Question: Question #1: WACC & Capital Budget Analysis - Based on the inputs below prepare a capital budget analysis for this Project Capital Investment using the

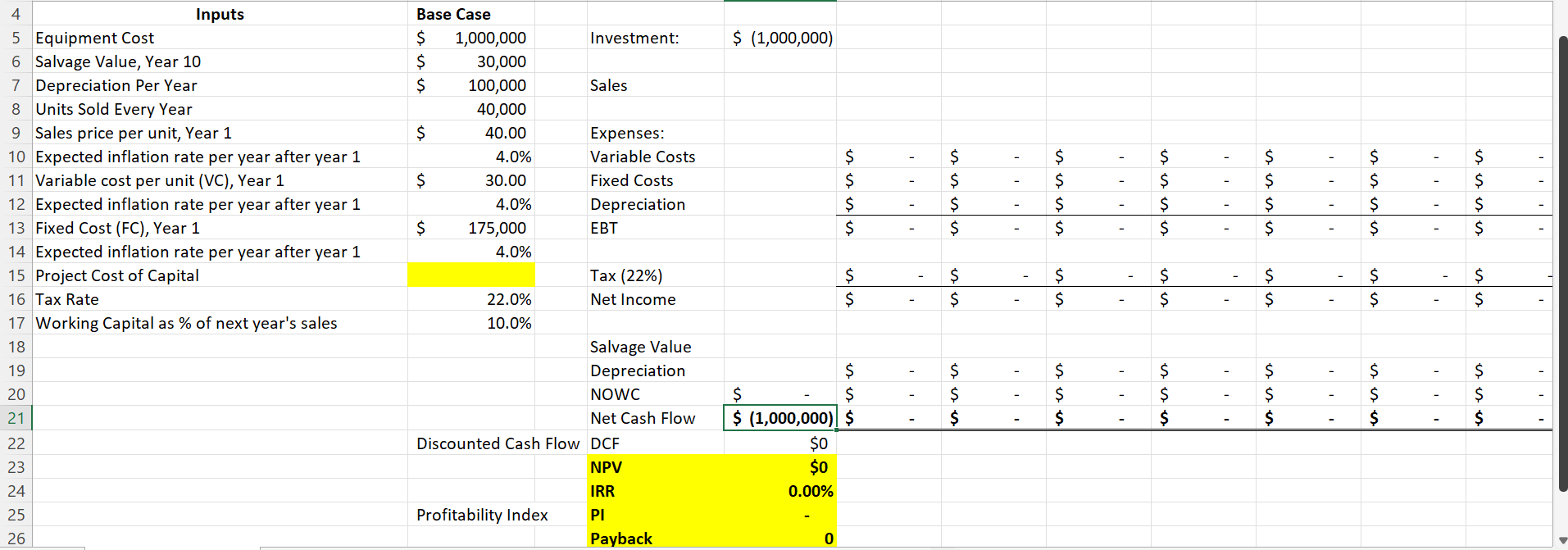

Question #1: WACC & Capital Budget Analysis - Based on the inputs below prepare a capital budget analysis for this Project Capital Investment using the Net Present Value, Internal Rate of Return, Profitability Index and Payback in years methods, determining whether the project is feasible. Please show your spreadsheet calculations and your determination on whether the company should proceed with this investment and why. Project Inputs: WACC - Debt is 65% and Equity is 35% of this firm's capital structure. Interest rate on the debt is 8.5%, firm's tax rate is 22%. Firm's beta is 1.40, Risk Free Rate is 3.0%, Market Return Rate is 8.0%. Project Investment Outlay, Year 0 - $1,000,000 Project Investment Life - 10 years Project Depreciation - $100,000/year Project Salvage Value - $30,000 Working Capital Base of Annual Sales - 10% Expected inflation rate per year - 3.0% Project Tax Rate - 22% Units sold per year - 40,000 Selling Price per Unit, Year 1 - $40.00 Fixed operating costs per year excluding depreciation - $175,000 Manufacturing (Variable) costs per unit, Year 1 - $30.00 4 5 Equipment Cost 6 Salvage Value, Year 10 7 Depreciation Per Year 8 Units Sold Every Year 9 Sales price per unit, Year 1 10 Expected inflation rate per year after year 1 11 Variable cost per unit (VC), Year 1 12 Expected inflation rate per year after year 1 13 Fixed Cost (FC), Year 1 14 Expected inflation rate per year after year 1 15 Project Cost of Capital 16 Tax Rate 17 Working Capital as % of next year's sales 18 19 20 21 22 23 24 25 26 Inputs Base Case $ $ $ $ $ $ Investment: Sales Expenses: Variable Costs Fixed Costs Depreciation EBT Tax (22%) Net Income Salvage Value Depreciation NOWC Net Cash Flow 1,000,000 30,000 100,000 40,000 40.00 4.0% 30.00 4.0% 175,000 4.0% 22.0% 10.0% Discounted Cash Flow DCF NPV IRR Profitability Index PI Payback $ (1,000,000) $ $ $ $ $ $ $ $ $ $ (1,000,000) $ $0 $0 0.00% 0 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts