Question: Question 10 (1 point) Everything else held constant, if the expected return on U.S. Treasury bonds falls from 10 to 7 percent while the expected

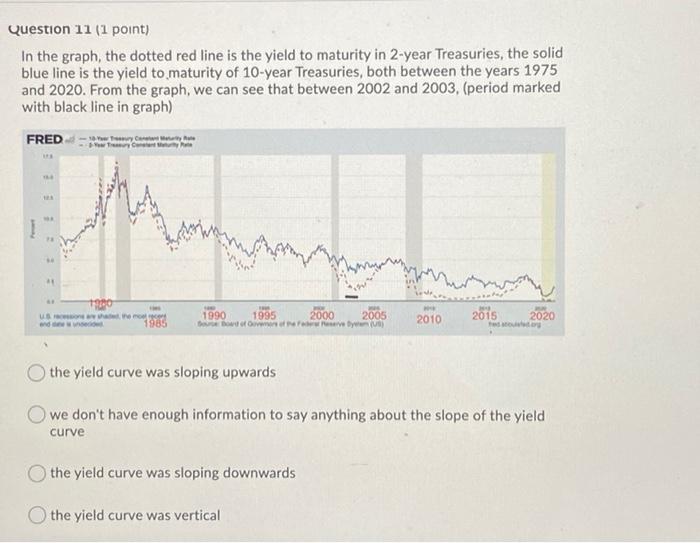

Question 10 (1 point) Everything else held constant, if the expected return on U.S. Treasury bonds falls from 10 to 7 percent while the expected return on GE stock stays constant at 6 percent, then the expected return of holding GE stock relative to U.S. Treasury bonds and the demand for GE stock OA) rises; rises B) falls; falls C) falls; rises D) rises; falls Question 11 (1 point) In the graph, the dotted red line is the yield to maturity in 2-year Treasuries, the solid blue line is the yield to maturity of 10-year Treasuries, both between the years 1975 and 2020. From the graph, we can see that between 2002 and 2003. (period marked with black line in graph) FRED we * mo 1985 1990 1995 2000 2005 Ovey (US) 2010 2015 and 2020 . the yield curve was sloping upwards we don't have enough information to say anything about the slope of the yield curve the yield curve was sloping downwards the yield curve was vertical Question 23 (1 point) You buy a stock for $47. The following year you sell it at again and receive a price that is $5 higher than what you paid. You also receive a dividend of 8. Your rate of return was: Give your answer with two decimals and with no $ or %. Note for instance that 10% = 0.1 = 10 should be written as 10.00. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts