Question: QUESTION 10 10 points Save Answer Portfolio Performance Consider a portfolio with 5122 invested in Stock A, 5240 invested in Stock Band 5332 invested in

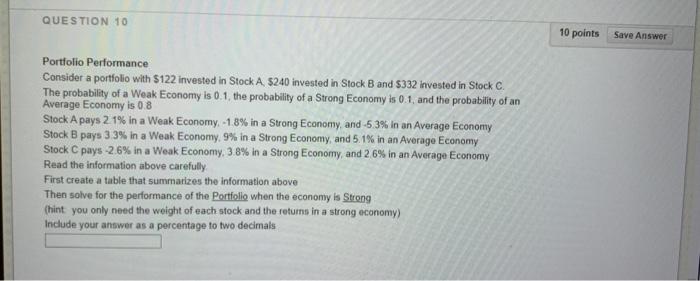

QUESTION 10 10 points Save Answer Portfolio Performance Consider a portfolio with 5122 invested in Stock A, 5240 invested in Stock Band 5332 invested in Stock C. The probability of a Weak Economy is 0.1, the probability of a Strong Economy is 0.1, and the probability of an Average Economy is 0.8 Stock A pays 21% in a Weak Economy. -1.8% in a Strong Economy, and -5.3% in an Average Economy Stock B pays 3.3% in a Weak Economy, 9% in a Strong Economy, and 5.1% in an Average Economy Stock C pays -26% in a Weak Economy 3 8% in a Strong Economy, and 2.6% in an Average Economy Read the information above carefully First create a table that summarizes the information above Then solve for the performance of the Portfolio when the economy is Strong (hint you only need the weight of each stock and the returns in a strong economy) Include your answer as a percentage to two decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts