Question: Question 1 : The biggest lesson that was learnt from financial crisis of 2008 2009 is that information and transparency are some of the preconditions

Question 1: The biggest lesson that was learnt from financial crisis of 2008 2009 is that information and transparency are some of the preconditions for well-functioning markets.

- Why is that the case or how was it concluded that this is the biggest lesson?

Question 2: Sezela Limited, has just sold 100 000 shares in an initial public offering. The underwriters explicit fees were R60 000. The offering price for the shares was R40, but immediately upon issue, the share price jumped to R44.

- What is the total cost to Sezela Limited of the equity issue?

- Is the entire cost of the underwriting a source of profit to the underwriters?

Question 3: Your syndicate group opens a brokerage account and purchases 300 shares of Internet Dreams at R40 per share. Your syndicate borrows R4 000 from the broker to help pay for the purchase. The interest rate on the loan is 8%.

- What is the margin in your account when you first purchase the shares?

- If the share price falls to R30 by year-end, what is the remaining margin in your account?

- If the maintenance margin requirement is 30%, will your syndicate receive a margin call?

- What is the rate of return on her investment?

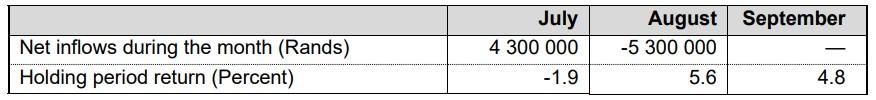

Question 4: You are the manager of the Allan Blue mutual fund. The following table reflects the activity of the fund during the last quarter. The fund started the quarter on 1 July with a balance of R60 million. The following monthly data (measured at the end of the month) is made available to you:

- Calculate the quarterly arithmetic average return on the fund.

- Calculate the quarterly geometric (time-weighted) average return on the fund.

- Calculate the quarterly internal rate of return on the fund.

\begin{tabular}{|l|r|r|r|} \hline & July & August & September \\ \hline Net inflows during the month (Rands) & 4300000 & 5300000 & \\ \hline Holding period return (Percent) & 1.9 & 5.6 & 4.8 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts