Question: Question Completion Status: QUESTION 9 10 points Save Answer Calculate the Weight of a stock in a portfolio. Imagine you hold 4 stocks in your

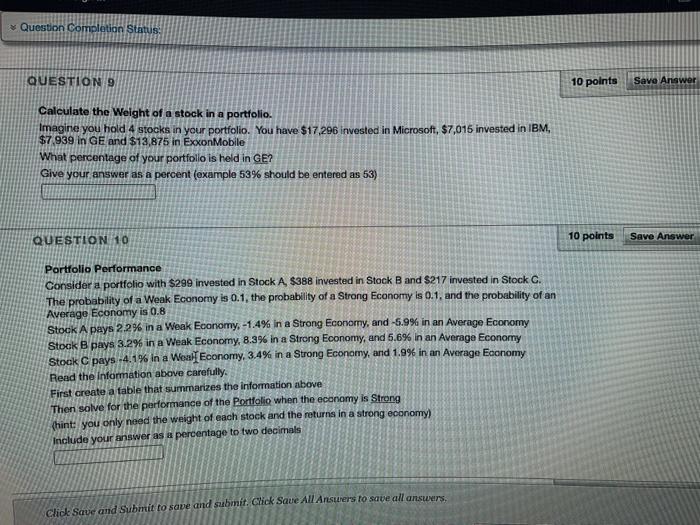

Question Completion Status: QUESTION 9 10 points Save Answer Calculate the Weight of a stock in a portfolio. Imagine you hold 4 stocks in your portfolio. You have $17,296 invested in Microsoft, $7,015 invested in IBM. $7.939 in GE and $13,875 in ExxonMobile What percentage of your portfolio is held in GE? Give your answer as a percent (example 53% should be entered as 53) QUESTION 10 10 points Save Answer Portfolio Performance Consider a portfolio with $299 invested in Stock A $388 invested in Stock Band $217 invested in Stock C. The probability of a Weak Economy is 0.1, the probability of a Strong Economy is 0.1, and the probability of an Average Economy is 0.8 Stock A pays 22% in a Weak Economy. -1.4% in a Strong Economy, and -5.996 in an Average Economy Stock B pays 3.2% in a Weak Economy, 8.3% in a Strong Economy, and 5.6% in an Average Economy Stock C pays -4.1% in a Woal Economy, 3.4% in a Strong Economy, and 1.9% in an Average Economy Read the information above carefully First create a fable that summarizes the information above Then solve for the performance of the Portfolio when the economy is Strong (hint: you only need the weight of each stock and the returns in a strong economy) Include your answer as a percentage to two decimals Click Save and Submit to save and submit. Click Save All Ansurers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts