Question: Type or paste question here Question 1 (6 marks) Consider a dividend-paying stock whose price follows a geometric Brownian motion (GBM) of the form: dS

Type or paste question here

Type or paste question here

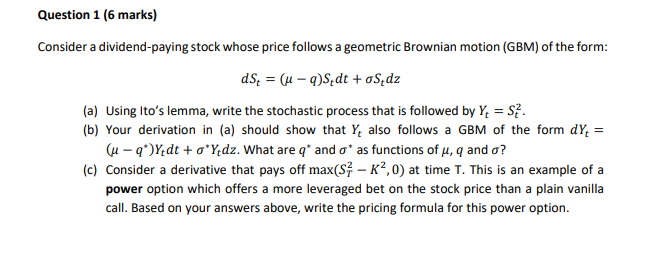

Question 1 (6 marks) Consider a dividend-paying stock whose price follows a geometric Brownian motion (GBM) of the form: dS = (u - )Sedt +os dz (a) Using Ito's lemma, write the stochastic process that is followed by Y= 5. (b) Your derivation in (a) should show that Y, also follows a GBM of the form dy, = (u - q*)Yedt + o*Yedz. What are q* and o* as functions of u, q and o? (c) Consider a derivative that pays off max(s. - K2,0) at time T. This is an example of a power option which offers a more leveraged bet on the stock price than a plain vanilla call. Based on your answers above, write the pricing formula for this power option. Question 1 (6 marks) Consider a dividend-paying stock whose price follows a geometric Brownian motion (GBM) of the form: dS = (u - )Sedt +os dz (a) Using Ito's lemma, write the stochastic process that is followed by Y= 5. (b) Your derivation in (a) should show that Y, also follows a GBM of the form dy, = (u - q*)Yedt + o*Yedz. What are q* and o* as functions of u, q and o? (c) Consider a derivative that pays off max(s. - K2,0) at time T. This is an example of a power option which offers a more leveraged bet on the stock price than a plain vanilla call. Based on your answers above, write the pricing formula for this power option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts