Question: question 1 urgent plz help Question 1 (60 marks) Mr. Andy Brown is a UK citizen and works at Orange Plc, a listed UK company.

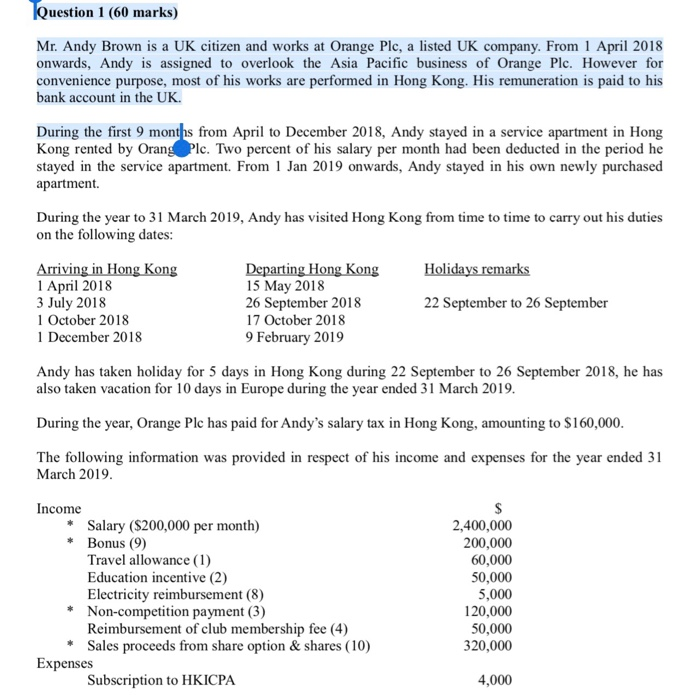

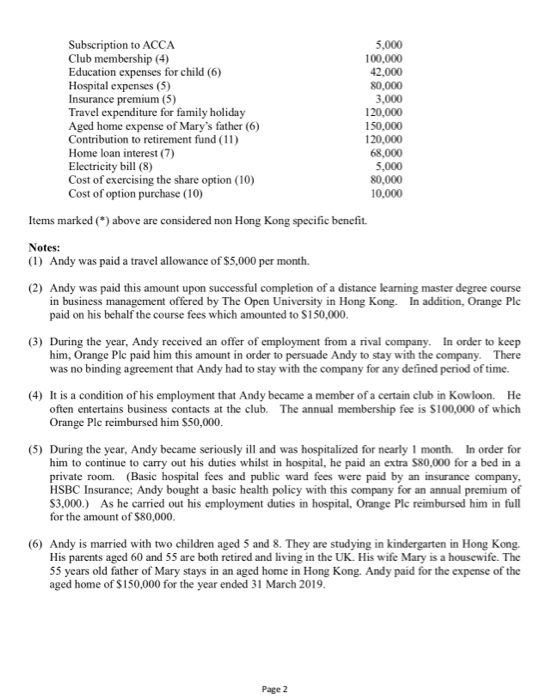

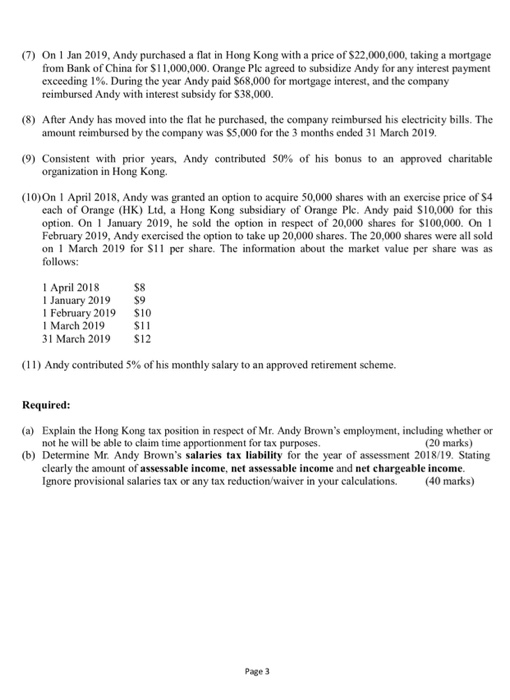

Question 1 (60 marks) Mr. Andy Brown is a UK citizen and works at Orange Plc, a listed UK company. From 1 April 2018 onwards, Andy is assigned to overlook the Asia Pacific business of Orange Ple. However for convenience purpose, most of his works are performed in Hong Kong. His remuneration is paid to his bank account in the UK. During the first 9 months from April to December 2018, Andy stayed in a service apartment in Hong Kong rented by Orang Plc. Two percent of his salary per month had been deducted in the period he stayed in the service apartment. From 1 Jan 2019 onwards, Andy stayed in his own newly purchased apartment. During the year to 31 March 2019, Andy has visited Hong Kong from time to time to carry out his duties on the following dates: Holidays remarks Arriving in Hong Kong 1 April 2018 3 July 2018 1 October 2018 1 December 2018 Departing Hong Kong 15 May 2018 26 September 2018 17 October 2018 9 February 2019 22 September to 26 September Andy has taken holiday for 5 days in Hong Kong during 22 September to 26 September 2018, he has also taken vacation for 10 days in Europe during the year ended 31 March 2019. During the year, Orange Ple has paid for Andy's salary tax in Hong Kong, amounting to $160,000. The following information was provided in respect of his income and expenses for the year ended 31 March 2019. Income Salary ($200,000 per month) Bonus (9) Travel allowance (1) Education incentive (2) Electricity reimbursement (8) * Non-competition payment (3) Reimbursement of club membership fee (4) Sales proceeds from share option & shares (10) Expenses Subscription to HKICPA 2,400,000 200,000 60,000 50,000 5,000 120,000 50,000 320,000 4,000 Subscription to ACCA Club membership (4) Education expenses for child (6) Hospital expenses (5) Insurance premium (5) Travel expenditure for family holiday Aged home expense of Mary's father (6) Contribution to retirement fund (11) Home loan interest (7) Electricity bill (8) Cost of exercising the share option (10) Cost of option purchase (10) 5,000 100,000 42.000 80,000 3,000 120,000 150,000 120,000 68,000 5,000 80,000 10,000 Items marked (*) above are considered non Hong Kong specific benefit. Notes: (1) Andy was paid a travel allowance of $5,000 per month. (2) Andy was paid this amount upon successful completion of a distance learning master degree course in business management offered by The Open University in Hong Kong. In addition, Orange Ple paid on his behalf the course fees which amounted to $150,000. (3) During the year, Andy received an offer of employment from a rival company. In order to keep him, Orange Ple paid him this amount in order to persuade Andy to stay with the company. There was no binding agreement that Andy had to stay with the company for any defined period of time. (4) It is a condition of his employment that Andy became a member of a certain club in Kowloon. He often entertains business contacts at the club. The annual membership fee is $100,000 of which Orange Ple reimbursed him $50,000. (5) During the year, Andy became seriously ill and was hospitalized for nearly 1 month. In order for him to continue to carry out his duties whilst in hospital, he paid an extra $80,000 for a bed in a private room. (Basic hospital fees and public ward fees were paid by an insurance company, HSBC Insurance; Andy bought a basic health policy with this company for an annual premium of $3,000.) As he carried out his employment duties in hospital, Orange Plc reimbursed him in full for the amount of $80,000. (6) Andy is married with two children aged 5 and 8. They are studying in kindergarten in Hong Kong. His parents aged 60 and 55 are both retired and living in the UK. His wife Mary is a housewife. The 55 years old father of Mary stays in an aged home in Hong Kong. Andy paid for the expense of the aged home of $150,000 for the year ended 31 March 2019. Page 2 (7) On 1 Jan 2019, Andy purchased a flat in Hong Kong with a price of $22,000,000, taking a mortgage from Bank of China for SI 1,000,000. Orange Plc agreed to subsidize Andy for any interest payment exceeding 1%. During the year Andy paid $68,000 for mortgage interest, and the company reimbursed Andy with interest subsidy for $38,000. (8) After Andy has moved into the flat he purchased, the company reimbursed his electricity bills. The amount reimbursed by the company was $5,000 for the 3 months ended 31 March 2019. (9) Consistent with prior years, Andy contributed 50% of his bonus to an approved charitable organization in Hong Kong (10) On 1 April 2018, Andy was granted an option to acquire 50,000 shares with an exercise price of $4 cach of Orange (HK) Ltd, a Hong Kong subsidiary of Orange Plc. Andy paid $10,000 for this option. On 1 January 2019, he sold the option in respect of 20,000 shares for $100,000. On February 2019, Andy exercised the option to take up 20,000 shares. The 20,000 shares were all sold on March 2019 for $11 per share. The information about the market value per share was as follows: 1 April 2018 1 January 2019 1 February 2019 1 March 2019 31 March 2019 $8 $9 S10 S11 $12 (11) Andy contributed 5% of his monthly salary to an approved retirement scheme. Required: (a) Explain the Hong Kong tax position in respect of Mr. Andy Brown's employment, including whether or not he will be able to claim time apportionment for tax purposes. (20 marks) (b) Determine Mr. Andy Brown's salaries tax liability for the year of assessment 2018/19. Stating clearly the amount of assessable income, net assessable income and net chargeable income. Ignore provisional salaries tax or any tax reduction/waiver in your calculations. (40 marks) Question 1 (60 marks) Mr. Andy Brown is a UK citizen and works at Orange Plc, a listed UK company. From 1 April 2018 onwards, Andy is assigned to overlook the Asia Pacific business of Orange Ple. However for convenience purpose, most of his works are performed in Hong Kong. His remuneration is paid to his bank account in the UK. During the first 9 months from April to December 2018, Andy stayed in a service apartment in Hong Kong rented by Orang Plc. Two percent of his salary per month had been deducted in the period he stayed in the service apartment. From 1 Jan 2019 onwards, Andy stayed in his own newly purchased apartment. During the year to 31 March 2019, Andy has visited Hong Kong from time to time to carry out his duties on the following dates: Holidays remarks Arriving in Hong Kong 1 April 2018 3 July 2018 1 October 2018 1 December 2018 Departing Hong Kong 15 May 2018 26 September 2018 17 October 2018 9 February 2019 22 September to 26 September Andy has taken holiday for 5 days in Hong Kong during 22 September to 26 September 2018, he has also taken vacation for 10 days in Europe during the year ended 31 March 2019. During the year, Orange Ple has paid for Andy's salary tax in Hong Kong, amounting to $160,000. The following information was provided in respect of his income and expenses for the year ended 31 March 2019. Income Salary ($200,000 per month) Bonus (9) Travel allowance (1) Education incentive (2) Electricity reimbursement (8) * Non-competition payment (3) Reimbursement of club membership fee (4) Sales proceeds from share option & shares (10) Expenses Subscription to HKICPA 2,400,000 200,000 60,000 50,000 5,000 120,000 50,000 320,000 4,000 Subscription to ACCA Club membership (4) Education expenses for child (6) Hospital expenses (5) Insurance premium (5) Travel expenditure for family holiday Aged home expense of Mary's father (6) Contribution to retirement fund (11) Home loan interest (7) Electricity bill (8) Cost of exercising the share option (10) Cost of option purchase (10) 5,000 100,000 42.000 80,000 3,000 120,000 150,000 120,000 68,000 5,000 80,000 10,000 Items marked (*) above are considered non Hong Kong specific benefit. Notes: (1) Andy was paid a travel allowance of $5,000 per month. (2) Andy was paid this amount upon successful completion of a distance learning master degree course in business management offered by The Open University in Hong Kong. In addition, Orange Ple paid on his behalf the course fees which amounted to $150,000. (3) During the year, Andy received an offer of employment from a rival company. In order to keep him, Orange Ple paid him this amount in order to persuade Andy to stay with the company. There was no binding agreement that Andy had to stay with the company for any defined period of time. (4) It is a condition of his employment that Andy became a member of a certain club in Kowloon. He often entertains business contacts at the club. The annual membership fee is $100,000 of which Orange Ple reimbursed him $50,000. (5) During the year, Andy became seriously ill and was hospitalized for nearly 1 month. In order for him to continue to carry out his duties whilst in hospital, he paid an extra $80,000 for a bed in a private room. (Basic hospital fees and public ward fees were paid by an insurance company, HSBC Insurance; Andy bought a basic health policy with this company for an annual premium of $3,000.) As he carried out his employment duties in hospital, Orange Plc reimbursed him in full for the amount of $80,000. (6) Andy is married with two children aged 5 and 8. They are studying in kindergarten in Hong Kong. His parents aged 60 and 55 are both retired and living in the UK. His wife Mary is a housewife. The 55 years old father of Mary stays in an aged home in Hong Kong. Andy paid for the expense of the aged home of $150,000 for the year ended 31 March 2019. Page 2 (7) On 1 Jan 2019, Andy purchased a flat in Hong Kong with a price of $22,000,000, taking a mortgage from Bank of China for SI 1,000,000. Orange Plc agreed to subsidize Andy for any interest payment exceeding 1%. During the year Andy paid $68,000 for mortgage interest, and the company reimbursed Andy with interest subsidy for $38,000. (8) After Andy has moved into the flat he purchased, the company reimbursed his electricity bills. The amount reimbursed by the company was $5,000 for the 3 months ended 31 March 2019. (9) Consistent with prior years, Andy contributed 50% of his bonus to an approved charitable organization in Hong Kong (10) On 1 April 2018, Andy was granted an option to acquire 50,000 shares with an exercise price of $4 cach of Orange (HK) Ltd, a Hong Kong subsidiary of Orange Plc. Andy paid $10,000 for this option. On 1 January 2019, he sold the option in respect of 20,000 shares for $100,000. On February 2019, Andy exercised the option to take up 20,000 shares. The 20,000 shares were all sold on March 2019 for $11 per share. The information about the market value per share was as follows: 1 April 2018 1 January 2019 1 February 2019 1 March 2019 31 March 2019 $8 $9 S10 S11 $12 (11) Andy contributed 5% of his monthly salary to an approved retirement scheme. Required: (a) Explain the Hong Kong tax position in respect of Mr. Andy Brown's employment, including whether or not he will be able to claim time apportionment for tax purposes. (20 marks) (b) Determine Mr. Andy Brown's salaries tax liability for the year of assessment 2018/19. Stating clearly the amount of assessable income, net assessable income and net chargeable income. Ignore provisional salaries tax or any tax reduction/waiver in your calculations. (40 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts