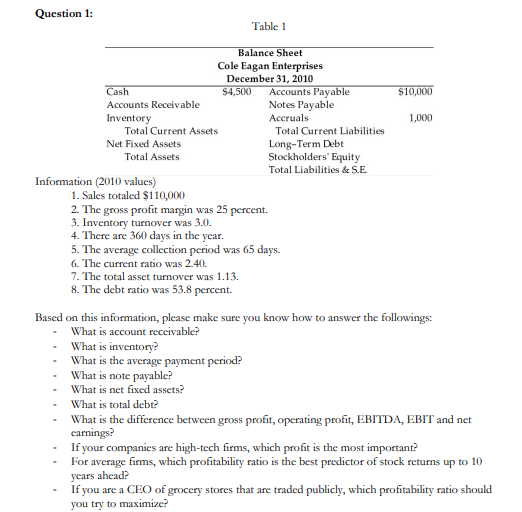

Question: Question 1: Table 1 S10000 1,000 Balance Sheet Cole Eagan Enterprises December 31, 2010 Cash $4,500 Accounts Payable Accounts Receivable Notes Payable Inventory Accruals Total

Question 1: Table 1 S10000 1,000 Balance Sheet Cole Eagan Enterprises December 31, 2010 Cash $4,500 Accounts Payable Accounts Receivable Notes Payable Inventory Accruals Total Current Assets Total Current Liabilities Net Fixed Assets Long-Term Debt Total Assets Stockholders' Equity Total Liabilities & S.E Information (2010 values) 1. Sales totaled $110,000 2. The gross profit margin was 25 percent. 3. Inventory turnover was 3.0. 4. There are 360 days in the year. 5. The average collection period was 65 days. 6. The current ratio was 2.40. 7. The total asset turnover was 1.13. 8. The debt ratio was 53.8 percent. Based on this information, please make sure you know how to answer the followings: What is account receivable? What is inventory? What is the average payment period? What is note payable? What is net fixed assets? What is total debe What is the difference between gross profit, operating profit, EBITDA, EBIT and net camnings? If your companies are high-tech firms, which profit is the most important? For average firms, which profitability ratio is the best predictor of stock returns up to 10 years ahead? If you are a CEO of grocery stores that are traded publicly, which profitability ratio should you try to maximize

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts