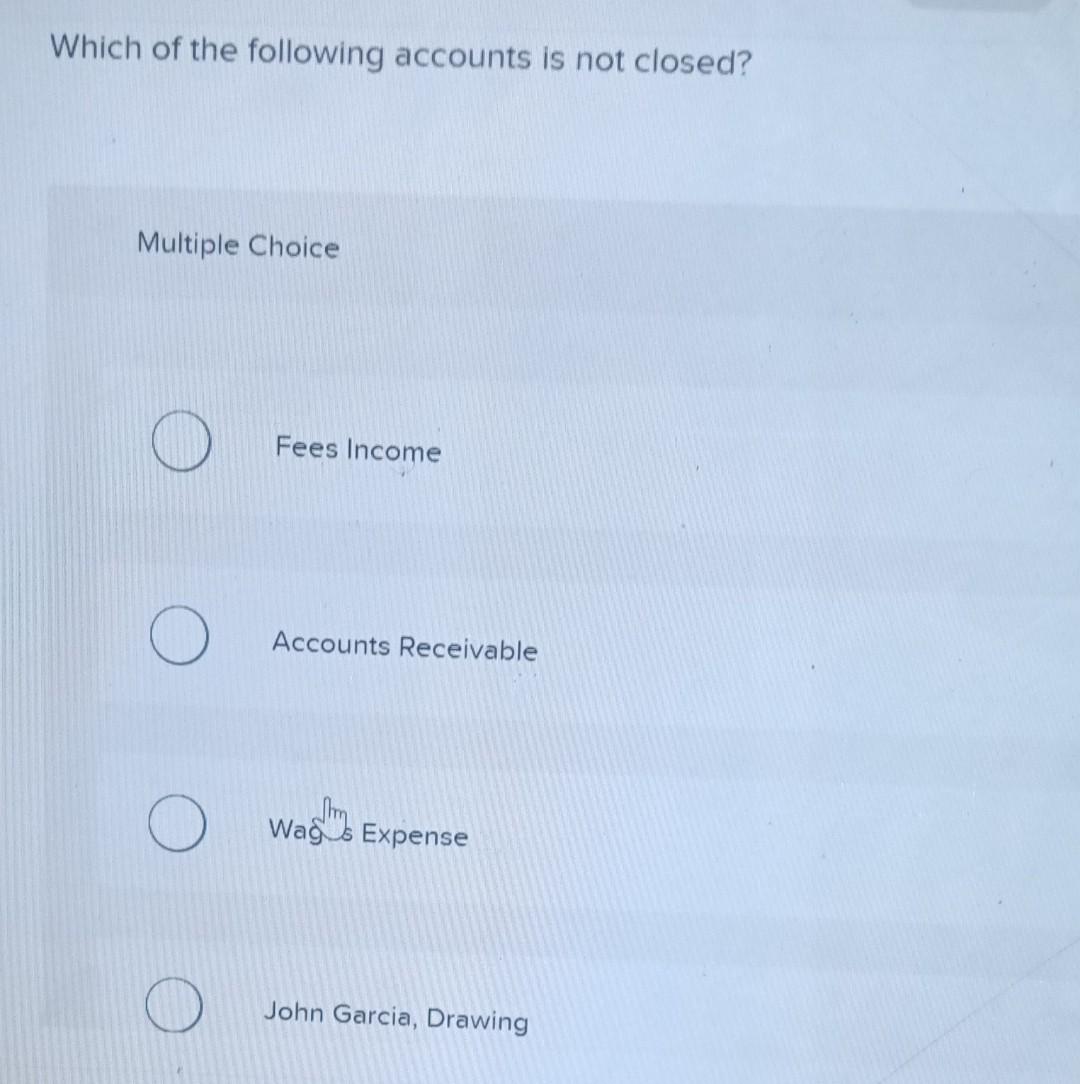

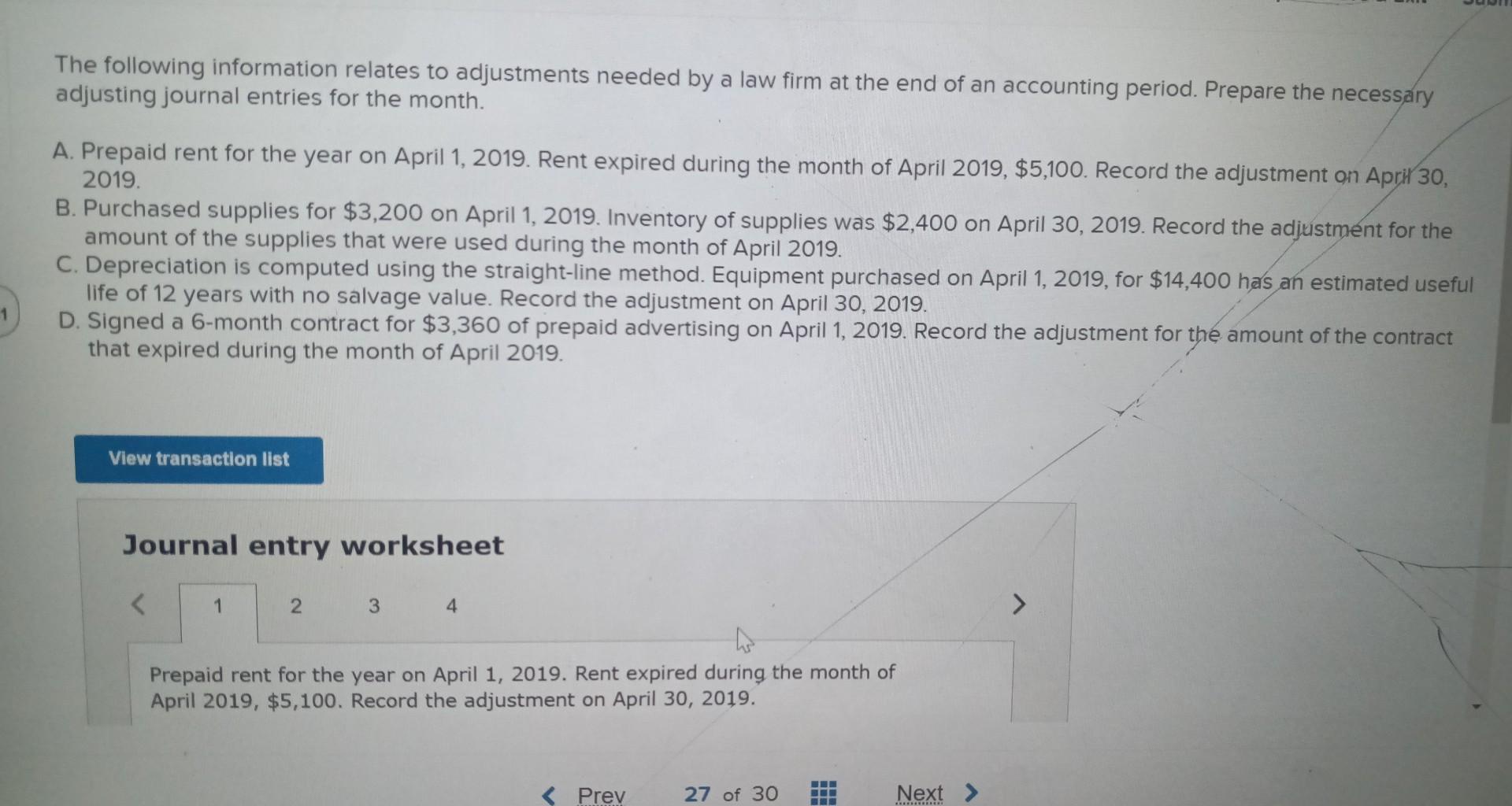

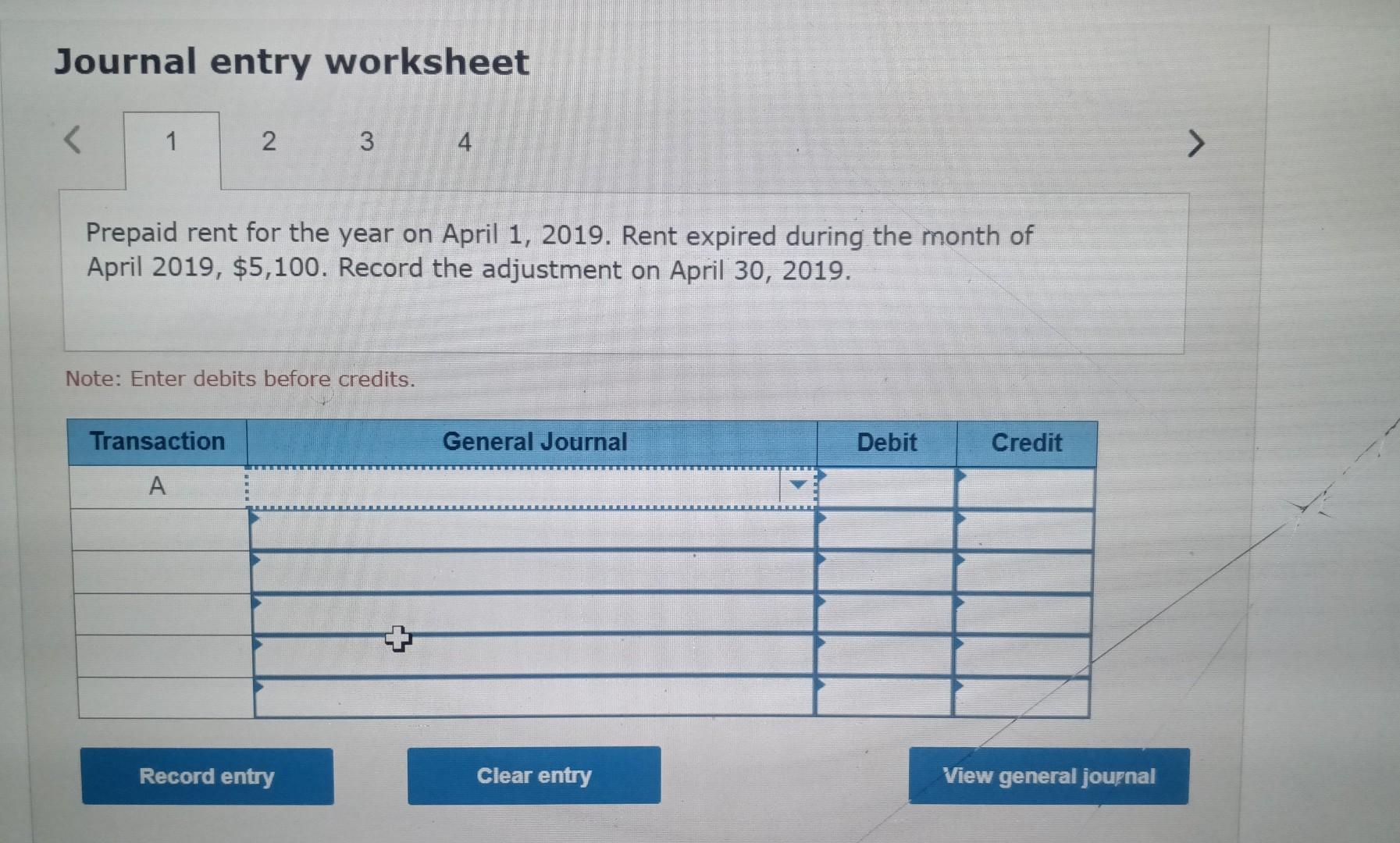

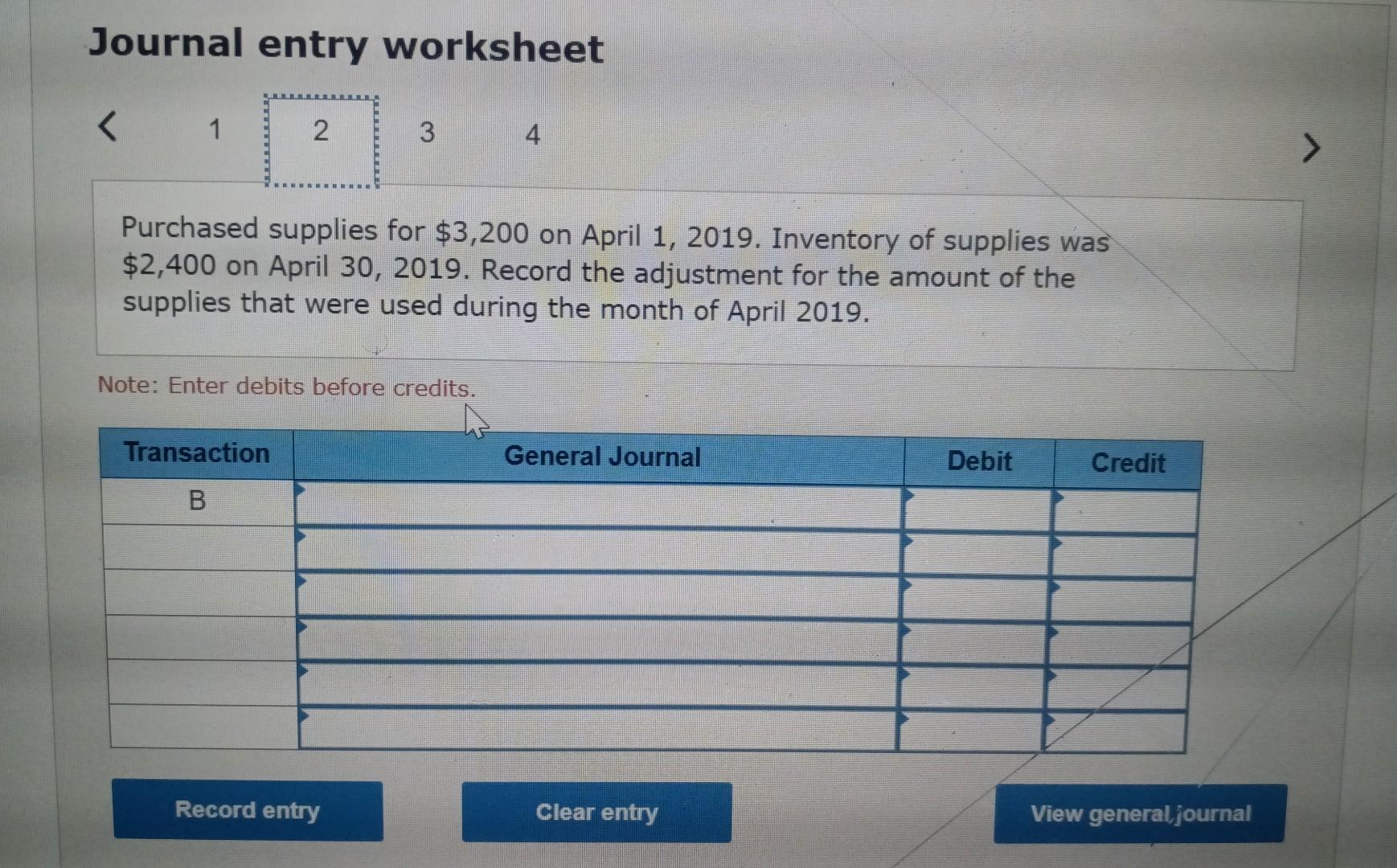

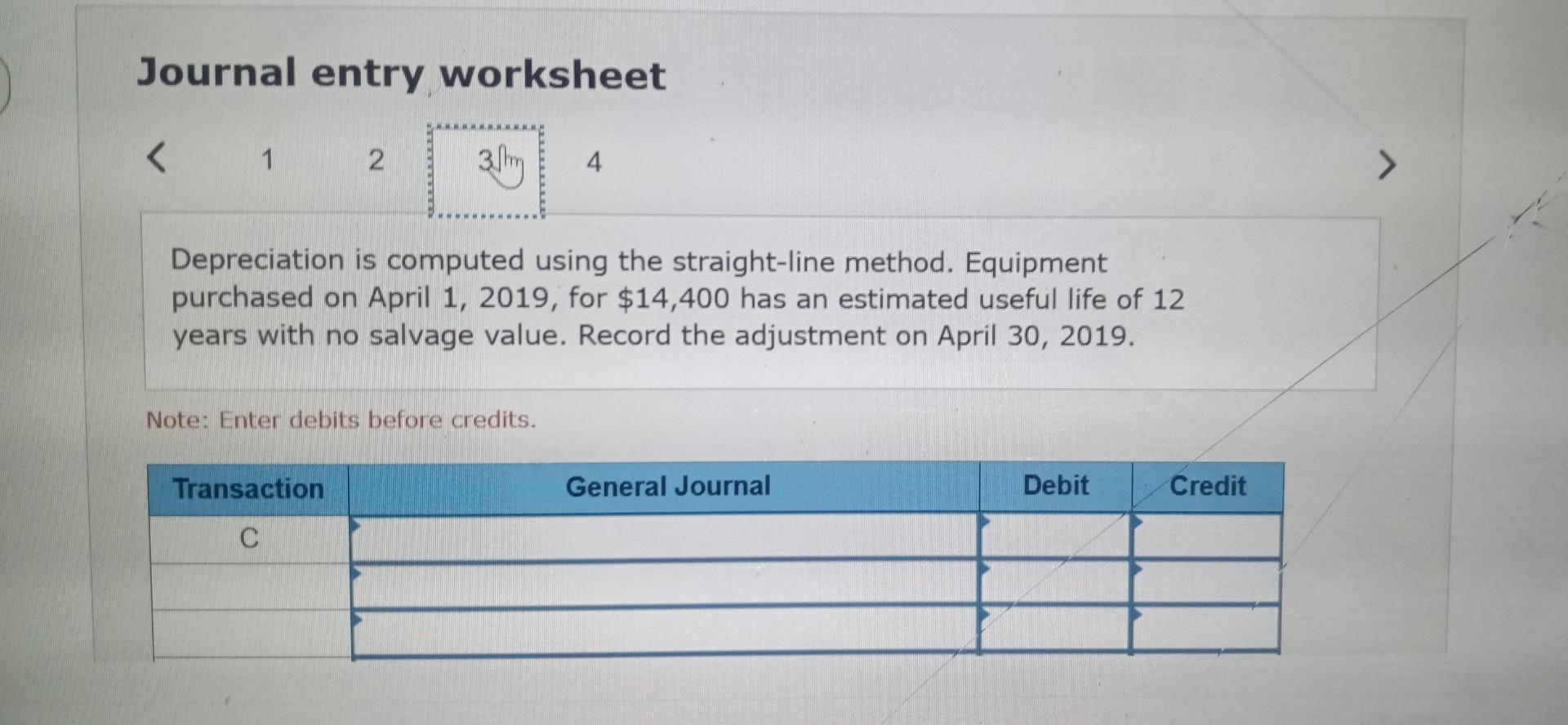

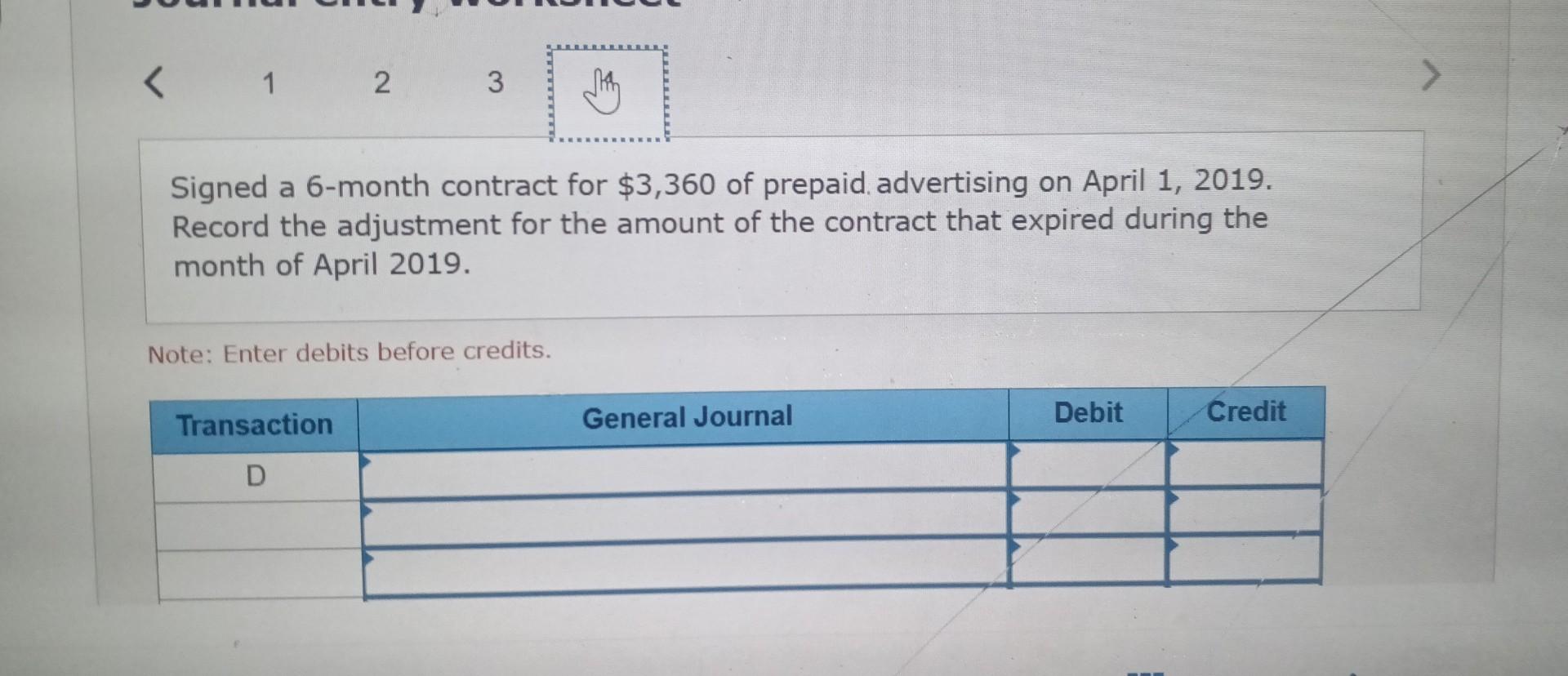

The Supplies account is: Multiple Choice reported on the Income Statement and has a normal debit balance. reported on the Income Statement and has a normal credit balance. reported on the Balance Sheet and has a normal credit balance. reported on the Balance Sheet and has a normal debit balance. Which of the following accounts is not closed? Multiple Choice Fees Income Accounts Receivable Waghos Expense John Garcia, Drawing The following information relates to adjustments needed by a law firm at the end of an accounting period. Prepare the necessary adjusting journal entries for the month. A. Prepaid rent for the year on April 1, 2019. Rent expired during the month of April 2019, $5,100. Record the adjustment on Apriv 30 , 2019. B. Purchased supplies for $3,200 on April 1, 2019. Inventory of supplies was $2,400 on April 30,2019 . Record the adjustment for the amount of the supplies that were used during the month of April 2019. C. Depreciation is computed using the straight-line method. Equipment purchased on April 1, 2019, for $14,400 has an estimated useful life of 12 years with no salvage value. Record the adjustment on April 30, 2019. D. Signed a 6-month contract for $3,360 of prepaid advertising on April 1, 2019. Record the adjustment for the amount of the contract that expired during the month of April 2019. Journal entry worksheet Prepaid rent for the year on April 1, 2019. Rent expired during the month of April 2019, $5,100. Record the adjustment on April 30, 2019. Journal entry worksheet Prepaid rent for the year on April 1, 2019. Rent expired during the month of April 2019, \$5,100. Record the adjustment on April 30, 2019. Note: Enter debits before credits. Journal entry worksheet Purchased supplies for $3,200 on April 1, 2019. Inventory of supplies was $2,400 on April 30,2019 . Record the adjustment for the amount of the supplies that were used during the month of April 2019. Note: Enter debits before credits. Journal entry worksheet Depreciation is computed using the straight-line method. Equipment purchased on April 1, 2019, for $14,400 has an estimated useful life of 12 years with no salvage value. Record the adjustment on April 30, 2019. Note: Enter debits before credits. Signed a 6-month contract for $3,360 of prepaid advertising on April 1, 2019. Record the adjustment for the amount of the contract that expired during the month of April 2019. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts