Question: Question 1 Suppose the expected return of Security A is 11% and the expected return from Security B is 6%. Both securities are dependent on

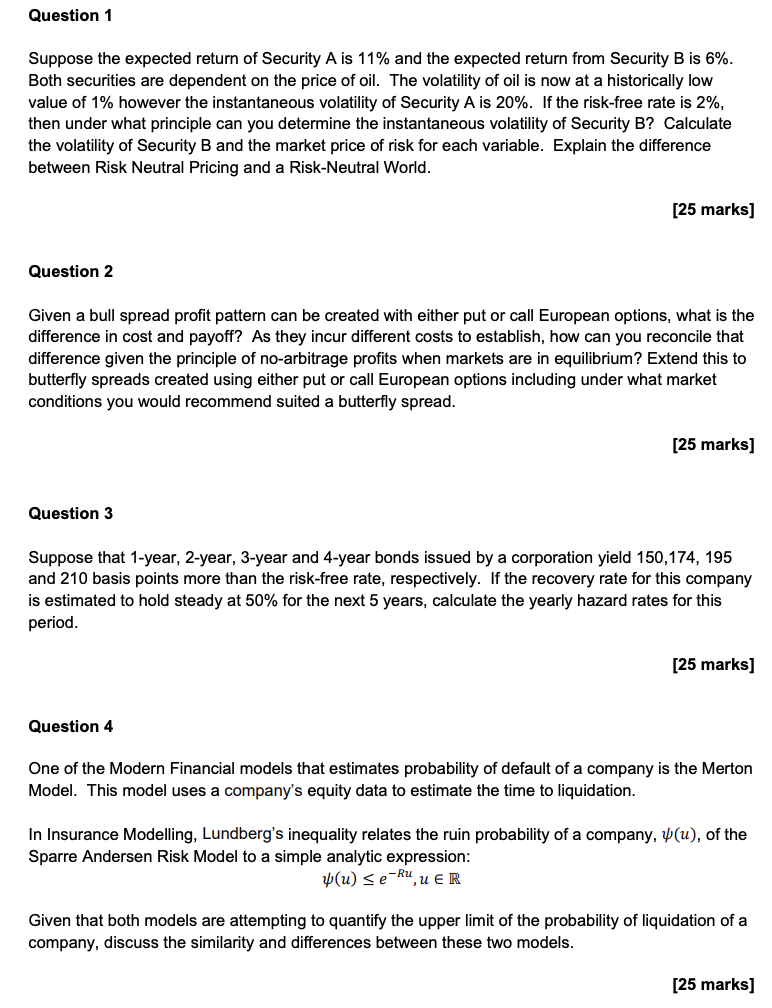

Question 1 Suppose the expected return of Security A is 11% and the expected return from Security B is 6%. Both securities are dependent on the price of oil. The volatility of oil is now at a historically low value of 1% however the instantaneous volatility of Security A is 20%. If the risk-free rate is 2%, then under what principle can you determine the instantaneous volatility of Security B? Calculate the volatility of Security B and the market price of risk for each variable. Explain the difference between Risk Neutral Pricing and a Risk-Neutral World. [25 marks] Question 2 Given a bull spread profit pattern can be created with either put or call European options, what is the difference in cost and payoff? As they incur different costs to establish, how can you reconcile that difference given the principle of no-arbitrage profits when markets are in equilibrium? Extend this to butterfly spreads created using either put or call European options including under what market conditions you would recommend suited a butterfly spread. [25 marks] Question 3 Suppose that 1-year, 2-year, 3-year and 4-year bonds issued by a corporation yield 150,174, 195 and 210 basis points more than the risk-free rate, respectively. If the recovery rate for this company is estimated to hold steady at 50% for the next 5 years, calculate the yearly hazard rates for this period. [25 marks] Question 4 One of the Modern Financial models that estimates probability of default of a company is the Merton Model. This model uses a company's equity data to estimate the time to liquidation. In Insurance Modelling, Lundberg's inequality relates the ruin probability of a company, 4(u), of the Sparre Andersen Risk Model to a simple analytic expression: yu) se-RU, ER Given that both models are attempting to quantify the upper limit of the probability of liquidation of a company, discuss the similarity and differences between these two models. [25 marks] Question 1 Suppose the expected return of Security A is 11% and the expected return from Security B is 6%. Both securities are dependent on the price of oil. The volatility of oil is now at a historically low value of 1% however the instantaneous volatility of Security A is 20%. If the risk-free rate is 2%, then under what principle can you determine the instantaneous volatility of Security B? Calculate the volatility of Security B and the market price of risk for each variable. Explain the difference between Risk Neutral Pricing and a Risk-Neutral World. [25 marks] Question 2 Given a bull spread profit pattern can be created with either put or call European options, what is the difference in cost and payoff? As they incur different costs to establish, how can you reconcile that difference given the principle of no-arbitrage profits when markets are in equilibrium? Extend this to butterfly spreads created using either put or call European options including under what market conditions you would recommend suited a butterfly spread. [25 marks] Question 3 Suppose that 1-year, 2-year, 3-year and 4-year bonds issued by a corporation yield 150,174, 195 and 210 basis points more than the risk-free rate, respectively. If the recovery rate for this company is estimated to hold steady at 50% for the next 5 years, calculate the yearly hazard rates for this period. [25 marks] Question 4 One of the Modern Financial models that estimates probability of default of a company is the Merton Model. This model uses a company's equity data to estimate the time to liquidation. In Insurance Modelling, Lundberg's inequality relates the ruin probability of a company, 4(u), of the Sparre Andersen Risk Model to a simple analytic expression: yu) se-RU, ER Given that both models are attempting to quantify the upper limit of the probability of liquidation of a company, discuss the similarity and differences between these two models. [25 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts