Question: Question 1. This question is compulsory P, a public limited company, acquired a subsidiary, S, on 1 January 20X2 and an associate, A, on 1

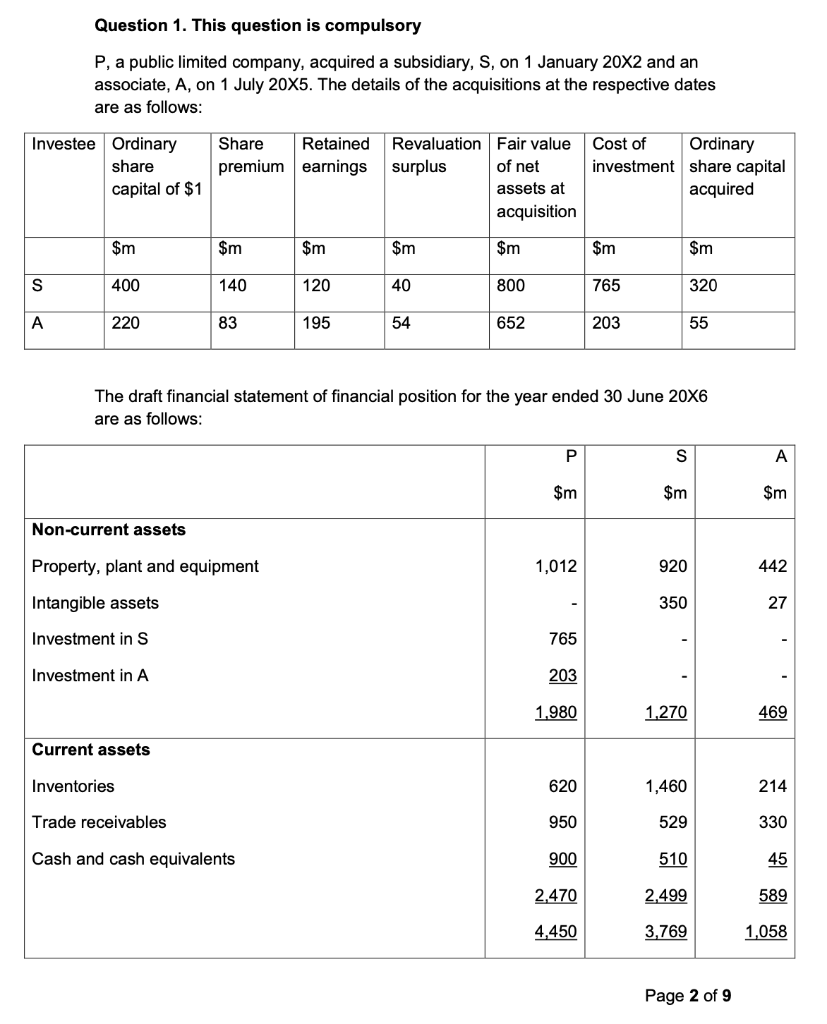

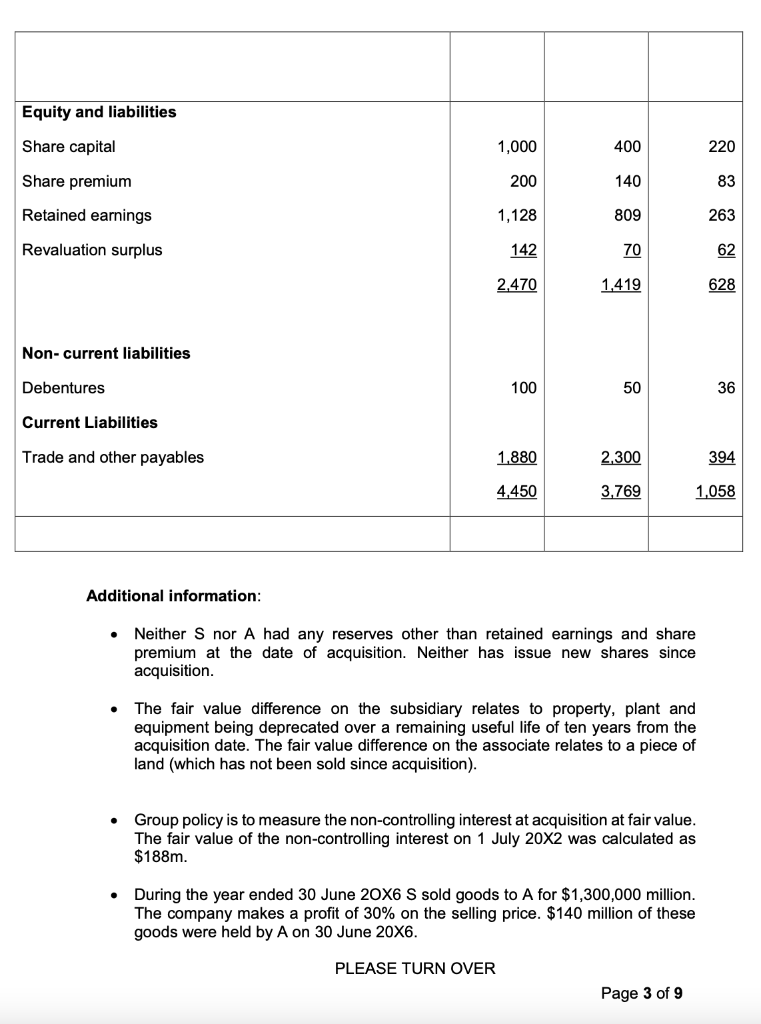

Question 1. This question is compulsory P, a public limited company, acquired a subsidiary, S, on 1 January 20X2 and an associate, A, on 1 July 20X5. The details of the acquisitions at the respective dates are as follows: Investee Ordinary share capital of $1 Share Retained Revaluation Fair value premium earnings surplus of net assets at acquisition Cost of Ordinary investment share capital acquired $m $m $m $m $m $m $m S 400 140 120 40 800 765 320 A 220 83 195 54 652 203 55 The draft financial statement of financial position for the year ended 30 June 20X6 are as follows: P S A $m $m $m Non-current assets Property, plant and equipment 1,012 920 442 Intangible assets 350 27 Investment in S 765 Investment in A 203 1.980 1,270 469 Current assets Inventories 620 1,460 214 Trade receivables 950 529 330 Cash and cash equivalents 900 510 45 2.470 2,499 589 4,450 3,769 1,058 Page 2 of 9 Equity and liabilities Share capital 1,000 400 220 Share premium 200 140 83 Retained earnings 1,128 809 263 Revaluation surplus 142 70 62 2.470 1,419 628 Non-current liabilities Debentures 100 50 36 Current Liabilities Trade and other payables 1,880 2.300 394 4,450 3,769 1,058 Additional information: Neither S nor A had any reserves other than retained earnings and share premium at the date of acquisition. Neither has issue new shares since acquisition. . The fair value difference on the subsidiary relates to property, plant and equipment being deprecated over a remaining useful life of ten years from the acquisition date. The fair value difference on the associate relates to a piece of land (which has not been sold since acquisition). Group policy is to measure the non-controlling interest at acquisition at fair value. The fair value of the non-controlling interest on 1 July 20X2 was calculated as $188m. During the year ended 30 June 20x6 S sold goods to A for $1,300,000 million. The company makes a profit of 30% on the selling price. $140 million of these goods were held by A on 30 June 20x6. PLEASE TURN OVER Page 3 of 9 Annual impairment tests have indicated impairment losses of $100m relating to the recognised goodwill of S including $25m in the current year. No impairment losses to date have been necessary for the investment in A. Required: Prepare the consolidated statement of financial position for the P Group as at 30 June 20X6. Question 1. This question is compulsory P, a public limited company, acquired a subsidiary, S, on 1 January 20X2 and an associate, A, on 1 July 20X5. The details of the acquisitions at the respective dates are as follows: Investee Ordinary share capital of $1 Share Retained Revaluation Fair value premium earnings surplus of net assets at acquisition Cost of Ordinary investment share capital acquired $m $m $m $m $m $m $m S 400 140 120 40 800 765 320 A 220 83 195 54 652 203 55 The draft financial statement of financial position for the year ended 30 June 20X6 are as follows: P S A $m $m $m Non-current assets Property, plant and equipment 1,012 920 442 Intangible assets 350 27 Investment in S 765 Investment in A 203 1.980 1,270 469 Current assets Inventories 620 1,460 214 Trade receivables 950 529 330 Cash and cash equivalents 900 510 45 2.470 2,499 589 4,450 3,769 1,058 Page 2 of 9 Equity and liabilities Share capital 1,000 400 220 Share premium 200 140 83 Retained earnings 1,128 809 263 Revaluation surplus 142 70 62 2.470 1,419 628 Non-current liabilities Debentures 100 50 36 Current Liabilities Trade and other payables 1,880 2.300 394 4,450 3,769 1,058 Additional information: Neither S nor A had any reserves other than retained earnings and share premium at the date of acquisition. Neither has issue new shares since acquisition. . The fair value difference on the subsidiary relates to property, plant and equipment being deprecated over a remaining useful life of ten years from the acquisition date. The fair value difference on the associate relates to a piece of land (which has not been sold since acquisition). Group policy is to measure the non-controlling interest at acquisition at fair value. The fair value of the non-controlling interest on 1 July 20X2 was calculated as $188m. During the year ended 30 June 20x6 S sold goods to A for $1,300,000 million. The company makes a profit of 30% on the selling price. $140 million of these goods were held by A on 30 June 20x6. PLEASE TURN OVER Page 3 of 9 Annual impairment tests have indicated impairment losses of $100m relating to the recognised goodwill of S including $25m in the current year. No impairment losses to date have been necessary for the investment in A. Required: Prepare the consolidated statement of financial position for the P Group as at 30 June 20X6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts