Question: Question 1 tion 3 tion 4 In Case Study 1 . 1 , what is the amount of taxable cancellation of debt income that the

Question

tion

tion

In Case Study what is the amount of taxable cancellation of debt income that the Walkers must report on their return?

$

$

$

$

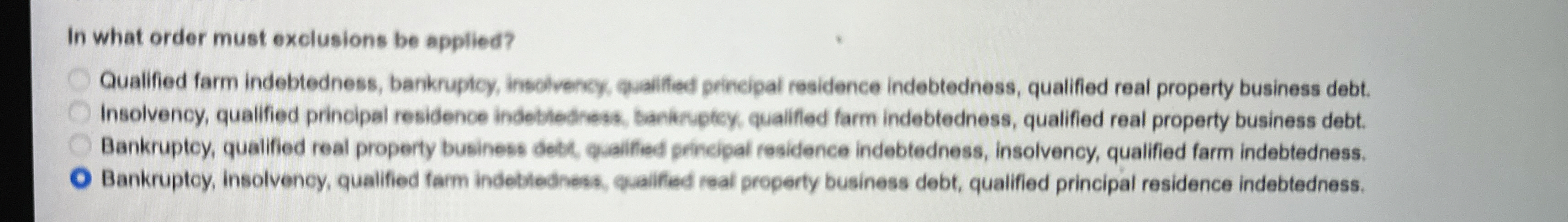

In what order must exclusions be applied?

Qualified farm indebtedness, bankruptcy, insolvercy, qualified principal residence indebtedness, qualified real property business debt. Insolvency, qualified principal residence indebtedress, banituptey, qualiffed farm indebtedness, qualified real property business debt. Bankruptcy, qualified real property business debt, quaified prineipal residence indebtedness, insolvency, qualified farm indebtedness. Bankruptcy, insolvency, qualified farm indettedness, qualifed real property business debt, qualified principal residence indebtedness.

In what order must exclusions be applied?

Qualified farm indebtedness, bankruptcy, insolvercy, qualified principal residence indebtedness, qualified real property business debt. Insolvency, qualified principal residence indebtedress, banituptey, qualiffed farm indebtedness, qualified real property business debt. Bankruptcy, qualified real property business debt, quaified prineipal residence indebtedness, insolvency, qualified farm indebtedness. Bankruptcy, insolvency, qualified farm indettedness, qualifed real property business debt, qualified principal residence indebtedness.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock