Question: QUESTION 10 10 p A CMO has 3 tranches, A, B, and Z an accrual tranche as well as a residual class. If the prepayment

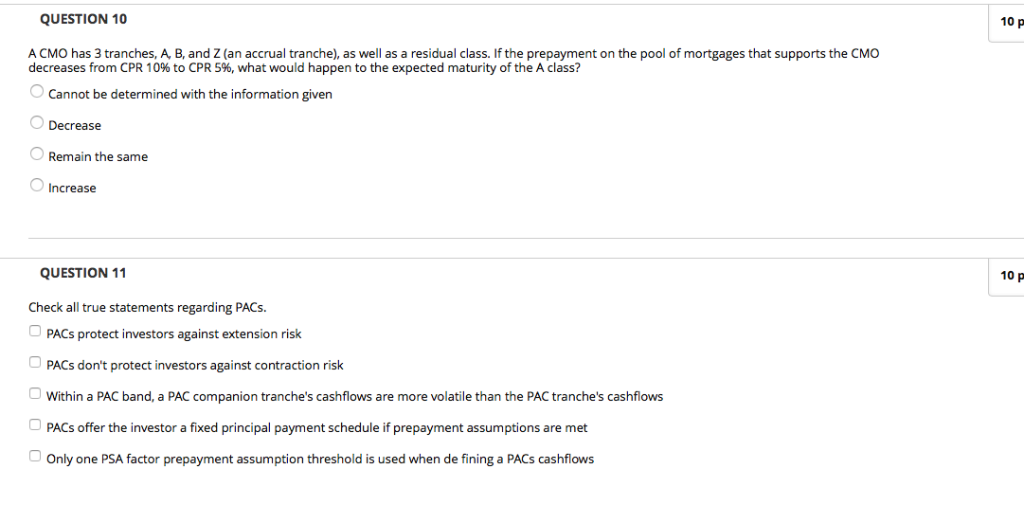

QUESTION 10 10 p A CMO has 3 tranches, A, B, and Z an accrual tranche as well as a residual class. If the prepayment on the pool of mortgages that supports the CMO decreases from CPR 10% to CPR 596, what would happen to the expected maturity of the A class? Cannot be determined with the information given Decrease Remain the same Increase QUESTION 11 Check all true statements regarding PACs. PACS protect investors against extension risik 10 p PACs don't protect investors against contraction risk Within a PAC band, a PAC companion tranche's cashflows are more volatile than the PAC tranche's cashflows PACs offer the investor a fixed principal payment schedule if prepayment assumptions are met Only one PSA factor prepayment assumption threshold is used when de fining a PACs cashflows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts