Question: Question 1. Structure, financial performance and transfer pricing The Appliance Company has two product divisions large and small and a corporate division. The large product

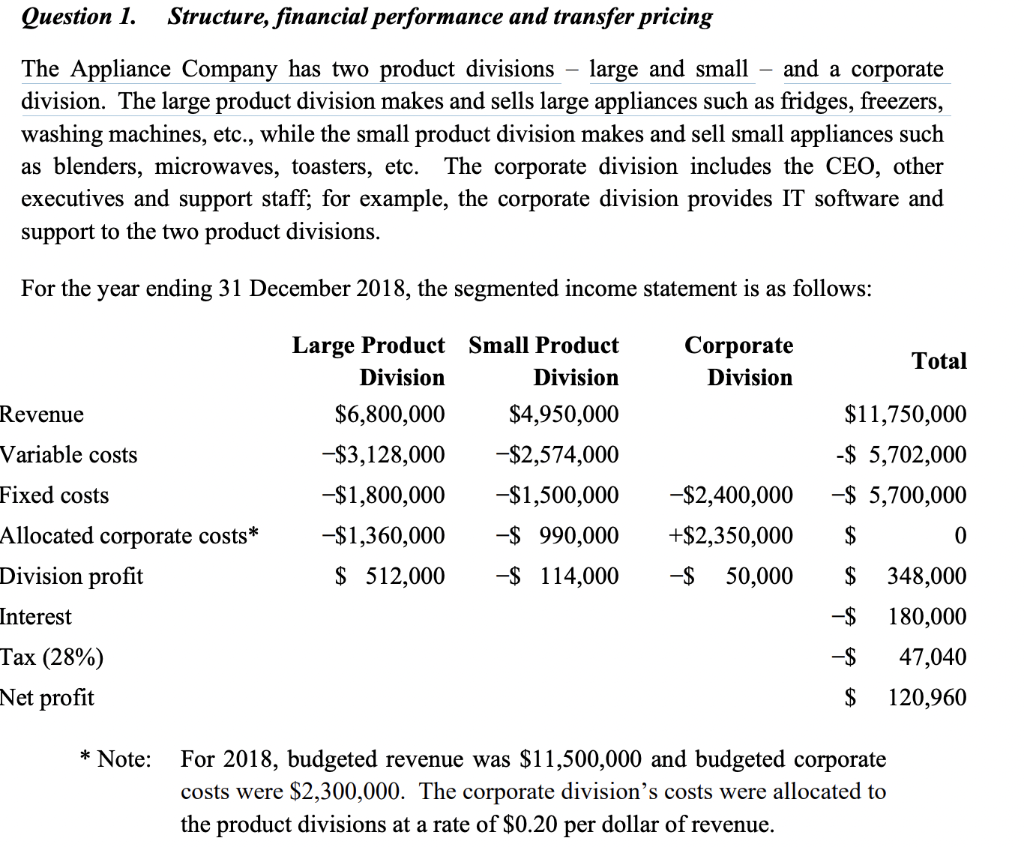

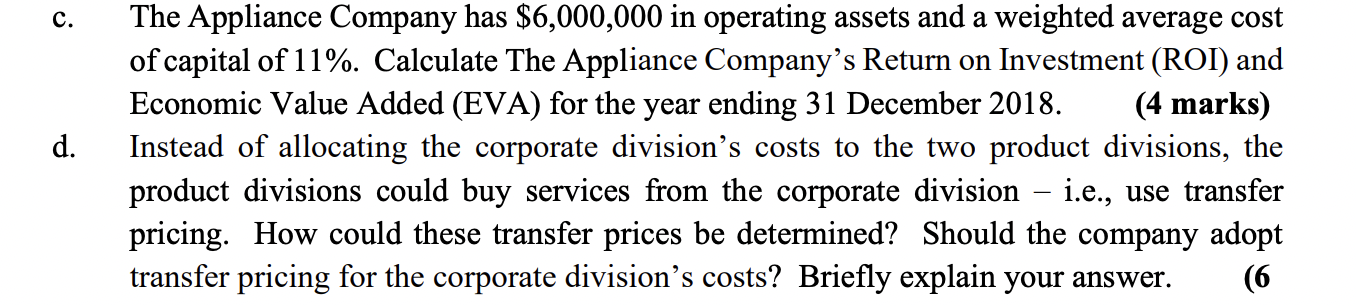

Question 1. Structure, financial performance and transfer pricing The Appliance Company has two product divisions large and small and a corporate division. The large product division makes and sells large appliances such as fridges, freezers, washing machines, etc., while the small product division makes and sell small appliances such as blenders, microwaves, toasters, etc. The corporate division includes the CEO, other executives and support staff, for example, the corporate division provides IT software and support to the two product divisions. For the year ending 31 December 2018, the segmented income statement is as follows: Large Product Small Product Division Division Corporate Division Total Revenue $6,800,000 $4,950,000 $11,750,000 Variable costs -$3,128,000 -$2,574,000 $ 5,702,000 Fixed costs -$1,800,000 -$1,500,000 -$2,400,000 -$ 5,700,000 -$1,360,000 -$ 990,000 +$2,350,000 $ 0 Allocated corporate costs* Division profit $ 512,000 -$ 114,000 -$ 50,000 $ 348,000 Interest -$ 180,000 Tax (28%) -$ 47,040 Net profit $ 120,960 * Note: For 2018, budgeted revenue was $11,500,000 and budgeted corporate costs were $2,300,000. The corporate division's costs were allocated to the product divisions at a rate of $0.20 per dollar of revenue. c. d. The Appliance Company has $6,000,000 in operating assets and a weighted average cost of capital of 11%. Calculate The Appliance Company's Return on Investment (ROI) and Economic Value Added (EVA) for the year ending 31 December 2018. (4 marks) Instead of allocating the corporate division's costs to the two product divisions, the product divisions could buy services from the corporate division - i.e., use transfer pricing. How could these transfer prices be determined? Should the company adopt transfer pricing for the corporate division's costs? Briefly explain your answer. (6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts