Question: QUESTION 1 Time Zero Cash Flow Enter with no $ and no commas. Enter as a negative number QUESTION 2 Market Value of Debt. Enter

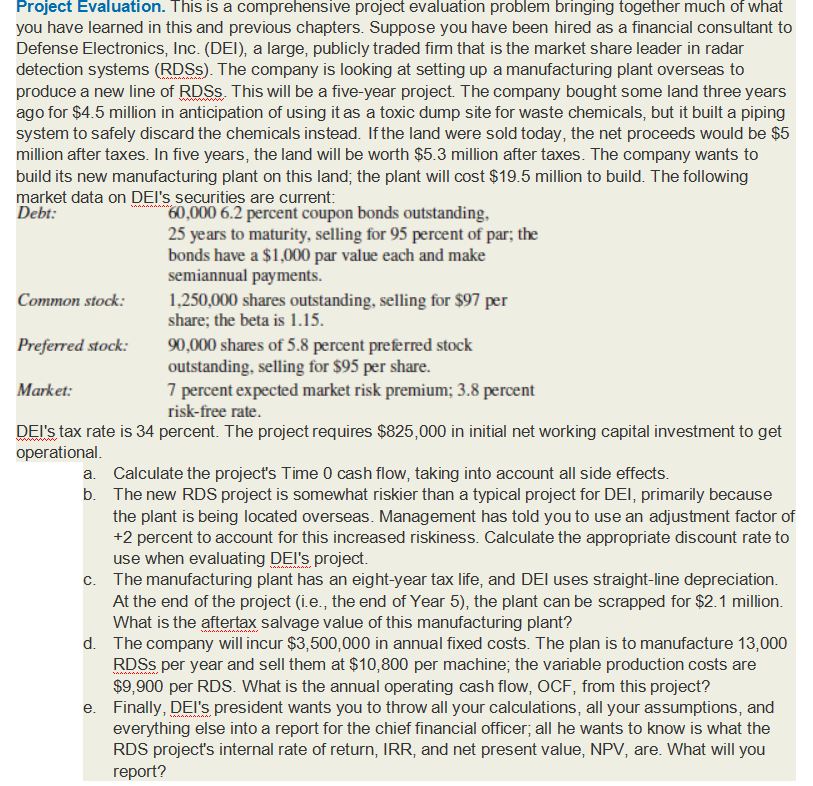

QUESTION 1

Time Zero Cash Flow Enter with no $ and no commas. Enter as a negative number

QUESTION 2

Market Value of Debt. Enter with no $ and no commas.

QUESTION 3

Market Value of Common Equity. Enter with no $ and no commas.

QUESTION 4

Market Value of preferred. Enter with no $ and no commas.

QUESTION 5

After-tax cost of debt. Enter as percentage with no % sign and with two decimals

QUESTION 6

Cost of Equity. Enter as percentage with no % sign and with two decimals

QUESTION 7

Cost of Preferred Enter as percentage with no % sign and with two decimals

QUESTION 8

WACC Enter as percentage with no % sign and with two decimals

QUESTION 9

Risk adjusted WACC. Enter as percentage with no % sign and with two decimals.

QUESTION 10

c. After-tax salvage value Enter with no $ and no commas

1 points

QUESTION 11

annual OCF. Enter with no $ and no commas

QUESTION 12

NPV Enter with no $ and no commas and no decimals

QUESTION 13

IRR. Enter as percentage with no % and two decimal points

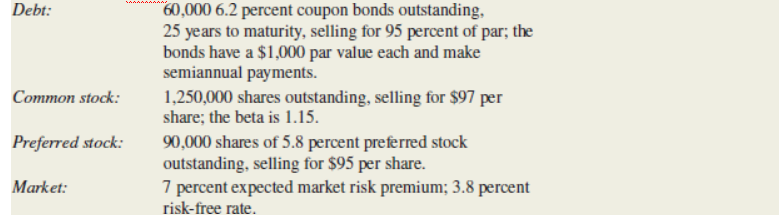

60,000 6.2 percent coupon bonds outstanding 25 years to maturity, selling for 95 percent of par; the bonds have a $1,000 par value each and make semiannual payments. 1,250,000 shares outstanding, selling for $97 per share; the beta is 1.15. 90,000 shares of 5.8 percent preferred stock outstanding, selling for $95 per share. 7 percent expected market risk premium; 3.8 percent risk-free rate. Debt Common stock: Preferred stock: Market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts