Question: QUESTION 1 (Show all workings) (a) Explain and define the concept of 'intrinsic value' as it is used in finance? In investors 'intrinsic value' for

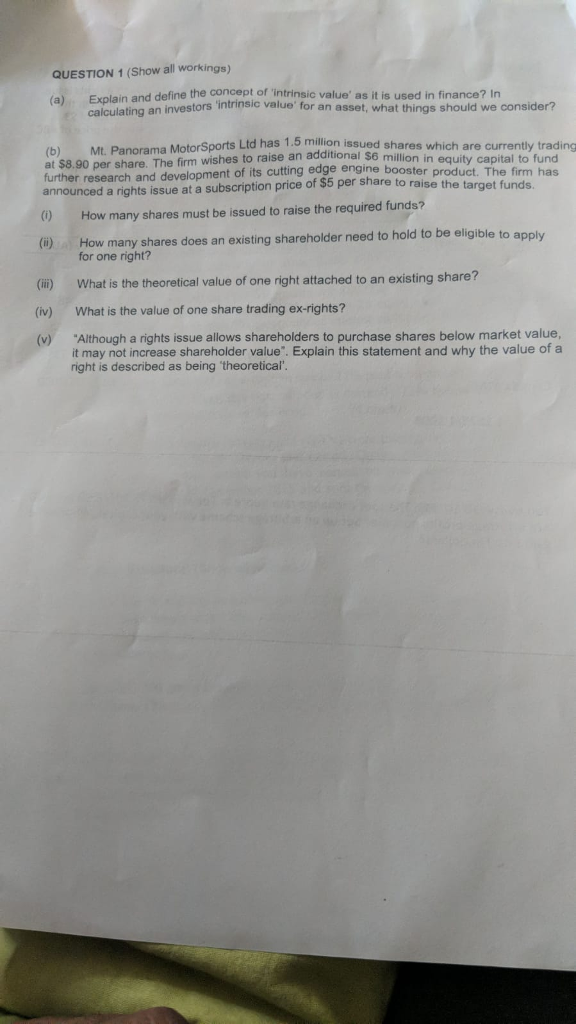

QUESTION 1 (Show all workings) (a) Explain and define the concept of 'intrinsic value' as it is used in finance? In investors 'intrinsic value' for an asset, what things should we consider? s Ltd has 1.5 million issued shares wh (b) Mt. Panorama MotorSport at $8.90 per share. The firm wishes further research and development of its cutting edge engine booster announced a rights issue at a subscription price of $5 per share to raise the ich are currently trading to raise an additional $6 million in equity capital to fund product. The firm has )How many shares must be issued to raise the required funds? How many shares does an existing shareholder need to hold to be eligible to apply for one right? (i) What is the theoretical value of one right attached to an existing share? (iv) What is the value of one share trading ex-rights? (v) Although a rights issue allows shareholders to purchase shares below market value, it may not increase shareholder value". Explain this statement and why the value of a right is described as being theoretical

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts