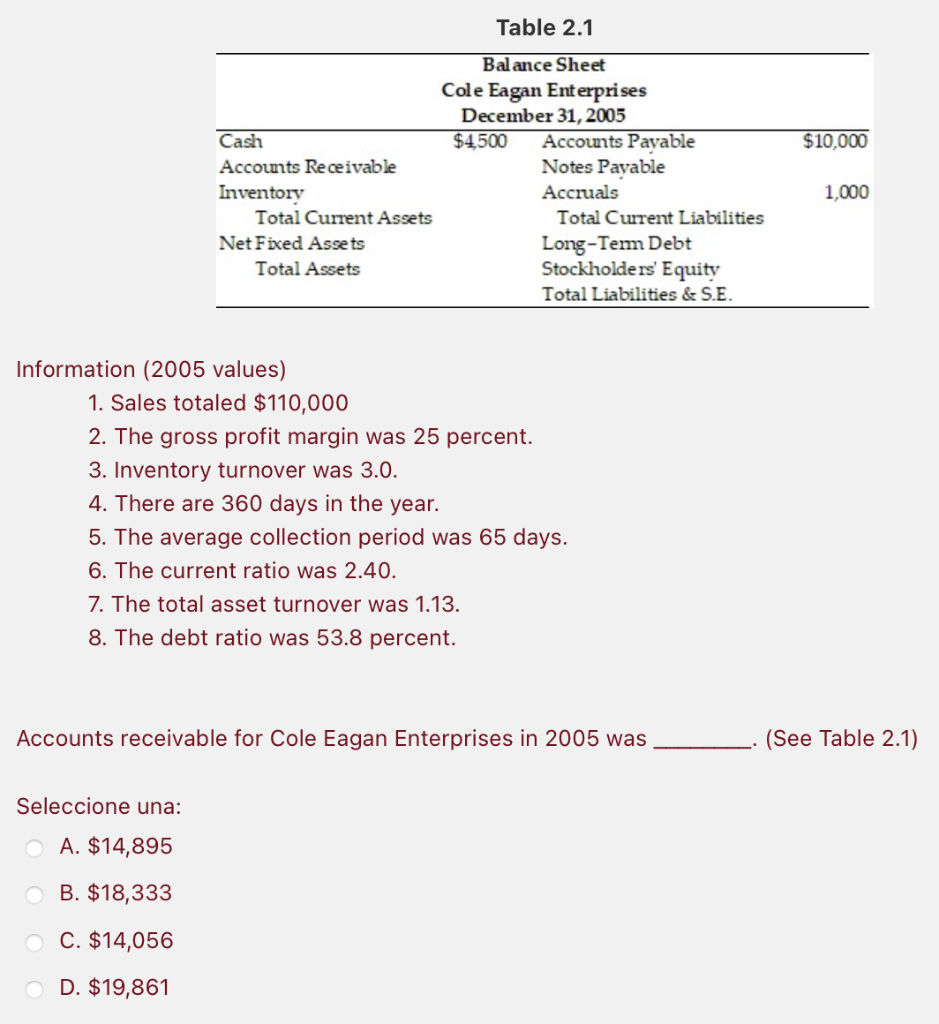

Question: a) Account Recievable= b) Total Assets= c) Net fixed Assets= d) Inventory= e) Notes Payable= f) Long-term Debt= Table 2.1 $10,000 Balance Sheet Cole Eagan

a) Account Recievable=

b) Total Assets=

c) Net fixed Assets=

d) Inventory=

e) Notes Payable=

f) Long-term Debt=

Table 2.1 $10,000 Balance Sheet Cole Eagan Enterprises December 31, 2005 Cash $4,500 Accounts Payable Accounts Receivable Notes Payable Inventory Accruals Total Current Assets Total Current Liabilities Net Fixed Assets Long-Term Debt Total Assets Stockholders' Equity Total Liabilities & S.E. 1,000 Information (2005 values) 1. Sales totaled $110,000 2. The gross profit margin was 25 percent. 3. Inventory turnover was 3.0. 4. There are 360 days in the year. 5. The average collection period was 65 days. 6. The current ratio was 2.40. 7. The total asset turnover was 1.13. 8. The debt ratio was 53.8 percent. Accounts receivable for Cole Eagan Enterprises in 2005 was (See Table 2.1) Seleccione una: O A. $14,895 B. $18,333 C. $14,056 D. $19,861

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts