Question: Question 1: (Total 10 marks) A. Using the following information, prepare the statement of revenues, expenditures, and changes in fund balance for the General Fund

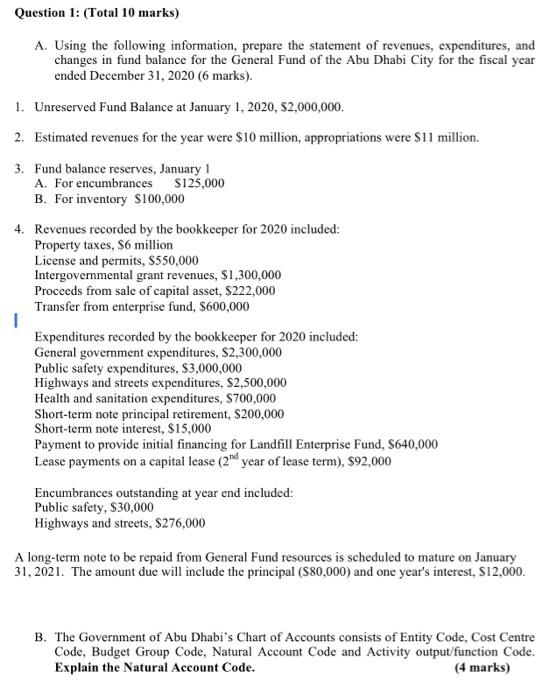

Question 1: (Total 10 marks) A. Using the following information, prepare the statement of revenues, expenditures, and changes in fund balance for the General Fund of the Abu Dhabi City for the fiscal year ended December 31, 2020 (6 marks). 1. Unreserved Fund Balance at January 1, 2020, $2,000,000 2. Estimated revenues for the year were $10 million, appropriations were $11 million. 3. Fund balance reserves, January 1 A. For encumbrances S125,000 B. For inventory S100,000 4. Revenues recorded by the bookkeeper for 2020 included: Property taxes, S6 million License and permits, S550,000 Intergovernmental grant revenues, $1,300,000 Proceeds from sale of capital asset, $222,000 Transfer from enterprise fund, $600,000 1 Expenditures recorded by the bookkeeper for 2020 included: General government expenditures, $2,300,000 Public safety expenditures, $3,000,000 Highways and streets expenditures, $2,500,000 Health and sanitation expenditures, $700,000 Short-term note principal retirement, $200,000 Short-term note interest, $15,000 Payment to provide initial financing for Landfill Enterprise Fund, S640,000 Lease payments on a capital lease (21 year of lease term), $92,000 Encumbrances outstanding at year end included: Public safety, $30,000 Highways and streets, S276,000 A long-term note to be repaid from General Fund resources is scheduled to mature on January 31, 2021. The amount due will include the principal ($80,000) and one year's interest, $12,000. B. The Government of Abu Dhabi's Chart of Accounts consists of Entity Code, Cost Centre Code, Budget Group Code, Natural Account Code and Activity output/function Code. Explain the Natural Account Code. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts