Question: QUESTION 1 Use the following information to answer the next two questions. The US dollar/Canadian dollar spot exchange rate is $.85/CS. The one year U.S.

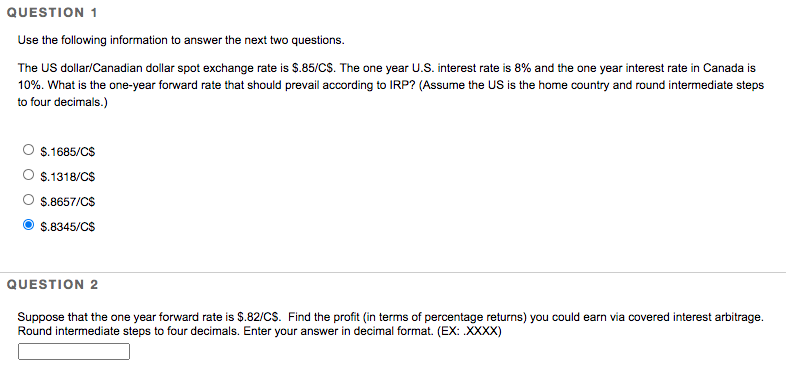

QUESTION 1 Use the following information to answer the next two questions. The US dollar/Canadian dollar spot exchange rate is $.85/CS. The one year U.S. interest rate is 8% and the one year interest rate in Canada is 10%. What is the one-year forward rate that should prevail according to IRP? (Assume the US is the home country and round intermediate steps to four decimals.) $.1685/C$ $.1318/C$ $.8657/CS $.8345/CS QUESTION 2 Suppose that the one year forward rate is $.82/CS. Find the profit (in terms of percentage returns) you could earn via covered interest arbitrage. Round intermediate steps to four decimals. Enter your answer in decimal format. (EX: .XXXX)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts