Question: Question 1. This question is compulsory L, a public limited company, acquired a subsidiary, M, on 1 January 20X2 and an associate, N, on 1

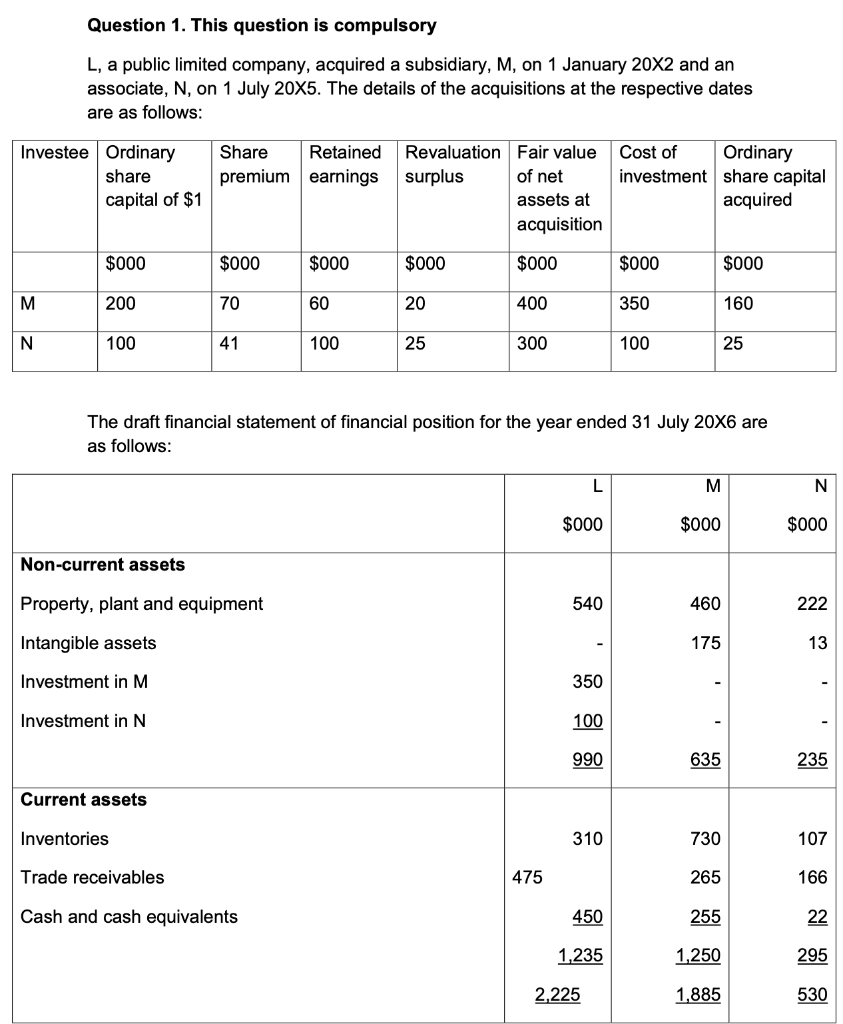

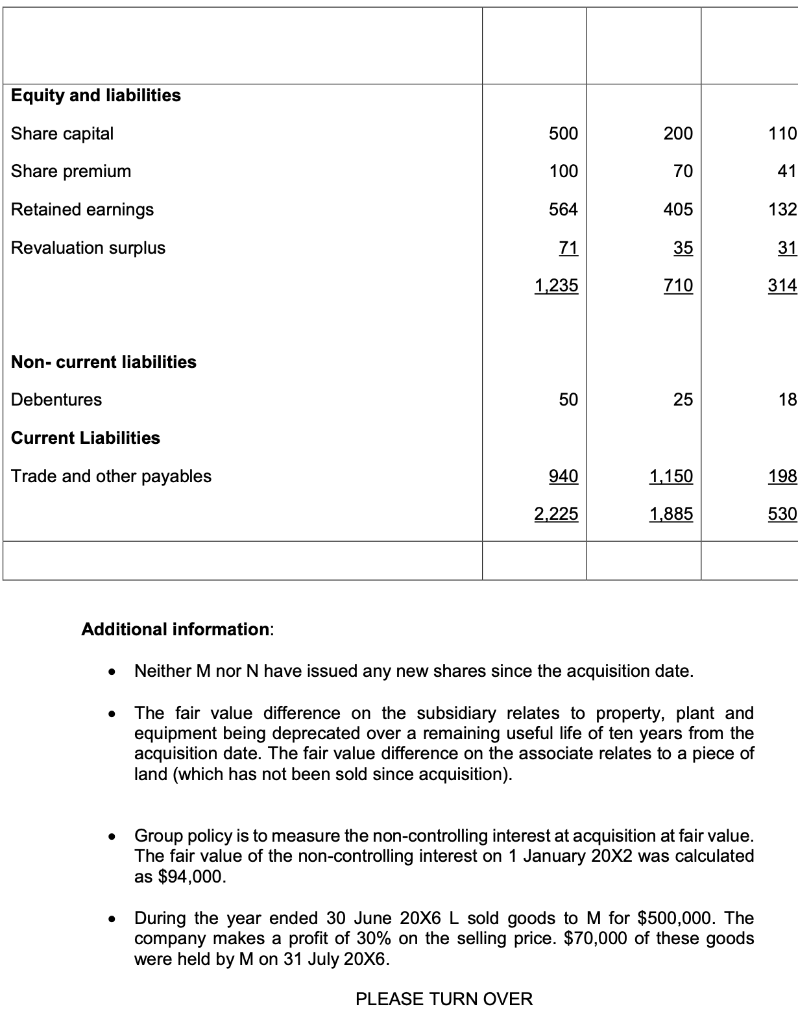

Question 1. This question is compulsory L, a public limited company, acquired a subsidiary, M, on 1 January 20X2 and an associate, N, on 1 July 20X5. The details of the acquisitions at the respective dates are as follows: Investee Ordinary share capital of $1 Share Retained premium earnings Revaluation Fair value surplus of net assets at acquisition Cost of Ordinary investment share capital acquired $000 $000 $000 $000 $000 $000 $000 M 200 70 60 20 400 350 160 N 100 41 100 25 300 100 25 The draft financial statement of financial position for the year ended 31 July 20X6 are as follows: M N $000 $000 $000 Non-current assets Property, plant and equipment 540 460 222 Intangible assets 175 13 Investment in M 350 - Investment in N 100 990 635 235 Current assets Inventories 310 730 107 Trade receivables 475 265 166 Cash and cash equivalents 450 255 22 1,235 1,250 295 2.225 1.885 530 Equity and liabilities Share capital 500 200 110 Share premium 100 70 41 Retained earnings 564 405 132 Revaluation surplus 71 35 31 1.235 710 314 Non-current liabilities Debentures 50 25 18 Current Liabilities Trade and other payables 940 1,150 198 2.225 1.885 530 Additional information: Neither M nor N have issued any new shares since the acquisition date. . The fair value difference on the subsidiary relates to property, plant and equipment being deprecated over a remaining useful life of ten years from the acquisition date. The fair value difference on the associate relates to a piece of land (which has not been sold since acquisition). Group policy is to measure the non-controlling interest at acquisition at fair value. The fair value of the non-controlling interest on 1 January 20X2 was calculated as $94,000. . During the year ended 30 June 20x6 L sold goods to M for $500,000. The company makes a profit of 30% on the selling price. $70,000 of these goods were held by M on 31 July 20X6. PLEASE TURN OVER . Annual impairment tests have indicated impairment losses of $500,000 relating to the recognised goodwill of M including $12,500 in the current year. No impairment losses to date have been necessary for the investment in N. Required: Prepare the consolidated statement of financial position for the P Group as at 30 June 20X6. (35 marks) Question 1. This question is compulsory L, a public limited company, acquired a subsidiary, M, on 1 January 20X2 and an associate, N, on 1 July 20X5. The details of the acquisitions at the respective dates are as follows: Investee Ordinary share capital of $1 Share Retained premium earnings Revaluation Fair value surplus of net assets at acquisition Cost of Ordinary investment share capital acquired $000 $000 $000 $000 $000 $000 $000 M 200 70 60 20 400 350 160 N 100 41 100 25 300 100 25 The draft financial statement of financial position for the year ended 31 July 20X6 are as follows: M N $000 $000 $000 Non-current assets Property, plant and equipment 540 460 222 Intangible assets 175 13 Investment in M 350 - Investment in N 100 990 635 235 Current assets Inventories 310 730 107 Trade receivables 475 265 166 Cash and cash equivalents 450 255 22 1,235 1,250 295 2.225 1.885 530 Equity and liabilities Share capital 500 200 110 Share premium 100 70 41 Retained earnings 564 405 132 Revaluation surplus 71 35 31 1.235 710 314 Non-current liabilities Debentures 50 25 18 Current Liabilities Trade and other payables 940 1,150 198 2.225 1.885 530 Additional information: Neither M nor N have issued any new shares since the acquisition date. . The fair value difference on the subsidiary relates to property, plant and equipment being deprecated over a remaining useful life of ten years from the acquisition date. The fair value difference on the associate relates to a piece of land (which has not been sold since acquisition). Group policy is to measure the non-controlling interest at acquisition at fair value. The fair value of the non-controlling interest on 1 January 20X2 was calculated as $94,000. . During the year ended 30 June 20x6 L sold goods to M for $500,000. The company makes a profit of 30% on the selling price. $70,000 of these goods were held by M on 31 July 20X6. PLEASE TURN OVER . Annual impairment tests have indicated impairment losses of $500,000 relating to the recognised goodwill of M including $12,500 in the current year. No impairment losses to date have been necessary for the investment in N. Required: Prepare the consolidated statement of financial position for the P Group as at 30 June 20X6. (35 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts