Question: Question 1: Question 2: Question 3: Question 4: Simon Company's year-end balance sheets follow. The company's income statements for the current year and one year

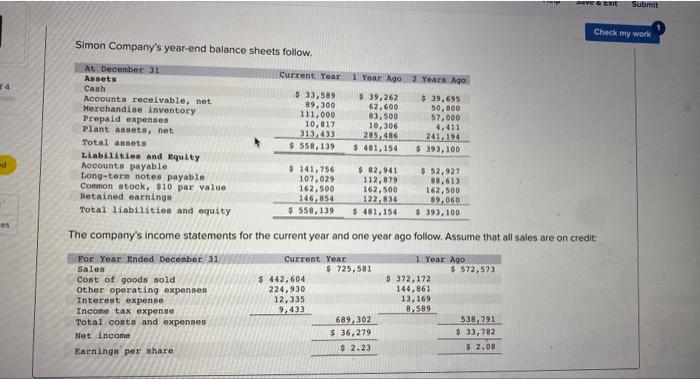

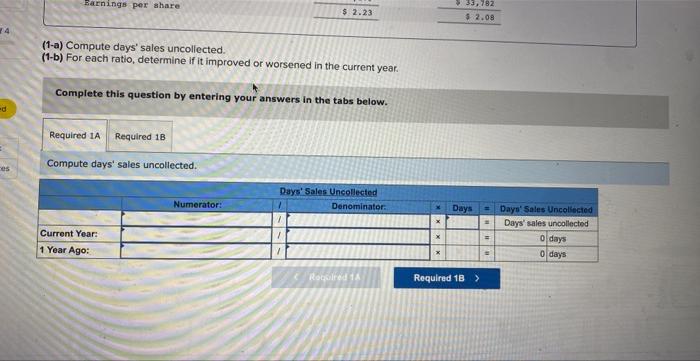

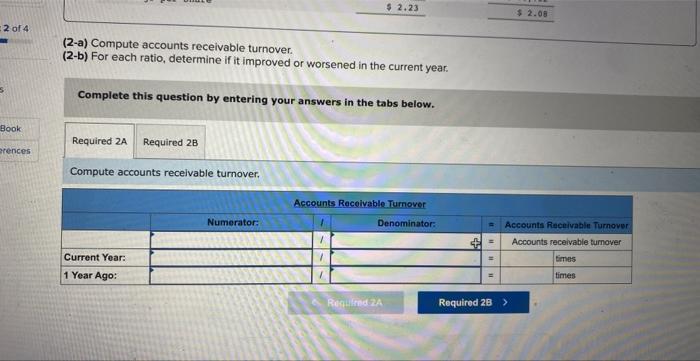

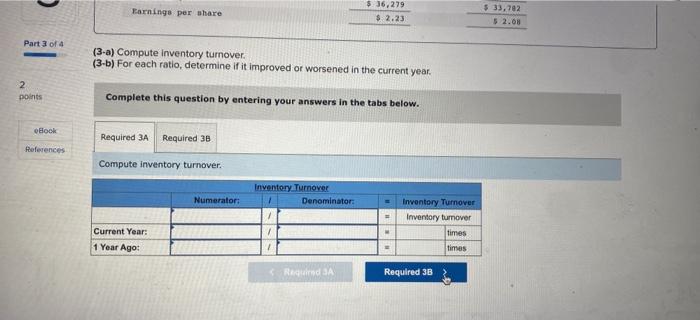

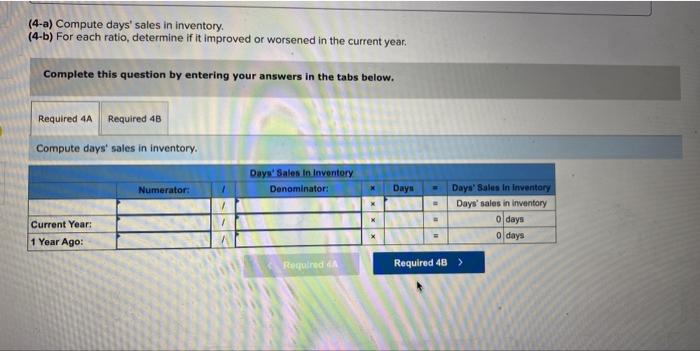

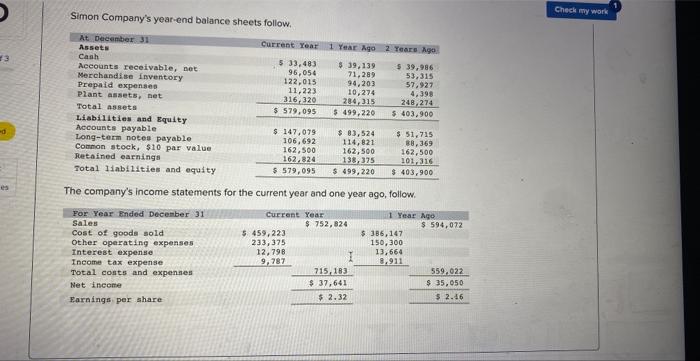

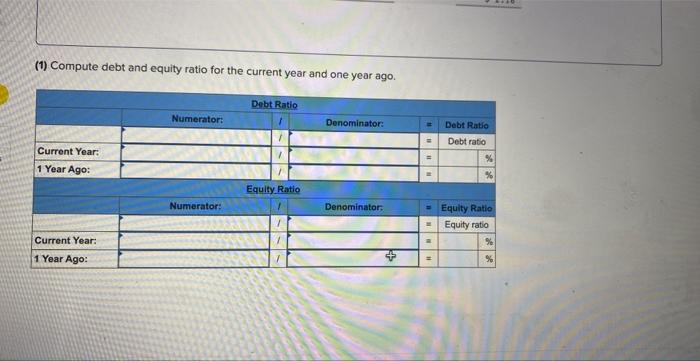

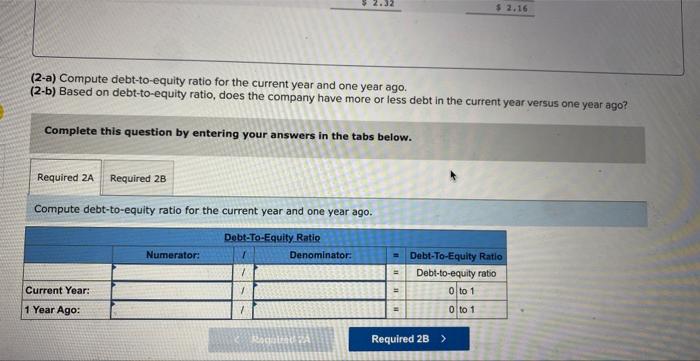

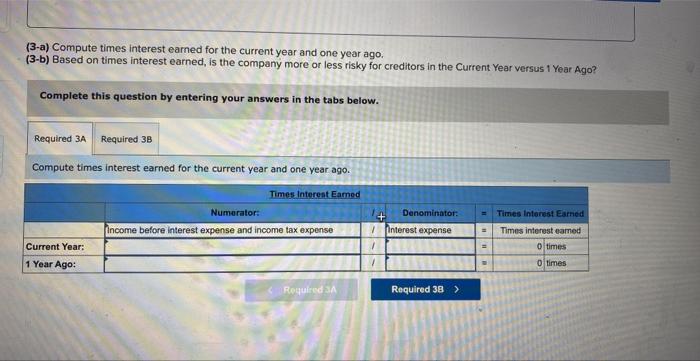

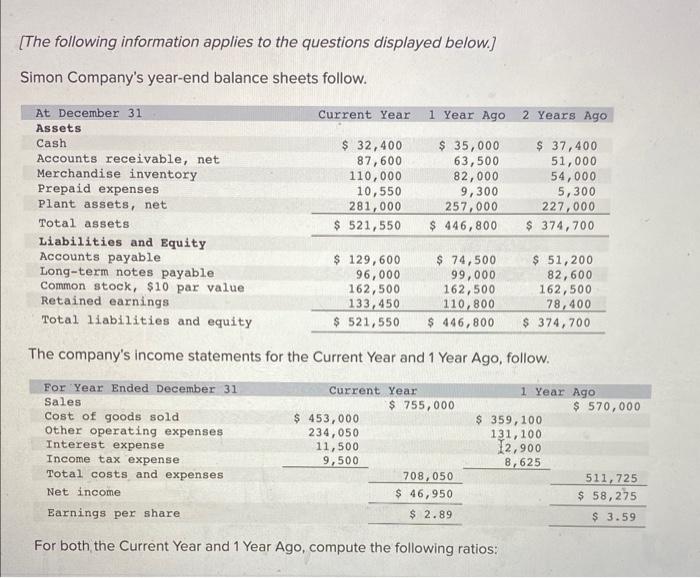

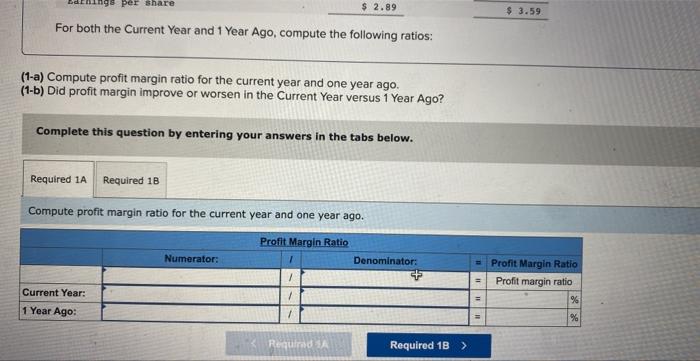

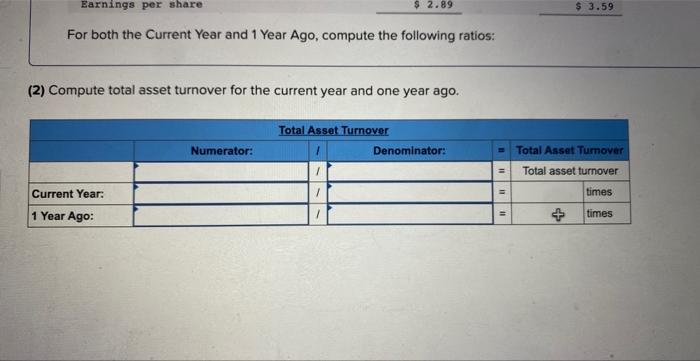

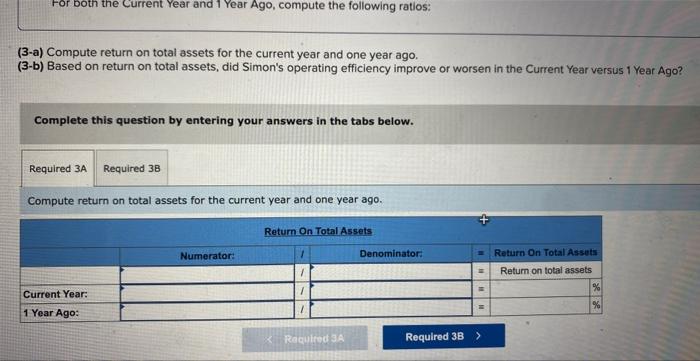

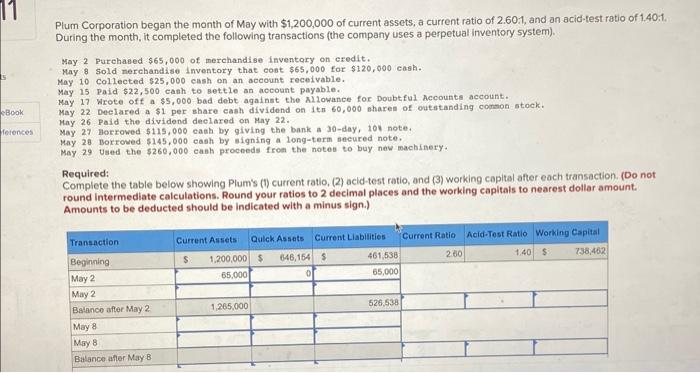

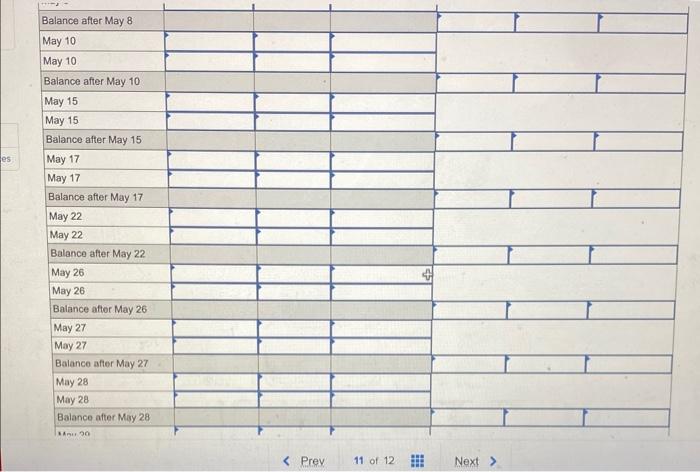

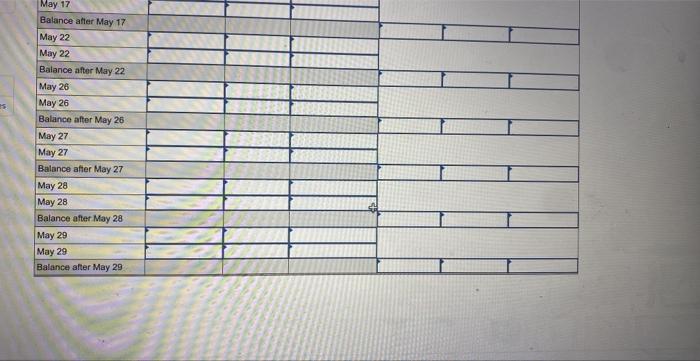

Simon Company's year-end balance sheets follow. The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: (1-a) Compute days' sales uncollected. (1-b) For each ratio, determine if it improved or worsened in the current year. Complete this question by entering your answers in the tabs below. Compute days' sales uncollected. (2-a) Compute accounts receivable turnover. (2-b) For each ratio, determine if it improved or worsened in the current year. Complete this question by entering your answers in the tabs below. Compute accounts receivable turnover. (3-a) Compute inventory turnover. (3-b) For each ratio, determine if it improved or worsened in the current year. Complete this question by entering your answers in the tabs below. Compute inventory turnover. (4-a) Compute days' sales in inventory. (4-b) For each ratio, determine if it improved or worsened in the current year. Complete this question by entering your answers in the tabs below. Compute days' sales in inventory. Simon Company's year-end balance sheets follow. The company's income statements for the current year and one year ago, follow. (1) Compute debt and equity ratio for the current year and one year ago. (2-a) Compute debt-to-equity ratio for the current year and one year ago. (2-b) Based on debt-to-equity ratio, does the company have more or less debt in the current year versus one year ago? Complete this question by entering your answers in the tabs below. Compute debt-to-equity ratio for the current year and one year ago. (3-a) Compute times interest earned for the current year and one year ago. (3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Compute times interest earned for the current year and one year ago. [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. The company's income statements for the Current Year and 1 Year Ago, follow. For both, the Current Year and 1 Year Ago, compute the following ratios: For both the Current Year and 1 Year Ago, compute the following ratios: (1-a) Compute profit margin ratio for the current year and one year ago. (1-b) Did profit margin improve or worsen in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Compute profit margin ratio for the current year and one year ago. For both the Current Year and 1 Year Ago, compute the following ratios: (2) Compute total asset turnover for the current year and one year ago. For Doth the Current Year and 1 Year Ago, compute the following ratios: (3-a) Compute return on total assets for the current year and one year ago. (3-b) Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Compute return on total assets for the current year and one year ago. Plum Corporation began the month of May with $1,200,000 of current assets, a current ratio of 2.601, and an acid-test ratio of 1.40:1. During the month, it completed the following transactions (the company uses a perpetual inventory system). May 2 Purchased $65,000 of merchandise inventory on credit. May 8 sold nerchandise inventory that cost $65,000 for $120,000 cash. May 10 Collected $25,000 eash on an account receivable. May 15 paid $22,500 cash to settle an account payable. May 17 Wrote off a $5,000 bad debt against the Allovance for Doubtful Accounts account. May 22 Deelared a $1 per share cash dividend on 1 tn 60,000 aharen of outstanding comson stock. May 26 . Paid the dividend declared on May 22. May 27 Borrowed $115,000 eanh by giving the bank a 30-day, 10 note. May 28. Borroved $145,000 eash by signing a leng-term secured note. May 29 Used the $260,000 cash proceeds fron the notes to buy new machinery. Required: Complete the table below showing Plum's (1) current ratio, (2) acid-test ratio, and (3) working capital after each transaction. (Do not round intermediate calculations. Round your ratios to 2 decimal places and the working capitals to nearest dollar amount. Amounts to be deducted should be indicated with a minus sign.) 12 Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts