Question: Question 1: Question 2: Question 3: Question 4: An investment project requires an initial investment of ( $ 220,000 ). The project is expected to

Question 1:

Question 2:

Question 3:

Question 4:

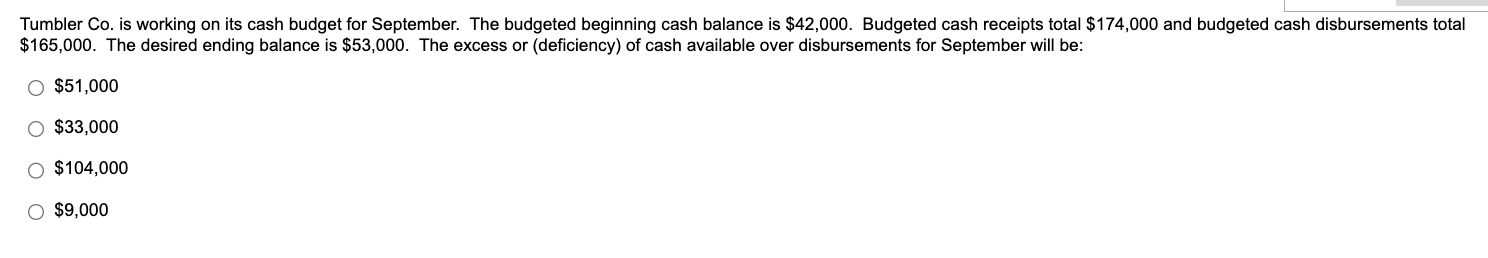

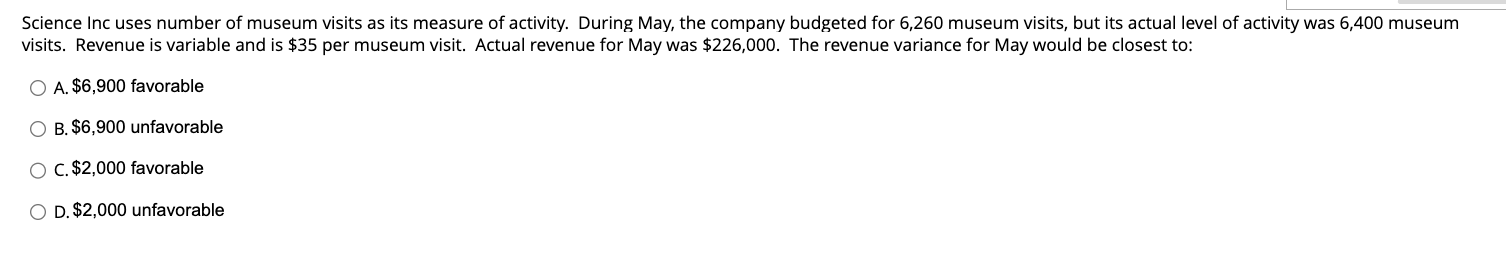

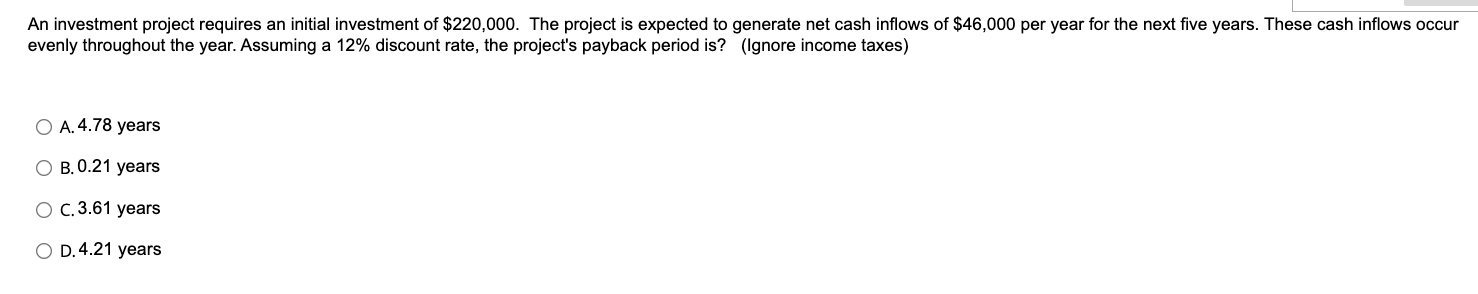

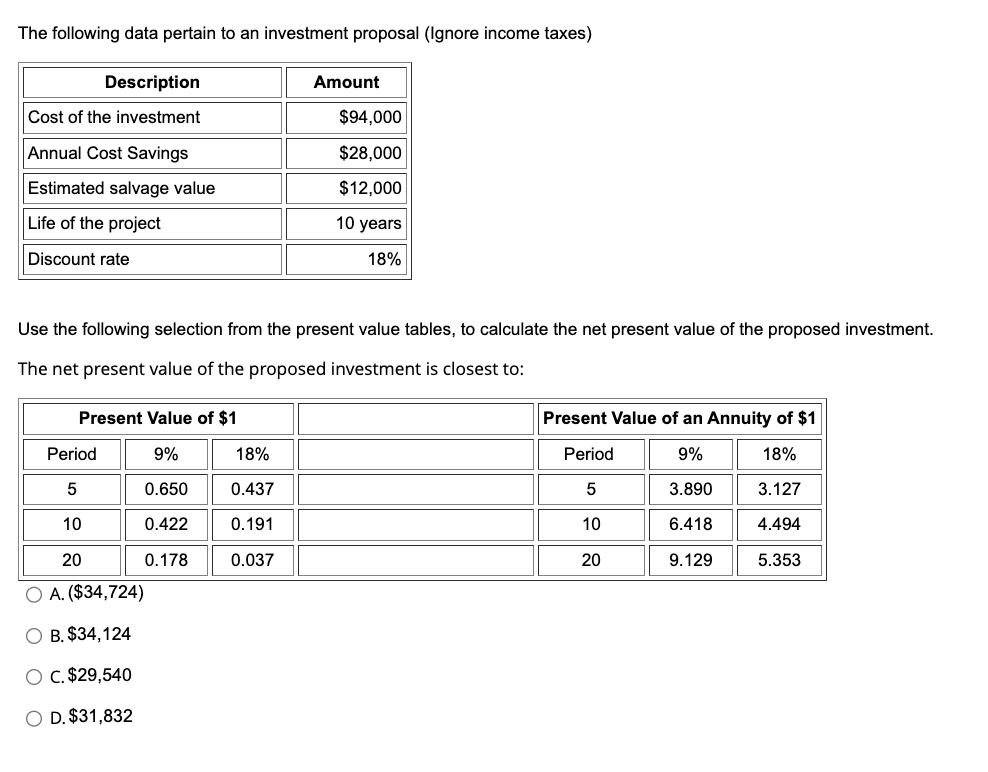

An investment project requires an initial investment of \\( \\$ 220,000 \\). The project is expected to generate net cash inflows of \\( \\$ 46,000 \\) per year for the next five years. These cash inflows occur evenly throughout the year. Assuming a \12 discount rate, the project's payback period is? (Ignore income taxes) A. 4.78 years B. 0.21 years C. 3.61 years D. 4.21 years Tumbler Co. is working on its cash budget for September. The budgeted beginning cash balance is \\( \\$ 42,000 \\). Budgeted cash receipts total \\( \\$ 174,000 \\) and budgeted cash disbursements total \\( \\$ 165,000 \\). The desired ending balance is \\( \\$ 53,000 \\). The excess or (deficiency) of cash available over disbursements for September will be: \\[ \\begin{array}{l} \\$ 51,000 \\\\ \\$ 33,000 \\\\ \\$ 104,000 \\\\ \\$ 9,000 \\end{array} \\] The following data pertain to an investment proposal (Ignore income taxes) Use the following selection from the present value tables, to calculate the net present value of the proposed investment. The net present value of the proposed investment is closest to: A. \\( (\\$ 34,1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts