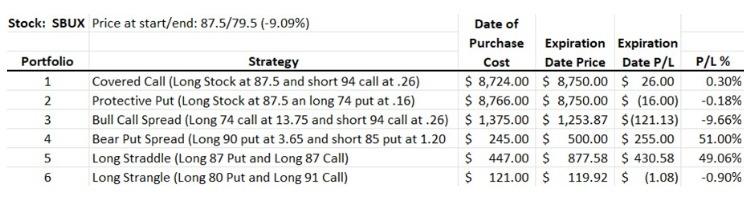

Question: QUESTION: 1) What contributed to this performance? Stock: SBUX Price at start/end: 87.5/79.5 (-9.09%) Portfolio 1 2 3 4 5 6 Strategy Covered Call (Long

QUESTION: 1) What contributed to this performance?

Stock: SBUX Price at start/end: 87.5/79.5 (-9.09%) Portfolio 1 2 3 4 5 6 Strategy Covered Call (Long Stock at 87.5 and short 94 call at .26) Protective Put (Long Stock at 87.5 an long 74 put at.16) Bull Call Spread (Long 74 call at 13.75 and short 94 call at .26) Bear Put Spread (Long 90 put at 3.65 and short 85 put at 1.20 Long Straddle (Long 87 Put and Long 87 Call) Long Strangle (Long 80 Put and Long 91 Call) Date of Purchase Cost $ 8,724.00 $8,750.00 $26.00 $ 8,766.00 $8,750.00 $ (16.00) $1,375.00 $1,253.87 $(121.13) $ 245.00 $ 500.00 $ 255.00 $ 447.00 $ 877.58 $430.58 $ 121.00 $ 119.92 $ (1.08) Expiration Expiration Date Price Date P/L P/L% 0.30% -0.18% -9.66% 51.00% 49.06% -0.90%

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

ANS WER The performance of the portfolio was largely determined by the m... View full answer

Get step-by-step solutions from verified subject matter experts