Question: QUESTION 1 This question uses the same information privided for assignment 4 question 1 part c : SO using this following information QUESTION 1 part

QUESTION 1

This question uses the same information privided for assignment 4 question 1 part c : SO using this following information QUESTION 1 part c following:

QUESTION 1 part c - for assignment 4 ENDS.

ANSWER THIS QUESTION:

Required:

(a) Assume Parent Ltd only acquired 20% of the equity in Subsidiary Ltd for $124 000 on 1 April 2008.

Prepare the notional journal entry on 31 March 2023 to account for Parent Ltds investment in Subsidiary Ltd using the equity method as required by NZ IAS 28 Investments in Associates. The directors believe the investment asset has never been impaired. The tax rate is 28%. Complete a quick estimate in the space provided.

(b) Refer back to your answer for (a) and determine the dollar amount of the investment asset after being equity accounted for in the financial statements as of 31 March 2023. Show your workings

Use this to answer the above question: QUESTION 1

| (a) Notional journal entry on 31/03/23 Workings must be shown.

| ||

| $ | $ | |

Workings to be shown of the quick estimate:

| (b) The investment asset, after being equity accounted for, will be measured at: |

$ |

| Workings:

|

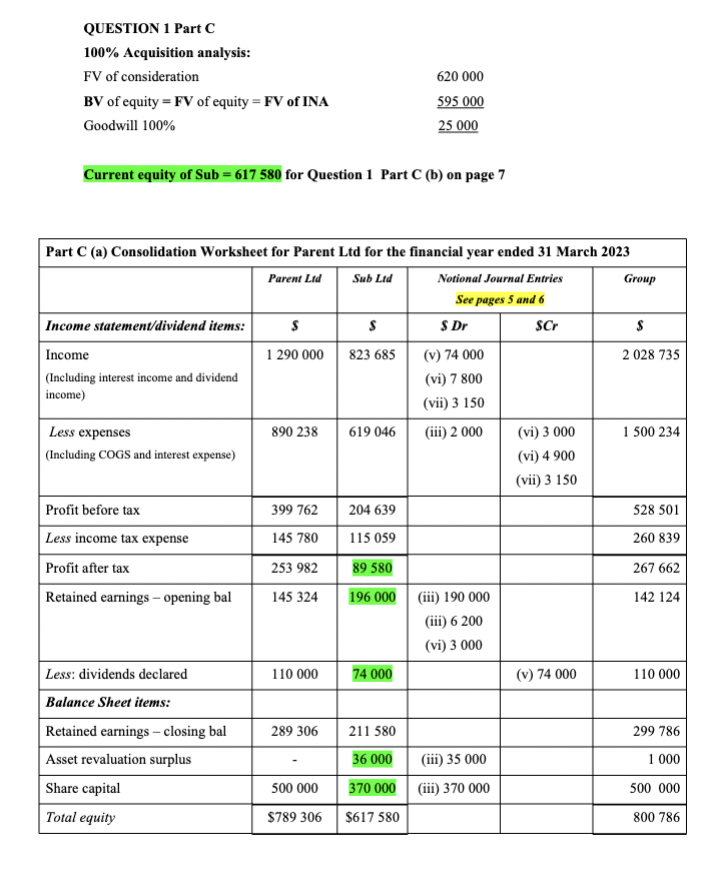

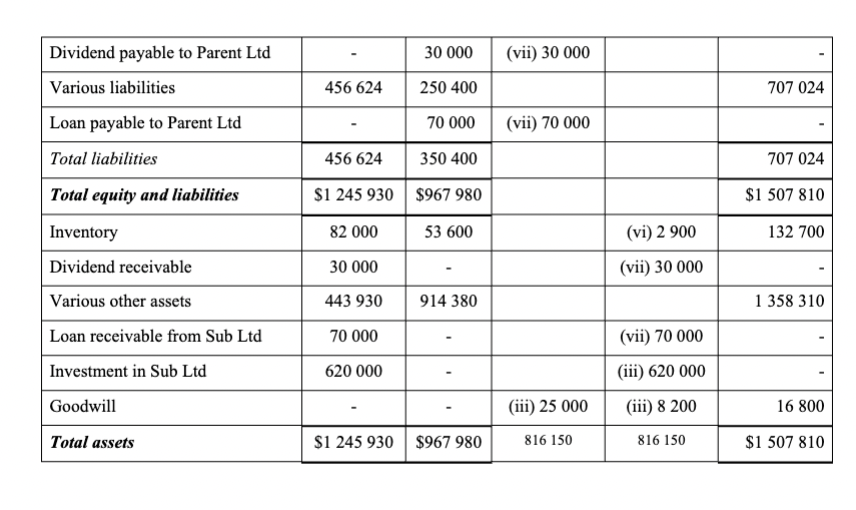

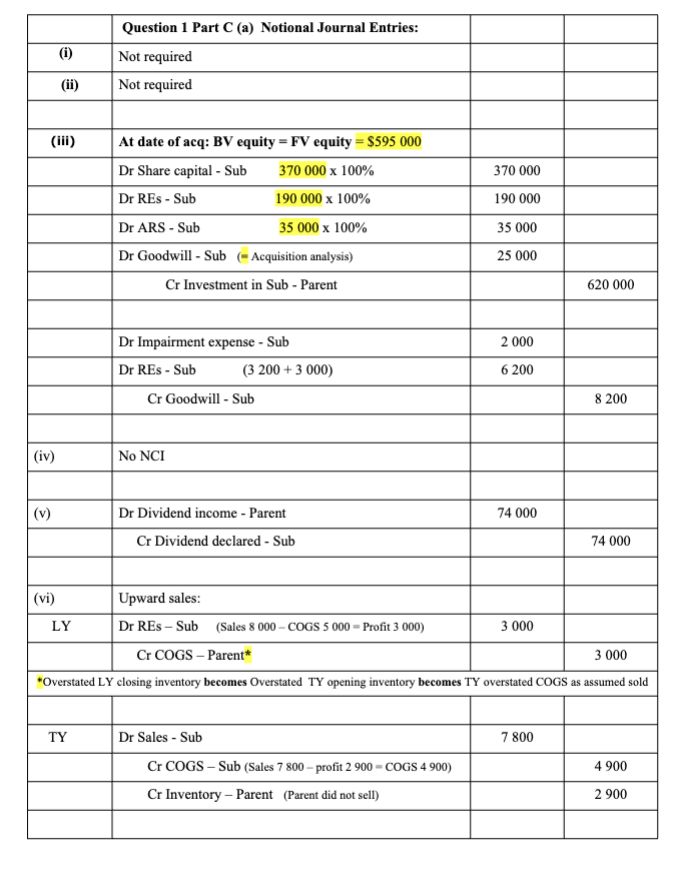

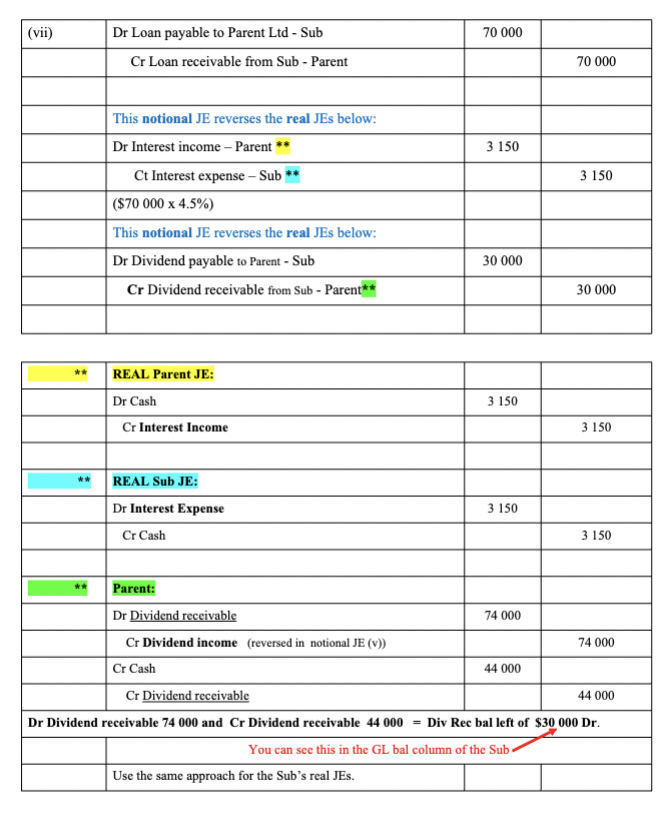

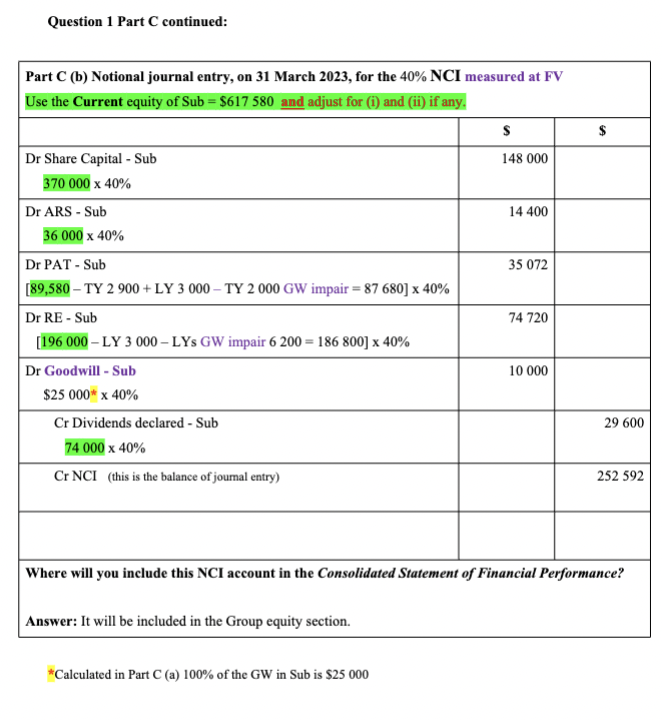

\begin{tabular}{|l|c|c|c|c|r|} \hline Dividend payable to Parent Ltd & - & 30000 & (vii) 30000 & & - \\ \hline Various liabilities & 456624 & 250400 & & & 707024 \\ \hline Loan payable to Parent Ltd & - & 70000 & (vii) 70000 & & - \\ \hline Total liabilities & 456624 & 350400 & & & 707024 \\ \hline Total equity and liabilities & $1245930 & $967980 & & & $1507810 \\ \hline Inventory & 82000 & 53600 & & (vi) 2900 & 132700 \\ \hline Dividend receivable & 30000 & - & & (vii) 30000 & - \\ \hline Various other assets & 443930 & 914380 & & & 1358310 \\ \hline Loan receivable from Sub Ltd & 70000 & - & & (vii) 70000 & - \\ \hline Investment in Sub Ltd & 620000 & - & & (iii) 620000 & - \\ \hline Goodwill & - & - & (iii) 25000 & (iii) 8200 & 16800 \\ \hline Total assets & $1245930 & $967980 & 816150 & 816150 & $1507810 \\ \hline \end{tabular} \begin{tabular}{|l|l|c|c|} \hline (vii) & Dr Loan payable to Parent Ltd - Sub & 70000 & \\ \hline & Cr Loan receivable from Sub - Parent & & 70000 \\ \hline & & & \\ \hline & This notional JE reverses the real JEs below: & 3150 & \\ \hline & Dr Interest income - Parent ** & & 3150 \\ \hline & Ct Interest expense - Sub ** & & \\ \hline & ($700004.5%) & 30000 & \\ \hline & This notional JE reverses the real JEs below: & & 30000 \\ \hline & Dr Dividend payable to Parent - Sub & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multirow[t]{3}{*}{ ** } & REAL Parent JE: & & \\ \hline & Dr Cash & 3150 & \\ \hline & Cr Interest Income & & 3150 \\ \hline \multirow[t]{3}{*}{ ** } & REAL Sub JE: & & \\ \hline & Dr Interest Expense & 3150 & \\ \hline & Cr Cash & & 3150 \\ \hline \multirow[t]{5}{*}{ ** } & Parent: & & \\ \hline & Dr Dividend receivable & 74000 & \\ \hline & Cr Dividend income (reversed in notional JE (v)) & & 74000 \\ \hline & Cr Cash & 44000 & \\ \hline & Cr Dividend receivable & & 44000 \\ \hline \multicolumn{4}{|c|}{ Dr Dividend receivable 74000 and Cr Dividend receivable 44000= Div Rec bal left of $30000Dr. } \\ \hline & \multicolumn{3}{|c|}{ You can see this in the GL bal column of the Sub } \\ \hline & Use the same approach for the Sub's real JEs. & & \\ \hline \end{tabular} Inswer: It will be included in the Group equity section. Calculated in Part C (a) 100% of the GW in Sub is $25000 \begin{tabular}{|c|c|c|c|} \hline & Question 1 Part C (a) Notional Journal Entries: & & \\ \hline (i) & Not required & & \\ \hline (ii) & Not required & & \\ \hline \multirow[t]{9}{*}{ (iii) } & At date of acq: BV equity =FV equity =$595000 & & \\ \hline & Dr Share capital - Sub 370000100% & 370000 & \\ \hline & Dr REs - Sub 190000100% & 190000 & \\ \hline & Dr ARS - Sub 35000100% & 35000 & \\ \hline & Dr Goodwill - Sub (- Acquisition analysis) & 25000 & \\ \hline & Cr Investment in Sub - Parent & & 620000 \\ \hline & Dr Impairment expense - Sub & 2000 & \\ \hline & Dr REs - Sub (3200+3000) & 6200 & \\ \hline & Cr Goodwill - Sub & & 8200 \\ \hline (iv) & No NCI & & \\ \hline \multirow[t]{2}{*}{ (v) } & Dr Dividend income - Parent & 74000 & \\ \hline & Cr Dividend declared - Sub & & 74000 \\ \hline (vi) & Upward sales: & & \\ \hline \multirow[t]{2}{*}{ LY } & Dr REs - Sub (Sales 8000COGS5000= Profit 3000 ) & 3000 & \\ \hline & Cr COGS - Parent* & & 3000 \\ \hline \multicolumn{4}{|c|}{ *Overstated LY closing inventory becomes Overstated TY opening inventory becomes TY overstated COGS as assumed sol } \\ \hline \multirow[t]{3}{*}{ TY } & Dr Sales - Sub & 7800 & \\ \hline & Cr COGS - Sub (Sales 7800 - profit 2900= COGS 4900 ) & & 4900 \\ \hline & Cr Inventory - Parent (Parent did not sell) & & 2900 \\ \hline \end{tabular} Current equity of Sub =617580 for Question 1PartC (b) on page 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts