Question: Question 1: Which strategy would you choose, strategy A or strategy B and why? Question 2: What would be the main risks attached to that

Question 1: Which strategy would you choose, strategy A or strategy B and why?

Question 2: What would be the main risks attached to that strategy and how would you attempt to minimise these risks?

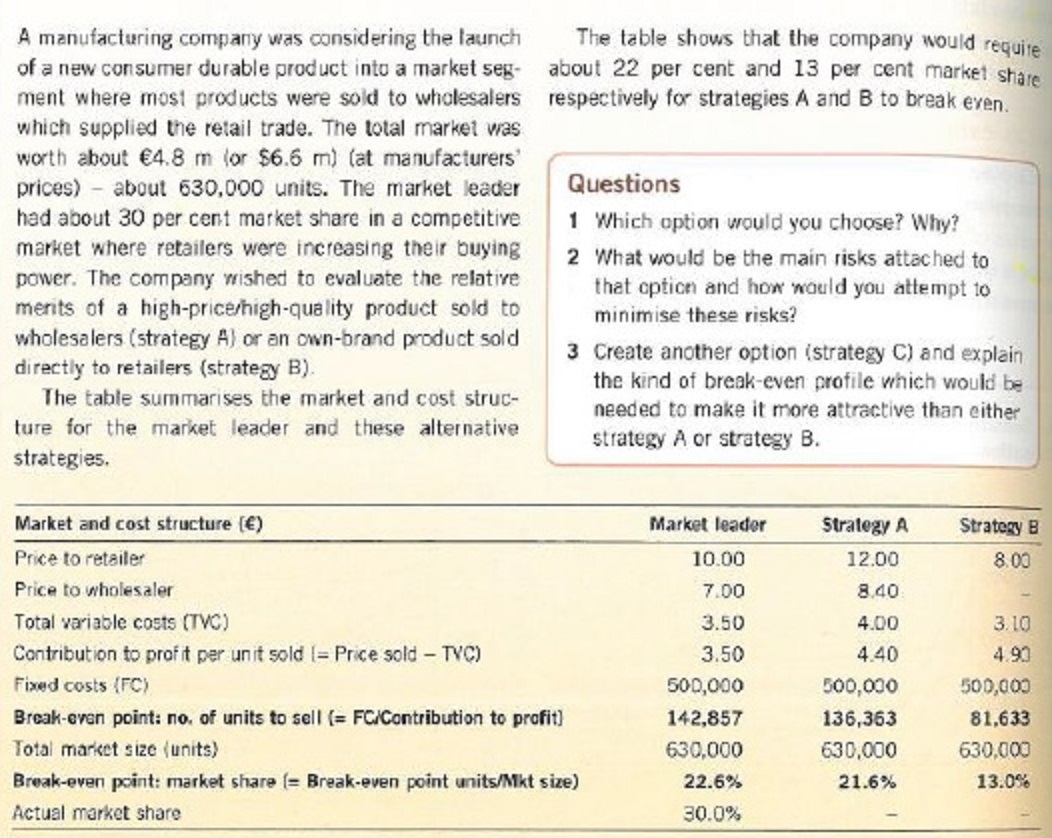

A manufacturing company was considering the launch The table shows that the company would require of a new consumer durable product into a market seg- about 22 per cent and 13 per cent market share ment where most products were sold to wholesalers respectively for strategies A and B to break even. which supplied the retail trade. The total market was worth about (4.8 m for $6.6 m) (at manufacturers prices) - about 630,000 units. The market leader Questions had about 30 per cent market share in a competitive 1 Which option would you choose? Why? market where retailers were increasing their buying power. The company wished to evaluate the relative 2 What would be the main risks attached to merits of a high-price/high-quality product sold to that option and how would you attempt to wholesalers (strategy A) or an own-brand product sold minimise these risks? directly to retailers (strategy B). 3 Create another option (strategy C) and explain The table summarises the market and cost struc- the kind of break-even profile which would be ture for the market leader and these alternative needed to make it more attractive than either strategies. strategy A or strategy B. Market and cost structure [e) Market leader Strategy A Strategy B Price to retailer 10.00 12.00 8.00 Price to wholesaler 7.00 8.40 Total variable costs (TVC) 3.50 4.00 3.10 Contribution to profit per unit sold [= Price sold - TVC) 3.50 4.40 4.93 Fixed costs (FC) 500,000 500,000 500,003 Break-even point: no. of units to sell (= FC/Contribution to profit] 142,857 136,363 81,633 Total market size (units) 630,000 630,000 630,000 Break-even point: market share (= Break-even point units/Mkt size) 22.6% 21.6% 13.0% Actual market share 30.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts