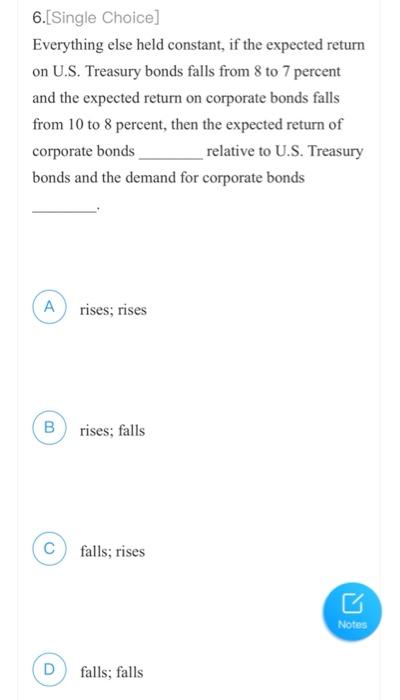

Question: 6.2 exercises: chapter 5-1 1. [Single Choice] Everything else held constant, if the expected return on ABC stock rises from 5 to 10 percent and

![6.2 exercises: chapter 5-1 1. [Single Choice] Everything else held constant,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6dcb747d11_39166f6dcb72533c.jpg)

![present value B future value c interest Notes D deflation 3.[Single Choice]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6dcbbb8242_39566f6dcbb53b18.jpg)

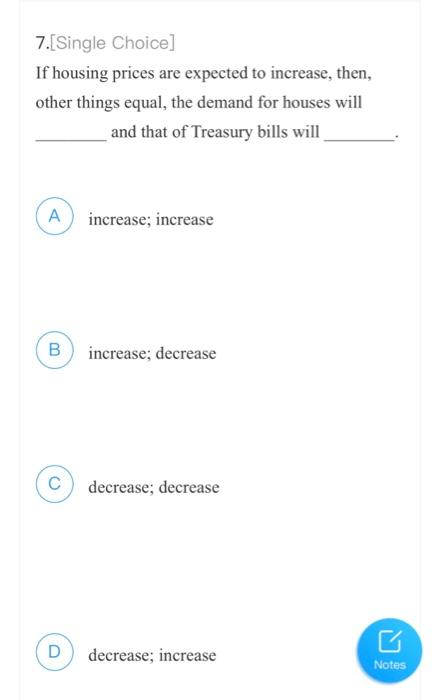

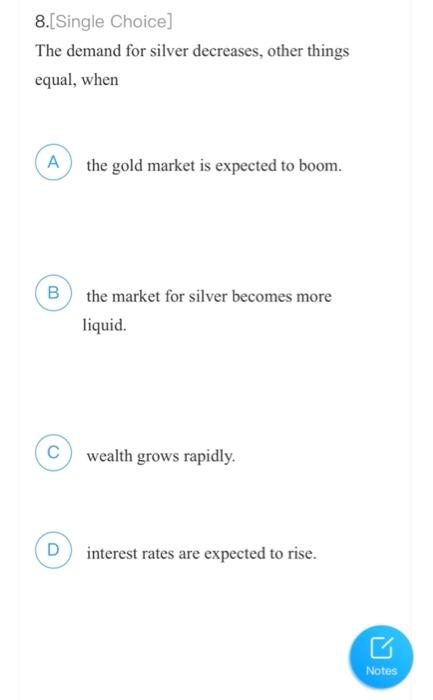

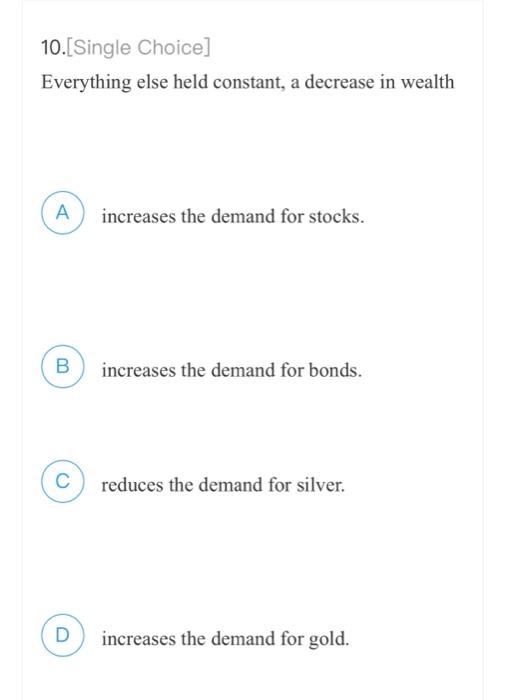

6.2 exercises: chapter 5-1 1. [Single Choice] Everything else held constant, if the expected return on ABC stock rises from 5 to 10 percent and the expected return on CBS stock is unchanged, then the expected return of holding CBS stock relative to ABC stock and the demand for CBS stock A rises; rises B rises; falls Cfalls; rises Notes D falls; falls 2. Single Choice The concept of is based on the common- sense notion that a dollar paid to you in the future is less valuable to you than a dollar today. A present value B future value c interest Notes D deflation 3.[Single Choice] You would be less willing to purchase U.S. Treasury bonds, other things equal, if A you inherit $1 million from your Uncle Harry. B you expect interest rates to fall. gold becomes more liquid. D stock prices are expected to fall. Notes 4.(Single Choice] An increase in the expected rate of inflation will the expected return on bonds relative to the that on assets, everything else held constant. A reduce; financial B reduce; real c raise; financial Notes D raise; real 5.[Single Choice] If brokerage commissions on bond sales decrease, then, other things equal, the demand for bonds will and the demand for real estate will A increase; increase B increase; decrease decrease; decrease D decrease; increase Notes 6.[Single Choice] Everything else held constant, if the expected return on U.S. Treasury bonds falls from 8 to 7 percent and the expected return on corporate bonds falls from 10 to 8 percent, then the expected return of corporate bonds relative to U.S. Treasury bonds and the demand for corporate bonds rises; rises B rises; falls falls; rises Notes falls; falls 7.[Single Choice] If housing prices are expected to increase, then, other things equal, the demand for houses will and that of Treasury bills will A increase; increase B increase; decrease decrease; decrease D decrease; increase Notes 8.[Single Choice] The demand for silver decreases, other things equal, when the gold market is expected to boom. B the market for silver becomes more liquid. wealth grows rapidly. D interest rates are expected to rise. Notes 9.(Single Choice] If stock prices are expected to drop dramatically, then, other things equal, the demand for stocks will and that of Treasury bills will A increase; increase B increase; decrease decrease; decrease D decrease; increase 10.[Single Choice] Everything else held constant, a decrease in wealth A increases the demand for stocks. B increases the demand for bonds. reduces the demand for silver. D increases the demand for gold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts