Question: QUESTION 2 A CMO has 3 tranches, A, B, and Z (an accrual tranche), as well as a residual class. If the prepayment in the

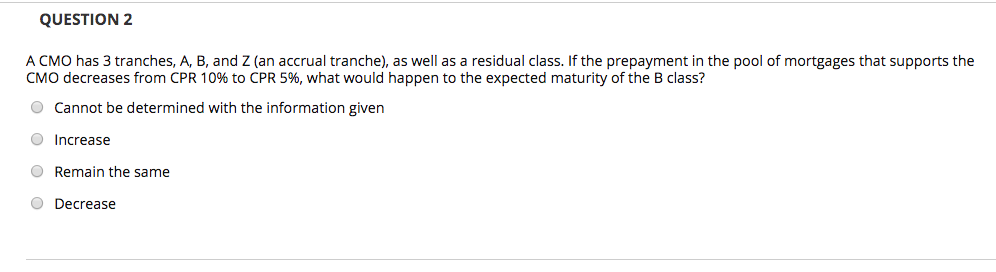

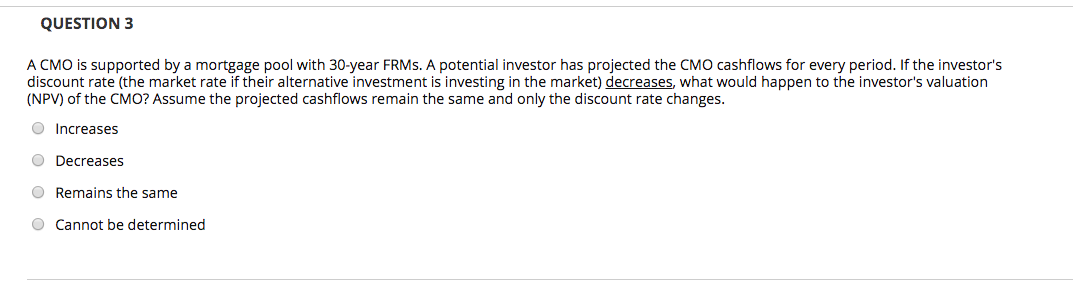

QUESTION 2 A CMO has 3 tranches, A, B, and Z (an accrual tranche), as well as a residual class. If the prepayment in the pool of mortgages that supports the CMO decreases from CPR 10% to CPR 5%, what would happen to the expected maturity of the B class? Cannot be determined with the information given Increase Remain the same O Decrease QUESTION 3 A CMO is supported by a mortgage pool with 30-year FRMs. A potential investor has projected the CMO cashflows for every period. If the investor's discount rate (the market rate if their alternative investment is investing in the market) decreases, what would happen to the investor's valuation (NPV) of the CMO? Assume the projected cashflows remain the same and only the discount rate changes. O Increases O Decreases Remains the same Cannot be determined QUESTION 2 A CMO has 3 tranches, A, B, and Z (an accrual tranche), as well as a residual class. If the prepayment in the pool of mortgages that supports the CMO decreases from CPR 10% to CPR 5%, what would happen to the expected maturity of the B class? Cannot be determined with the information given Increase Remain the same O Decrease QUESTION 3 A CMO is supported by a mortgage pool with 30-year FRMs. A potential investor has projected the CMO cashflows for every period. If the investor's discount rate (the market rate if their alternative investment is investing in the market) decreases, what would happen to the investor's valuation (NPV) of the CMO? Assume the projected cashflows remain the same and only the discount rate changes. O Increases O Decreases Remains the same Cannot be determined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts