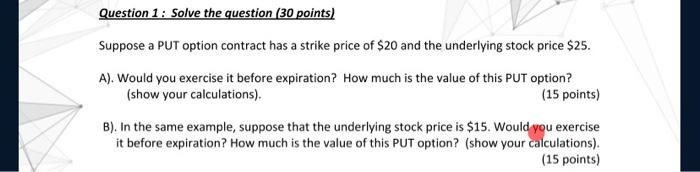

Question: Question 1: Solve the question (30 points) Suppose a PUT option contract has a strike price of $20 and the underlying stock price $25. A).

Question 1: Solve the question (30 points) Suppose a PUT option contract has a strike price of $20 and the underlying stock price $25. A). Would you exercise it before expiration? How much is the value of this PUT option? (show your calculations). (15 points) B). In the same example, suppose that the underlying stock price is $15. Would you exercise it before expiration? How much is the value of this PUT option? (show your calculations). (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts