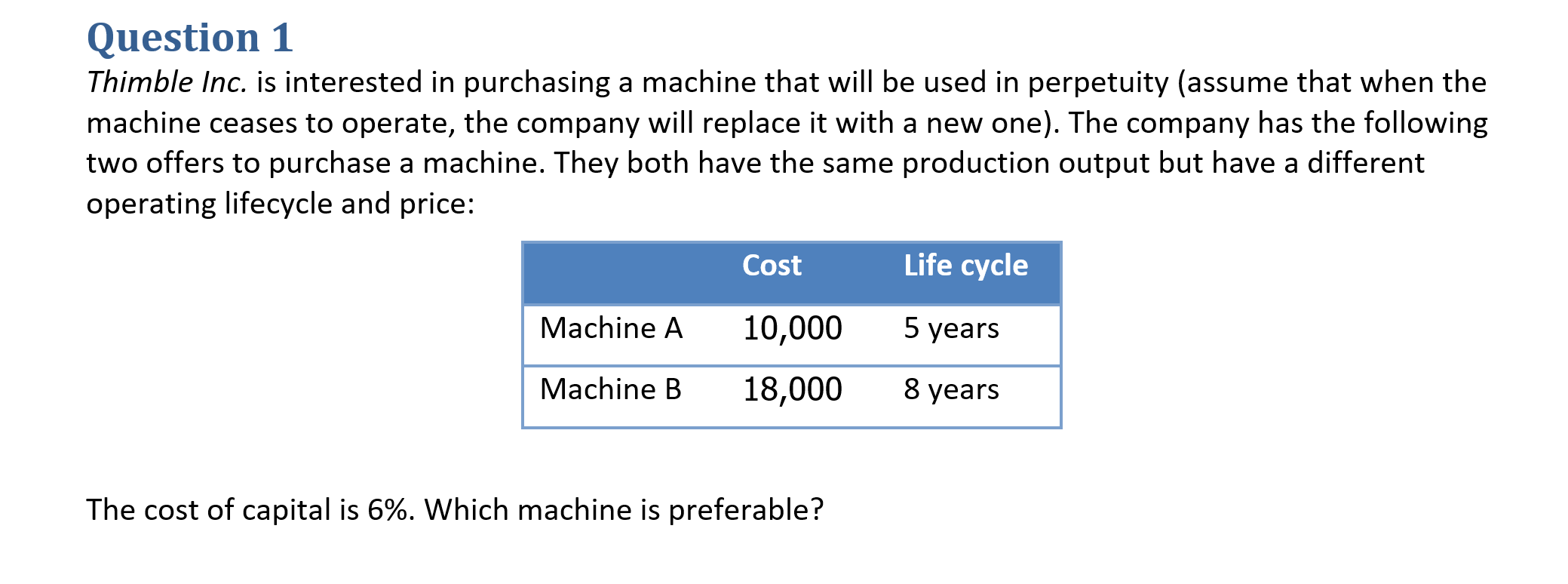

Question: Question 1 Thimble Inc. is interested in purchasing a machine that will be used in perpetuity (assume that when the machine ceases to operate, the

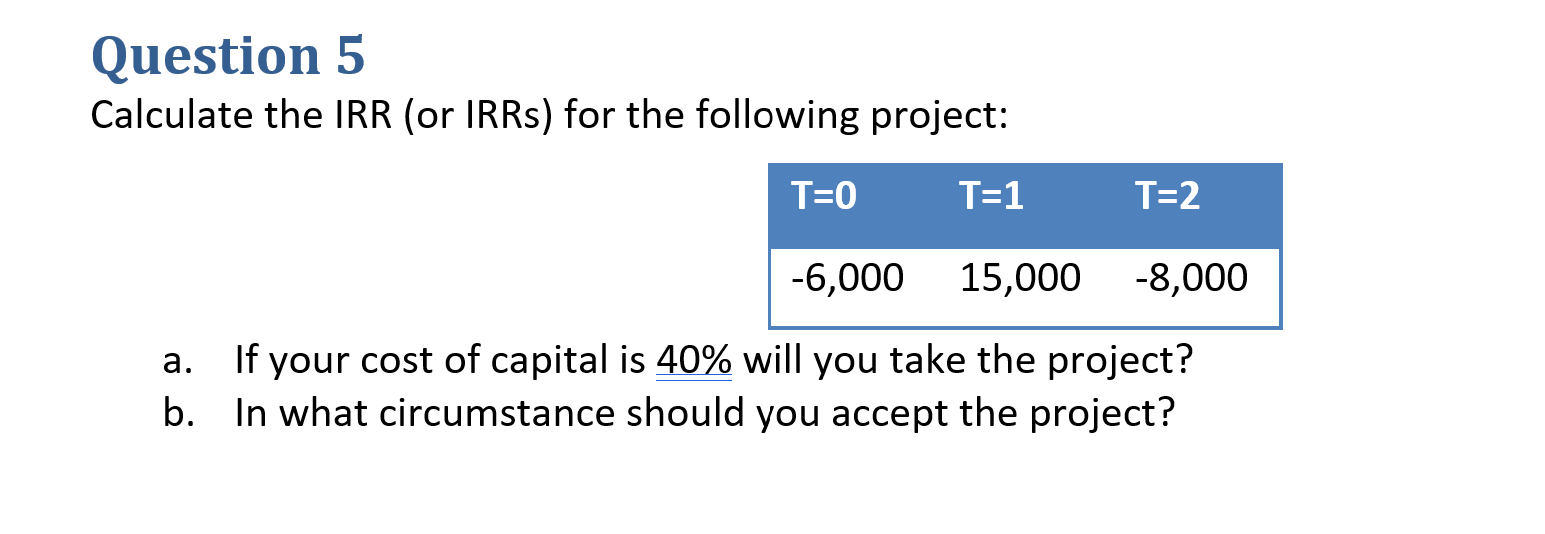

Question 1 Thimble Inc. is interested in purchasing a machine that will be used in perpetuity (assume that when the machine ceases to operate, the company will replace it with a new one). The company has the following two offers to purchase a machine. They both have the same production output but have a different operating lifecycle and price: Cost Life cycle Machine A 10,000 5 years Machine B 18,000 8 years The cost of capital is 6%. Which machine is preferable? Question 5 Calculate the IRR (or IRRs) for the following project: T=0 T=1 T=2 -6,000 15,000 -8,000 a. If your cost of capital is 40% will you take the project? In what circumstance should you accept the project? b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts