Question: QUESTION 1 Use the following in-class exercise (I copied from the slide 4 of Lecture Note 7 to answer all questions in this test. As

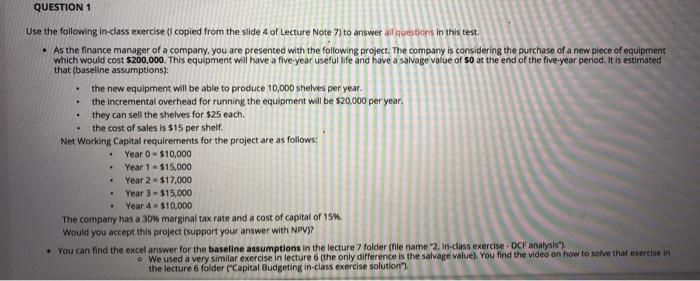

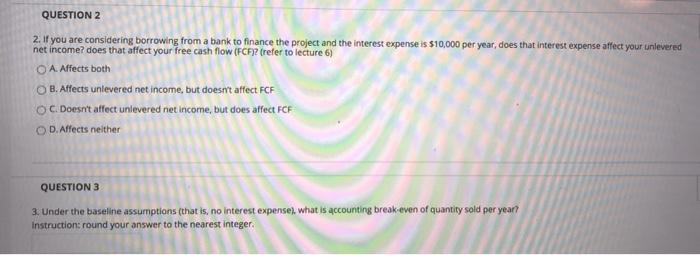

QUESTION 1 Use the following in-class exercise (I copied from the slide 4 of Lecture Note 7 to answer all questions in this test. As the finance manager of a company, you are presented with the following project. The company is considering the purchase of a new piece of equipment which would cost $200,000. This equipment will have a five-year useful life and have a salvage value of so at the end of the five-year period. It is estimated that baseline assumptions): the new equipment will be able to produce 10,000 shelves per year. the incremental overhead for running the equipment will be $20,000 per year. they can sell the shelves for $25 each, the cost of sales is $15 per shelf. Net Working Capital requirements for the project are as follows: Year 0-$10,000 Year 1 - $15,000 Year 2 -$17.000 Year 3 - $15,000 Year 4-510,000 The company has a 3D marginal tax rate and a cost of capital of 15%. Would you accept this project (support your answer with NPV)? You can find the excel answer for the baseline assumptions in the lecture 7 folder (file name 2. In-dass exercise - DCF analysis"), We used a very similar exercise in lecture 6 (the only difference is the salvage value). You find the video on how to solve that exercise in the lecture 6 folder Capital Budgeting in-class exercise solution") QUESTION 2 2. If you are considering borrowing from a bank to finance the project and the interest expense is $10,000 per year, does that interest expense affect your unlevered net income? does that affect your free cash flow (FCF/2 (refer to lecture 6) A. Affects both OB. Affects unlevered net income, but doesn't affect FCF OC. Doesn't affect unlevered net income, but does affect FCF D. Affects neither QUESTION 3 3. Under the baseline assumptions (that is, no interest expense). what is accounting break-even of quantity sold per year Instruction: round your answer to the nearest Integer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts