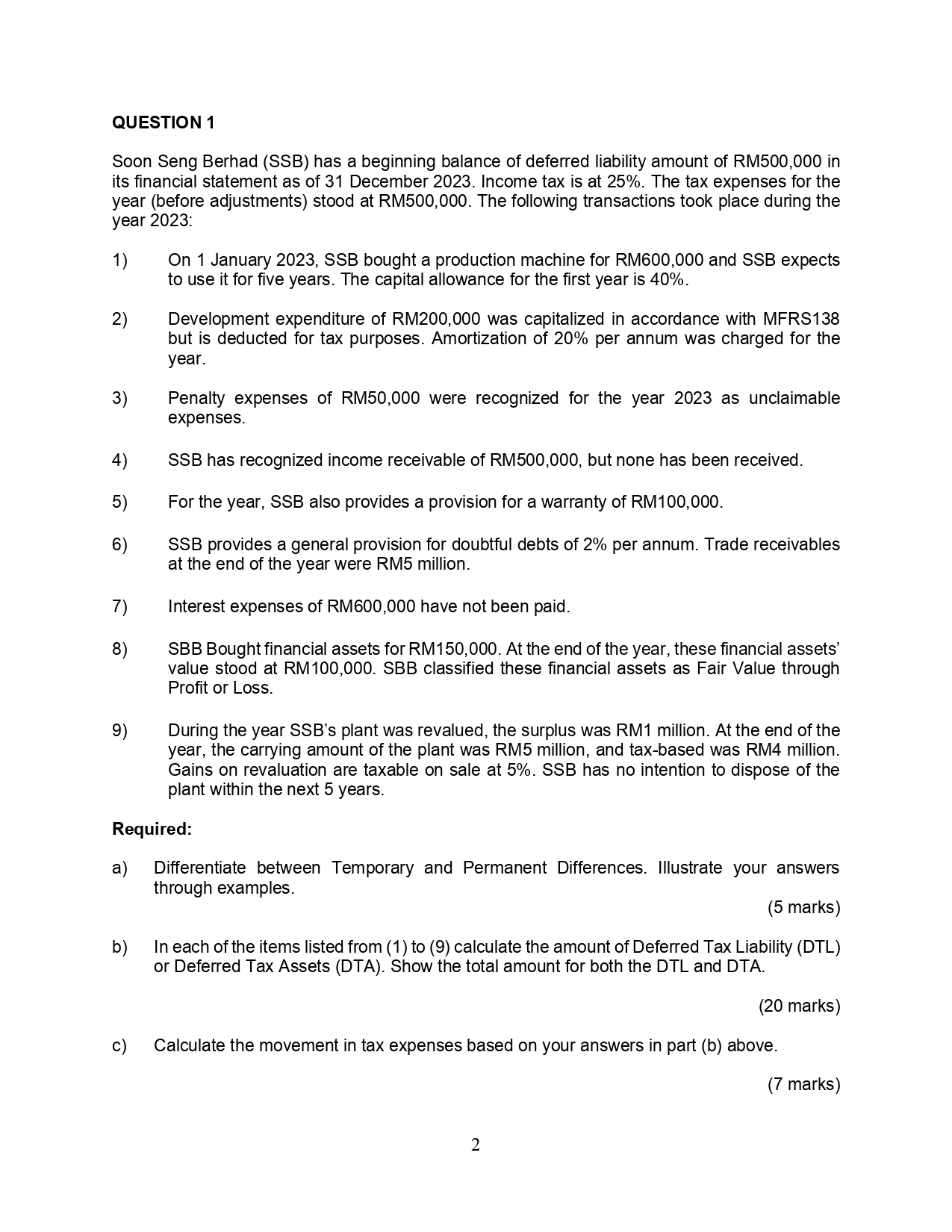

Question: QUESTION 1 Soon Seng Berhad ( SSB ) has a beginning balance of deferred liability amount of RM 5 0 0 , 0 0 0

QUESTION

Soon Seng Berhad SSB has a beginning balance of deferred liability amount of RM in

its financial statement as of December Income tax is at The tax expenses for the

year before adjustments stood at RM The following transactions took place during the

year :

On January SSB bought a production machine for RM and SSB expects

to use it for five years. The capital allowance for the first year is

Development expenditure of RM was capitalized in accordance with MFRS

but is deducted for tax purposes. Amortization of per annum was charged for the

year.

Penalty expenses of RM were recognized for the year as unclaimable

expenses.

SSB has recognized income receivable of RM but none has been received.

For the year, SSB also provides a provision for a warranty of RM

SSB provides a general provision for doubtful debts of per annum. Trade receivables

at the end of the year were RM million.

Interest expenses of RM have not been paid.

SBB Bought financial assets for RM At the end of the year, these financial assets'

value stood at RM SBB classified these financial assets as Fair Value through

Profit or Loss.

During the year SSBs plant was revalued, the surplus was RM million. At the end of the

year, the carrying amount of the plant was RM million, and taxbased was RM million.

Gains on revaluation are taxable on sale at SSB has no intention to dispose of the

plant within the next years.

Required:

a Differentiate between Temporary and Permanent Differences. Illustrate your answers

through examples.

marks

b In each of the items listed from to calculate the amount of Deferred Tax Liability DTL

or Deferred Tax Assets DTA Show the total amount for both the DTL and DTA.

marks

c Calculate the movement in tax expenses based on your answers in part b above.

marks

d Write a journal for each of the items from to in the above questions.

e Show an extract of SSBs Statement of Profit or Loss and Other Comprehensive Income

and Statement of Financial Positions as at December

marks

Total: marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock