Question: I need solution and answer as soon as possible Question 1 You are asked to evaluate two mutually exclusive projects with the following cash flow

I need solution and answer as soon as possible

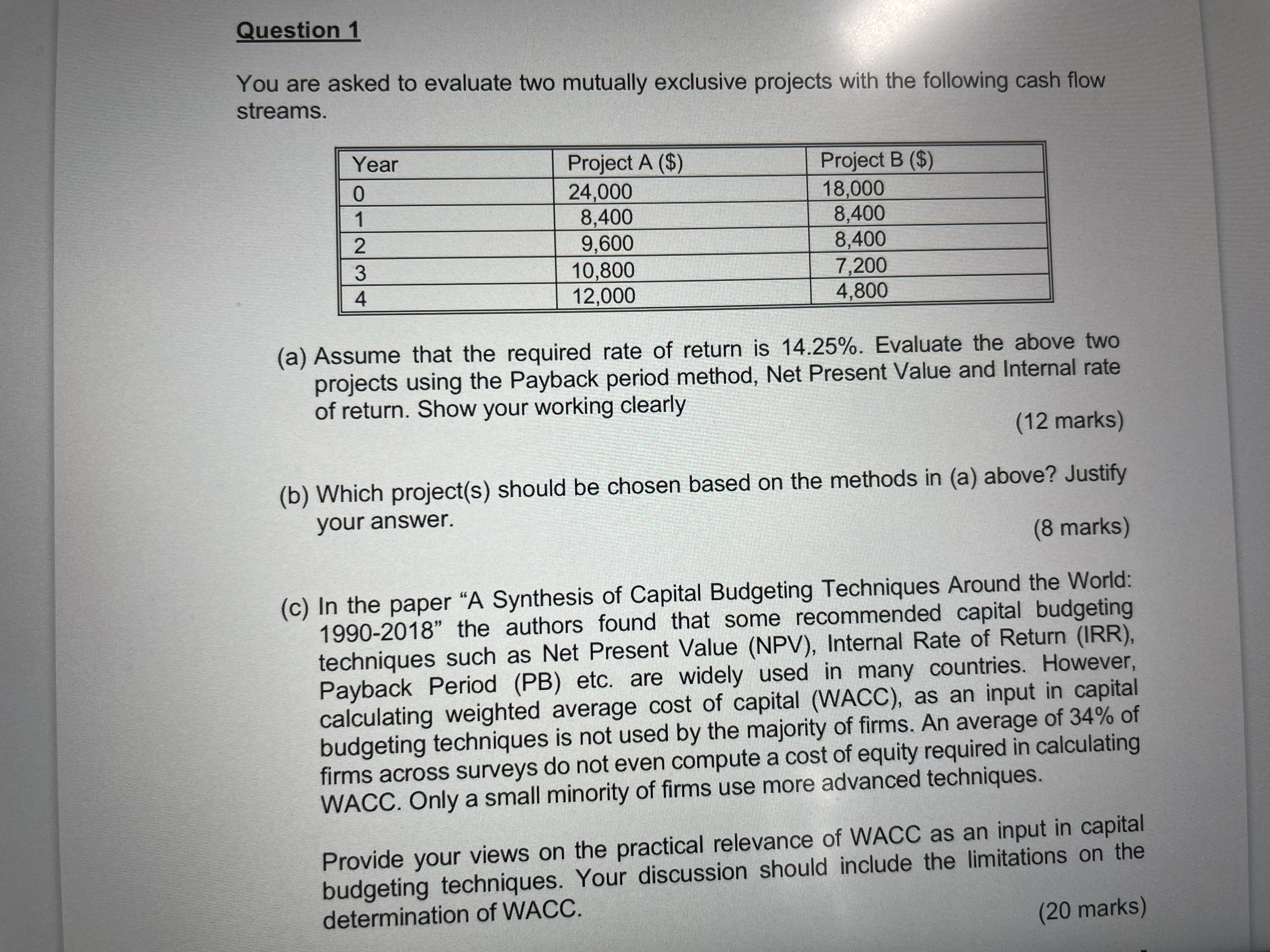

Question 1 You are asked to evaluate two mutually exclusive projects with the following cash flow streams. Year Project A ($) Project B ($) 0 24,000 18,000 1 8,400 8,400 2 9,600 8,400 3 10,800 7,200 4 12,000 4,800 (a) Assume that the required rate of return is 14.25%. Evaluate the above two projects using the Payback period method, Net Present Value and Internal rate of return. Show your working clearly (12 marks) (b) Which project(s) should be chosen based on the methods in (a) above? Justify your answer. (8 marks) (c) In the paper "A Synthesis of Capital Budgeting Techniques Around the World: 1990-2018" the authors found that some recommended capital budgeting techniques such as Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period (PB) etc. are widely used in many countries. However, calculating weighted average cost of capital (WACC), as an input in capital budgeting techniques is not used by the majority of firms. An average of 34% of firms across surveys do not even compute a cost of equity required in calculating WACC. Only a small minority of firms use more advanced techniques. Provide your views on the practical relevance of WACC as an input in capital budgeting techniques. Your discussion should include the limitations on the determination of WACC. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts