Question: Question 1 You are an audit manager in Princewill & Co, a firm of Chartered Accountants which offers a range of assurance services. You are

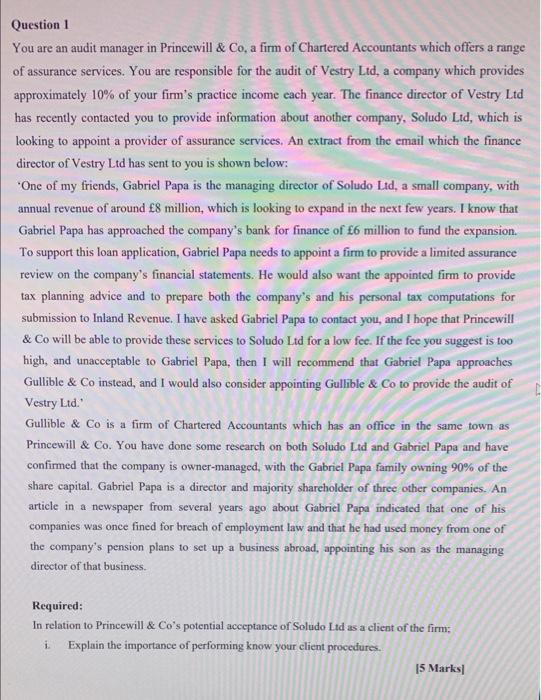

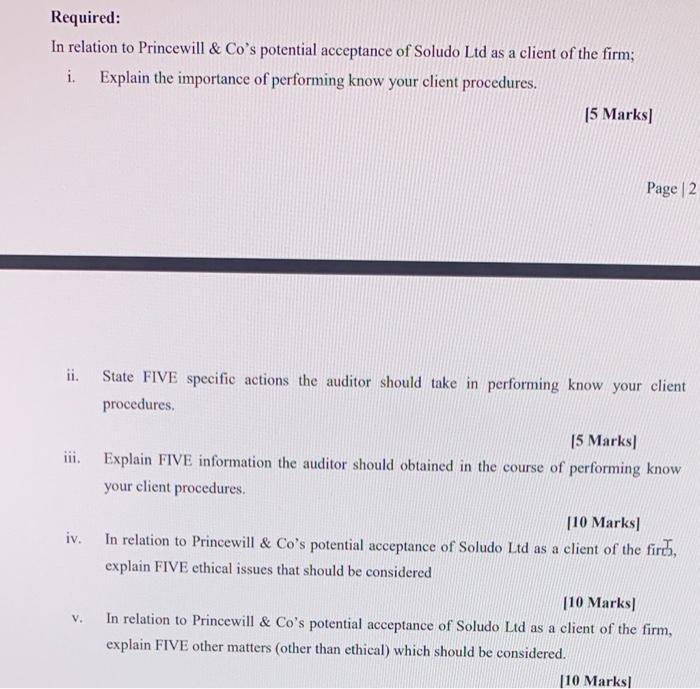

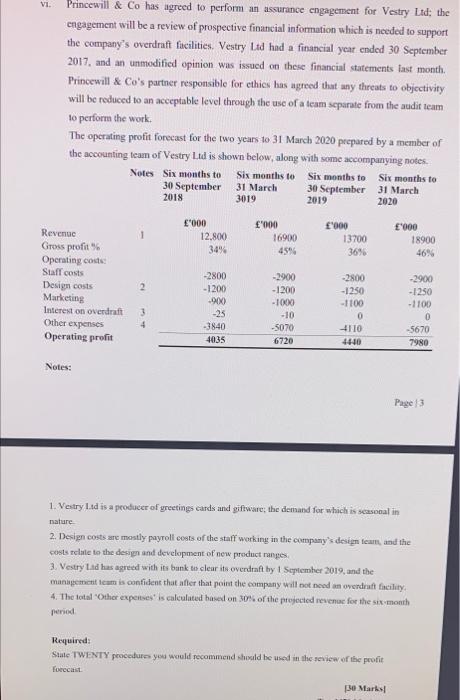

Question 1 You are an audit manager in Princewill & Co, a firm of Chartered Accountants which offers a range of assurance services. You are responsible for the audit of Vestry Ltd, a company which provides approximately 10% of your firm's practice income each year. The finance director of Vestry Ltd has recently contacted you to provide information about another company, Soludo Ltd, which is looking to appoint a provider of assurance services. An extract from the email which the finance director of Vestry Ltd has sent to you is shown below: 'One of my friends, Gabriel Papa is the managing director of Soludo Ltd, a small company, with annual revenue of around 8 million, which is looking to expand in the next few years. I know that Gabriel Papa has approached the company's bank for finance of 6 million to fund the expansion. To support this loan application, Gabriel Papa needs to appoint a firm to provide a limited assurance review on the company's financial statements. He would also want the appointed firm to provide tax planning advice and to prepare both the company's and his personal tax computations for submission to Inland Revenue. I have asked Gabriel Papa to contact you, and I hope that Princewill & Co will be able to provide these services to Soludo Ltd for a low fee. If the fce you suggest is too high, and unacceptable to Gabriel Papa, then I will recommend that Gabriel Papa approaches Gullible & Co instead, and I would also consider appointing Gullible & Co to provide the audit of Vestry Ltd. Gullible & Co is a firm of Chartered Accountants which has an office in the same town as Princewill & Co. You have done some research on both Soludo Ltd and Gabriel Papa and have confirmed that the company is owner-managed, with the Gabriel Papa family owning 90% of the share capital. Gabriel Papa is a director and majority shareholder of three other companies. An article in a newspaper from several years ago about Gabriel Papa indicated that one of his companies was once fined for breach of employment law and that he had used money from one of the company's pension plans to set up a business abroad, appointing his son as the managing director of that business. Required: In relation to Princewill & Co's potential acceptance of Soludo Ltd as a client of the firm; Explain the importance of performing know your client procedures. 15 Marks i. a Required: In relation to Princewill & Co's potential acceptance of Soludo Ltd as a client of the firm; i. Explain the importance of performing know your client procedures. 15 Marks] Page 2 ii. iii. State FIVE specific actions the auditor should take in performing know your client procedures 15 Marks Explain FIVE information the auditor should obtained in the course of performing know your client procedures. 110 Marks In relation to Princewill & Co's potential acceptance of Soludo Ltd as a client of the firds, explain FIVE ethical issues that should be considered 110 Marks! In relation to Princewill & Co's potential acceptance of Soludo Ltd as a client of the firm, explain FIVE other matters (other than ethical) which should be considered. [10 Marks! iv. V. VI. Princewill & Co has agreed to perform an assurance engagement for Vestry Ltd: the engagement will be a review of prospective financial information which is needed to support the company's overdraft facilities. Vestry Lad had a financial year ended 30 September 2017, and an unmodified opinion was issued on these financial statements fast month. Princewill & Co's partner responsible for ethics has agreed that any threats to objectivity will be reduced to an acceptable level through the use of a team separate from the audit team to perform the work The operating profit forecast for the two years to 31 March 2020 prepared by a member of the accounting team of Vestry Ltd is shown below, along with some accompanying notes Notes Six months to Six months to Six months to Six months to 30 September 31 March 30 September 31 March 2018 2019 2020 3019 '000 12.800 34% f"000 16900 45 f'000 13700 36% '000 18900 46% Revenue Gross profit Operating costs Staff costs Design costs Marketing Interest on overdraft Other expenses Operating profit 2 -2800 -1200 -90) -25 -3840 4035 -2900 -1200 -1000 3 4 -10 -2800 -1250 -1100 0 4110 4440 -2900 -1250 -1100 0 -5670 7980 -50.70 6720 Notes: Page 3 1. Vestry Ltd is a producer of greeting cards and giftware, the demand for which is scasonal in nature 2. Design costs are mostly payroll costs of the staff working in the company's design team, and the costs relate to the design and development of new product ranges 3. Vestry Lad has agreed with its bank to clear its overdraft by 1 September 2019, and the management team is confident that after that point the company will not need an overdratt fcility 4. The total Other expenses" is calculated based on 30% of the projected revenue for the six month period Required: State TWENTY procedures you would recommend should be used in the review of the profit forecast 30 Marks! Question 1 You are an audit manager in Princewill & Co, a firm of Chartered Accountants which offers a range of assurance services. You are responsible for the audit of Vestry Ltd, a company which provides approximately 10% of your firm's practice income each year. The finance director of Vestry Ltd has recently contacted you to provide information about another company, Soludo Ltd, which is looking to appoint a provider of assurance services. An extract from the email which the finance director of Vestry Ltd has sent to you is shown below: 'One of my friends, Gabriel Papa is the managing director of Soludo Ltd, a small company, with annual revenue of around 8 million, which is looking to expand in the next few years. I know that Gabriel Papa has approached the company's bank for finance of 6 million to fund the expansion. To support this loan application, Gabriel Papa needs to appoint a firm to provide a limited assurance review on the company's financial statements. He would also want the appointed firm to provide tax planning advice and to prepare both the company's and his personal tax computations for submission to Inland Revenue. I have asked Gabriel Papa to contact you, and I hope that Princewill & Co will be able to provide these services to Soludo Ltd for a low fee. If the fce you suggest is too high, and unacceptable to Gabriel Papa, then I will recommend that Gabriel Papa approaches Gullible & Co instead, and I would also consider appointing Gullible & Co to provide the audit of Vestry Ltd. Gullible & Co is a firm of Chartered Accountants which has an office in the same town as Princewill & Co. You have done some research on both Soludo Ltd and Gabriel Papa and have confirmed that the company is owner-managed, with the Gabriel Papa family owning 90% of the share capital. Gabriel Papa is a director and majority shareholder of three other companies. An article in a newspaper from several years ago about Gabriel Papa indicated that one of his companies was once fined for breach of employment law and that he had used money from one of the company's pension plans to set up a business abroad, appointing his son as the managing director of that business. Required: In relation to Princewill & Co's potential acceptance of Soludo Ltd as a client of the firm; Explain the importance of performing know your client procedures. 15 Marks i. a Required: In relation to Princewill & Co's potential acceptance of Soludo Ltd as a client of the firm; i. Explain the importance of performing know your client procedures. 15 Marks] Page 2 ii. iii. State FIVE specific actions the auditor should take in performing know your client procedures 15 Marks Explain FIVE information the auditor should obtained in the course of performing know your client procedures. 110 Marks In relation to Princewill & Co's potential acceptance of Soludo Ltd as a client of the firds, explain FIVE ethical issues that should be considered 110 Marks! In relation to Princewill & Co's potential acceptance of Soludo Ltd as a client of the firm, explain FIVE other matters (other than ethical) which should be considered. [10 Marks! iv. V. VI. Princewill & Co has agreed to perform an assurance engagement for Vestry Ltd: the engagement will be a review of prospective financial information which is needed to support the company's overdraft facilities. Vestry Lad had a financial year ended 30 September 2017, and an unmodified opinion was issued on these financial statements fast month. Princewill & Co's partner responsible for ethics has agreed that any threats to objectivity will be reduced to an acceptable level through the use of a team separate from the audit team to perform the work The operating profit forecast for the two years to 31 March 2020 prepared by a member of the accounting team of Vestry Ltd is shown below, along with some accompanying notes Notes Six months to Six months to Six months to Six months to 30 September 31 March 30 September 31 March 2018 2019 2020 3019 '000 12.800 34% f"000 16900 45 f'000 13700 36% '000 18900 46% Revenue Gross profit Operating costs Staff costs Design costs Marketing Interest on overdraft Other expenses Operating profit 2 -2800 -1200 -90) -25 -3840 4035 -2900 -1200 -1000 3 4 -10 -2800 -1250 -1100 0 4110 4440 -2900 -1250 -1100 0 -5670 7980 -50.70 6720 Notes: Page 3 1. Vestry Ltd is a producer of greeting cards and giftware, the demand for which is scasonal in nature 2. Design costs are mostly payroll costs of the staff working in the company's design team, and the costs relate to the design and development of new product ranges 3. Vestry Lad has agreed with its bank to clear its overdraft by 1 September 2019, and the management team is confident that after that point the company will not need an overdratt fcility 4. The total Other expenses" is calculated based on 30% of the projected revenue for the six month period Required: State TWENTY procedures you would recommend should be used in the review of the profit forecast 30 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts