Question: Question 1 Select the statement that is most correct. The SML relates required returns to the firms' market risk. The slope and intercept of this

Question

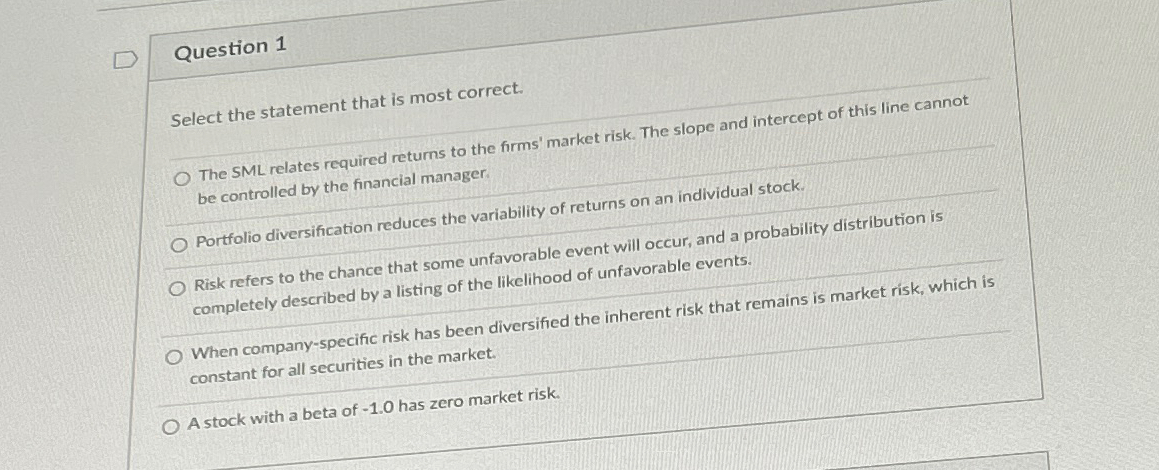

Select the statement that is most correct.

The SML relates required returns to the firms' market risk. The slope and intercept of this line cannot be controlled by the financial manager.

Portfolio diversification reduces the variability of returns on an individual stock.

Risk refers to the chance that some unfavorable event will occur, and a completely described by a listing of the likelihood of unfavorable events.

When companyspecific risk has been diversified the inherent risk that remains is market risk, which is constant for all securities in the market.

A stock with a beta of has zero market risk.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock