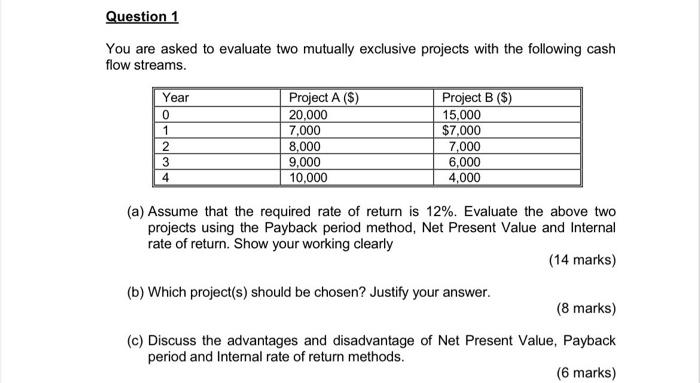

Question: Question 1 You are asked to evaluate two mutually exclusive projects with the following cash flow streams. Year 0 1 2 3 4 Project A

Question 1 You are asked to evaluate two mutually exclusive projects with the following cash flow streams. Year 0 1 2 3 4 Project A ($) 20,000 7,000 8,000 9,000 10,000 Project B ($) 15,000 $7,000 7,000 6,000 4,000 (a) Assume that the required rate of return is 12%. Evaluate the above two projects using the Payback period method, Net Present Value and Internal rate of return. Show your working clearly (14 marks) (b) Which project(s) should be chosen? Justify your answer. (8 marks) (c) Discuss the advantages and disadvantage of Net Present Value, Payback period and Internal rate of return methods. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts