Question: Question 1: Two new software projects are proposed to a young, start-up company. The Alpha project will cost $150,000 to develop and is expected to

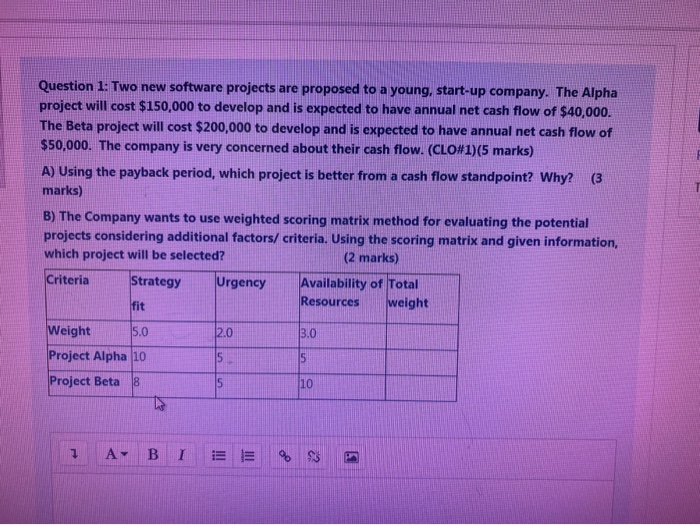

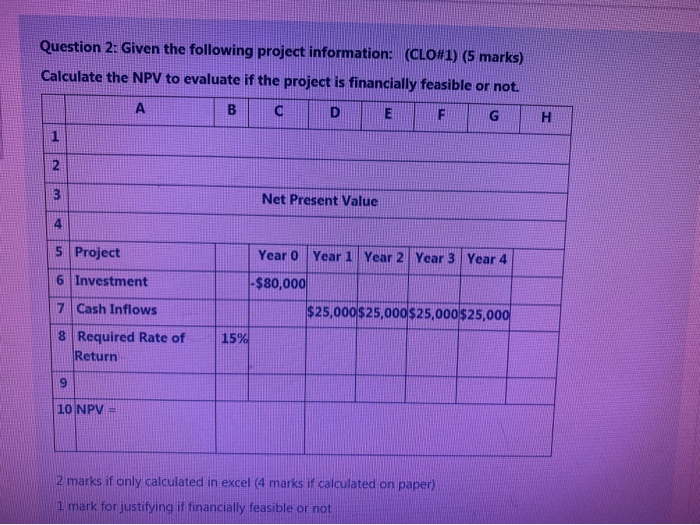

Question 1: Two new software projects are proposed to a young, start-up company. The Alpha project will cost $150,000 to develop and is expected to have annual net cash flow of $40,000. The Beta project will cost $200,000 to develop and is expected to have annual net cash flow of $50,000. The company is very concerned about their cash flow. (CLO#1)(5 marks) A) Using the payback period, which project is better from a cash flow standpoint? Why? (3 marks) B) The Company wants to use weighted scoring matrix method for evaluating the potential projects considering additional factors/ criteria. Using the scoring matrix and given information, which project will be selected? (2 marks) Criteria Strategy Urgency Availability of Total Resources weight fit 2.0 3.0 Weight 5.0 Project Alpha 10 Project Beta 18 IS 10 1 A B Question 2: Given the following project information: (CLO#1) (5 marks) Calculate the NPV to evaluate if the project is financially feasible or not. A B C E F G H 1 N Net Present Value 5 Project Year 0 Year 1 Year 2 Year 3 Year 4 6 Investment 7 Cash Inflows |-$80,000 $25,000 $25,000 $25,000 $25,000 15% 8 Required Rate of Return 9 10 NPV = 2 marks if only calculated in excel (4 marks if calculated on paper) 1 mark for justifying if financially feasible or not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts