Question: Question 1: Question 2: Question 3: Please answer all 3 questions, thank you, will give thumbs up open correct answer Pharoah Industries is expanding its

Question 1:

Question 2:

Question 2:

Question 3:

Question 3:

Please answer all 3 questions, thank you, will give thumbs up open correct answer

Please answer all 3 questions, thank you, will give thumbs up open correct answer

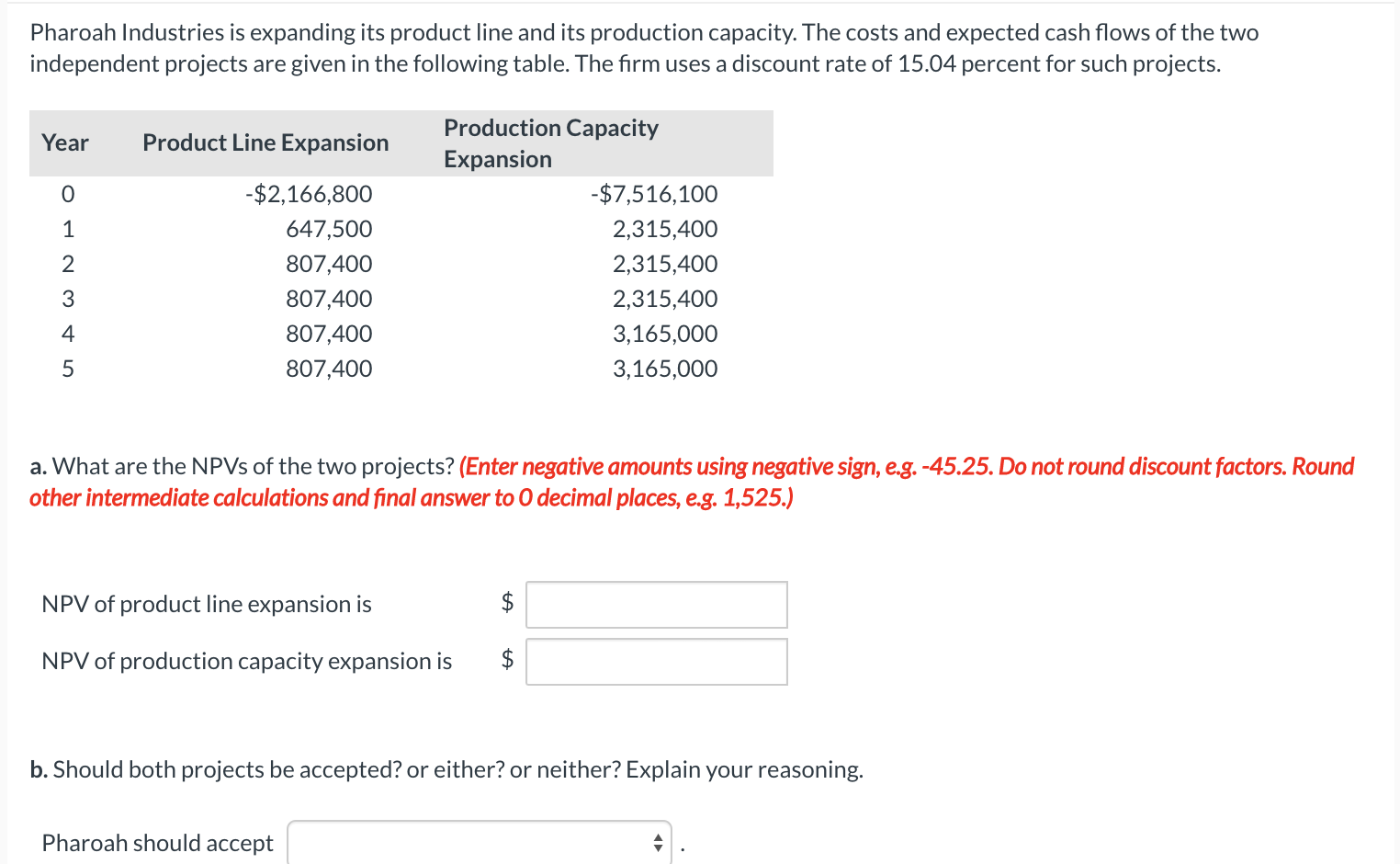

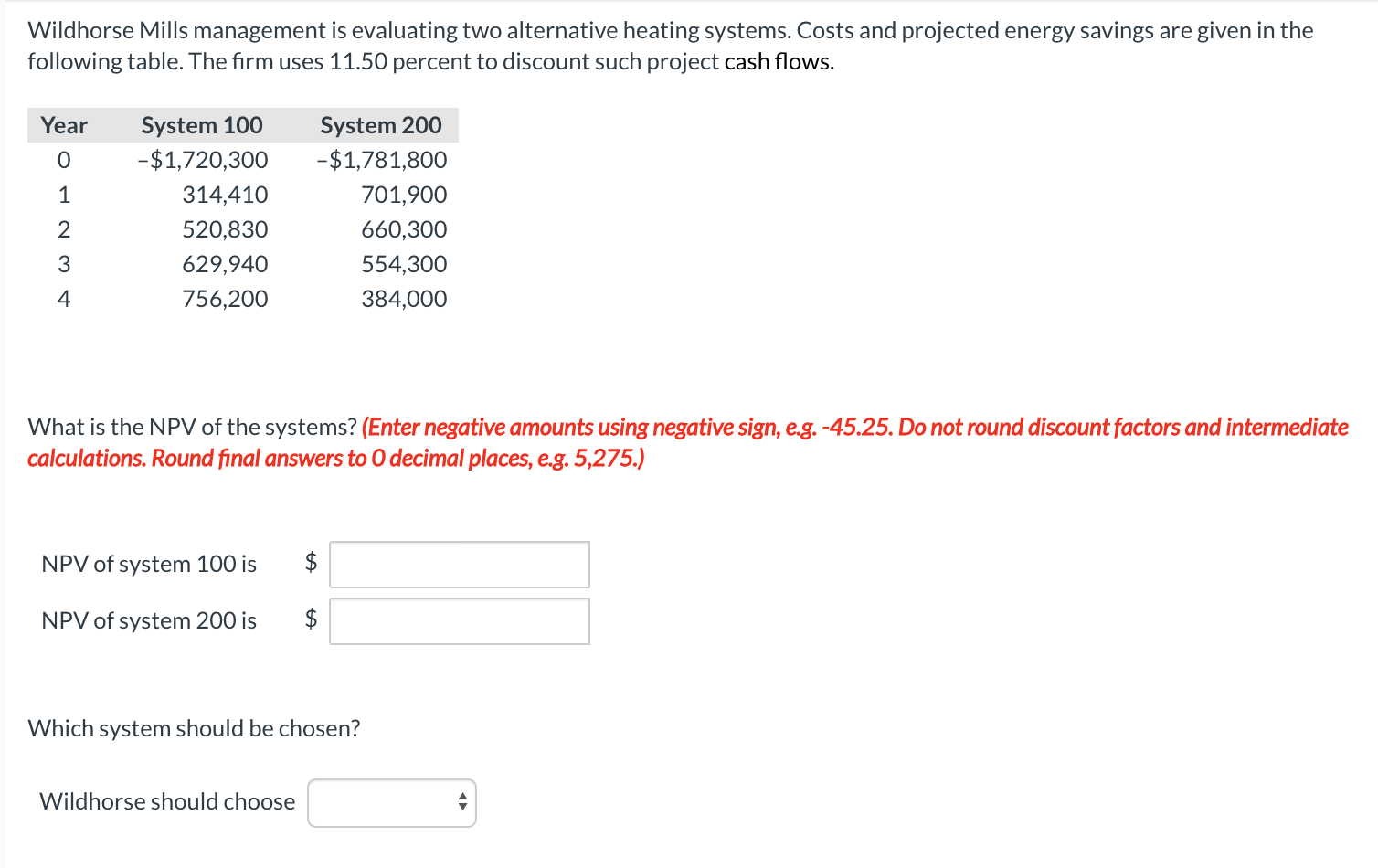

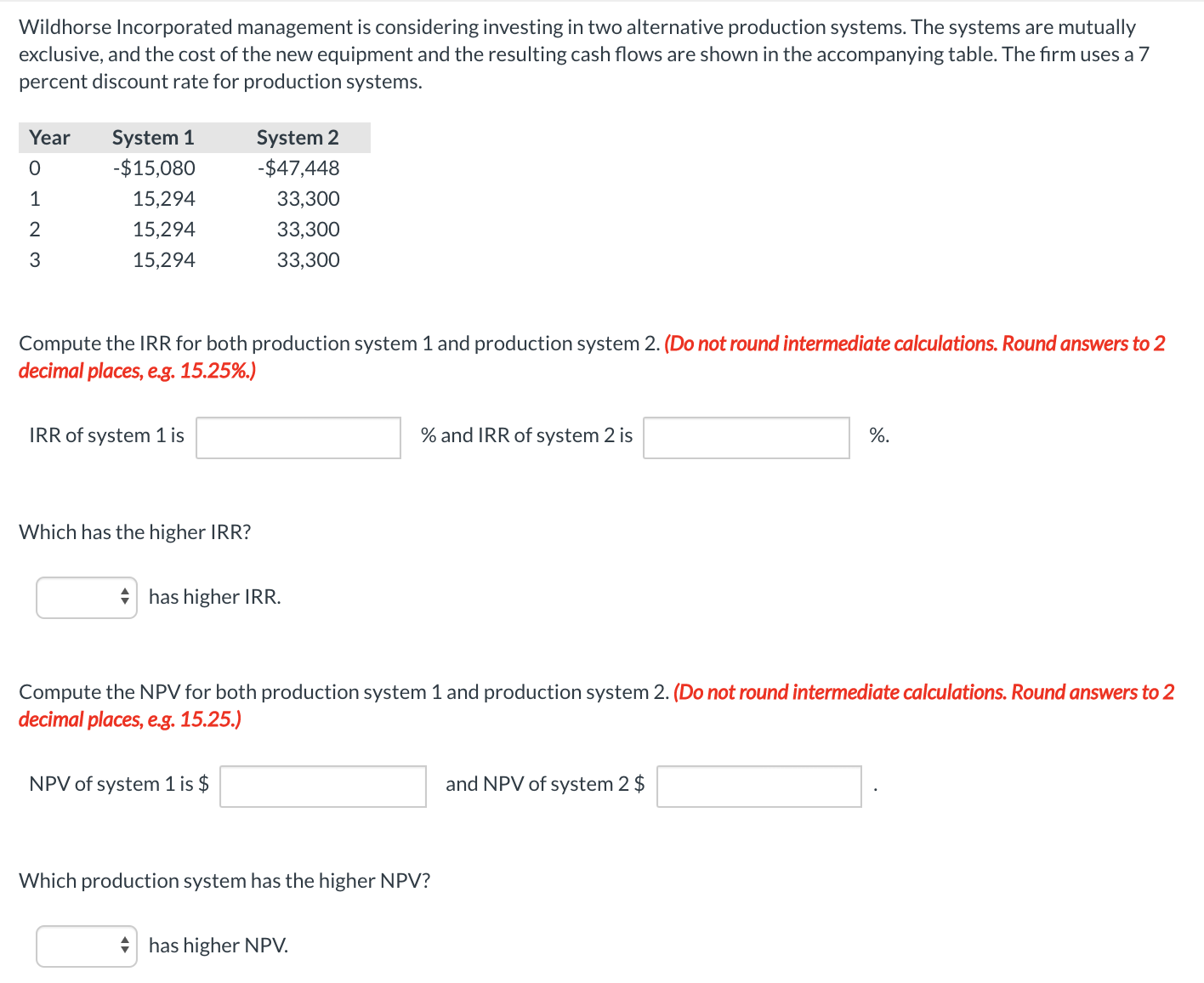

Pharoah Industries is expanding its product line and its production capacity. The costs and expected cash flows of the two independent projects are given in the following table. The firm uses a discount rate of 15.04 percent for such projects. Year Product Line Expansion 0 1 Production Capacity Expansion -$7,516,100 2,315,400 2,315,400 2,315,400 3,165,000 3,165,000 -$2,166,800 647,500 807,400 807,400 807,400 807,400 2 3 4 5 a. What are the NPVs of the two projects? (Enter negative amounts using negative sign, e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) NPV of product line expansion is $ NPV of production capacity expansion is $ b. Should both projects be accepted? or either? or neither? Explain your reasoning. Pharoah should accept Wildhorse Mills management is evaluating two alternative heating systems. Costs and projected energy savings are given in the following table. The firm uses 11.50 percent to discount such project cash flows. Year 0 1 System 100 -$1,720,300 314,410 520,830 629,940 756,200 System 200 -$1,781,800 701,900 660,300 554,300 384,000 2 3 4 What is the NPV of the systems? (Enter negative amounts using negative sign, e.g. -45.25. Do not round discount factors and intermediate calculations. Round final answers to 0 decimal places, e.g. 5,275.) NPV of system 100 is $ NPV of system 200 is Which system should be chosen? Wildhorse should choose Wildhorse Incorporated management is considering investing in two alternative production systems. The systems are mutually exclusive, and the cost of the new equipment and the resulting cash flows are shown in the accompanying table. The firm uses a 7 percent discount rate for production systems. Year 0 1 System 1 -$15,080 15,294 15,294 15,294 System 2 -$47,448 33,300 33,300 33,300 2 3 Compute the IRR for both production system 1 and production system 2. (Do not round intermediate calculations. Round answers to 2 decimal places, e.g. 15.25%.) IRR of system 1 is % and IRR of system 2 is %. Which has the higher IRR? has higher IRR. Compute the NPV for both production system 1 and production system 2. (Do not round intermediate calculations. Round answers to 2 decimal places, e.g. 15.25.) NPV of system 1 is $ and NPV of system 2 $ Which production system has the higher NPV? A has higher NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts