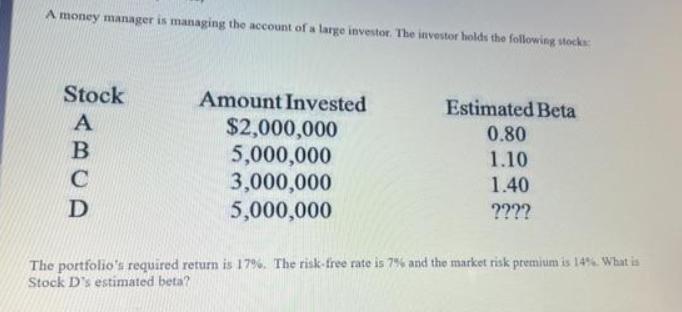

Question: A money manager is managing the account of a large investor. The investor holds the following stocks Stock Amount Invested Estimated Beta $2,000,000 5,000,000

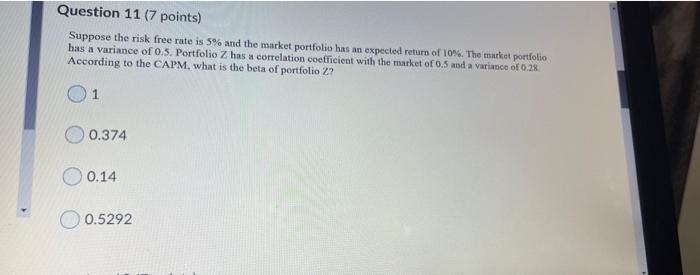

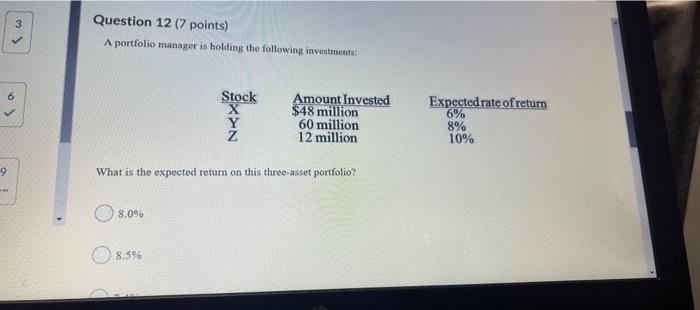

A money manager is managing the account of a large investor. The investor holds the following stocks Stock Amount Invested Estimated Beta $2,000,000 5,000,000 3,000,000 5,000,000 0.80 1.10 C 1.40 ???? The portfolio's required return is 17%. The risk-free rate is 7% and the market risk premium is 14% What is Stock D's estimated beta? Question 11 (7 points) Suppose the risk free rate is 5% and the market portfolio has an expected return of 10%. The market portfolio has a variance of 0.5. Portfolio Z has a correlation coefficient with the market of0.5 and a variance of 0.28 According to the CAPM, what is the beta of portfolio 2? 0.374 0.14 O 0.5292 3 Question 12 (7 points) A portfolio manager is holding the following investments: Stock Amount Invested $48 million 60 million 12 million Expected rate of return 6% 8% 10% 6. What is the expected return on this three-asset portfolio? 8,0% O 8.5%

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Portfolio beta is found from the CAPM 17 7 14 7bp bp 14286 1 The portfolio beta is a weighte... View full answer

Get step-by-step solutions from verified subject matter experts