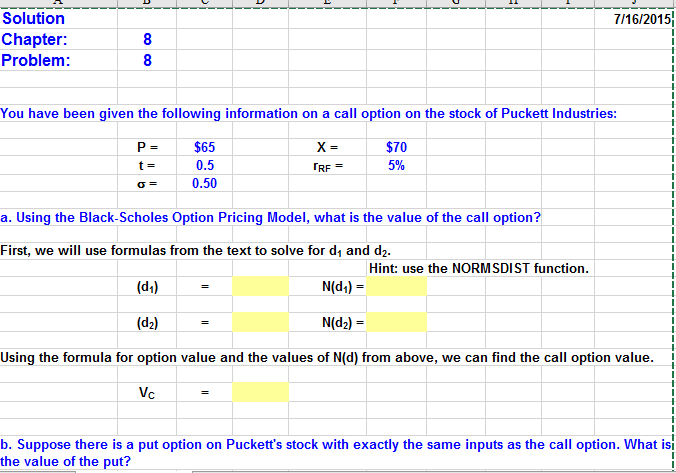

Question: Solution Chapter: Problem: 7/16/2015 You have been given the following information on a call option on the stock of Puckett Industries: P= $65 t0.5 0.50

Solution Chapter: Problem: 7/16/2015 You have been given the following information on a call option on the stock of Puckett Industries: P= $65 t0.5 0.50 $70 5% TRF- a. Using the Black-Scholes Option Pricing Model, what is the value of the call option? First, we will use formulas from the text to solve for di and d2. Hint: use the NORMSDIST function. n(d) = N(d2) Using the formula for option value and the values of N(d) from above, we can find the call option value. | Vc b. Suppose there is a put option on Puckett's stock with exactly the same inputs as the call option. What is the value of the put

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts