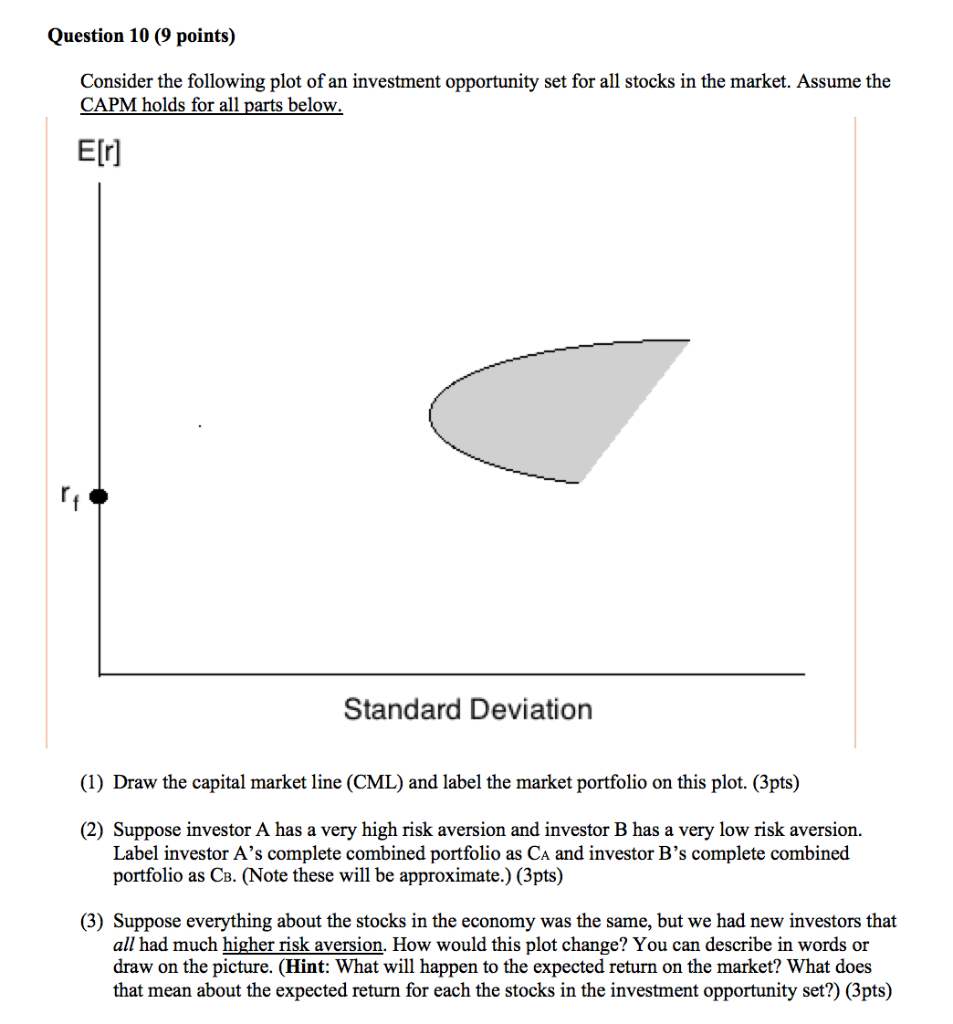

Question: Question 10 9 points) Consider the following plot of an investment opportunity set for all stocks in the market. Assume the CAPM holds for all

Question 10 9 points) Consider the following plot of an investment opportunity set for all stocks in the market. Assume the CAPM holds for all parts below Elrl Standard Deviation (1) Draw the capital market line (CML) and label the market portfolio on this plot. (3pts) (2) Suppose investor A has a very high risk aversion and investor B has a very low risk aversion. Label investor A's complete combined portfolio as Ca and investor B's complete combined portfolio as CB. (Note these will be approximate.) (3pts) (3) Suppose everything about the stocks in the economy was the same, but we had new investors that all had much higher risk aversion. How would this plot change? You can describe in words or draw on the picture. (Hint: What will happen to the expected return on the market? What does that mean about the expected return for each the stocks in the investment opportunity set?) (3pts) Question 10 9 points) Consider the following plot of an investment opportunity set for all stocks in the market. Assume the CAPM holds for all parts below Elrl Standard Deviation (1) Draw the capital market line (CML) and label the market portfolio on this plot. (3pts) (2) Suppose investor A has a very high risk aversion and investor B has a very low risk aversion. Label investor A's complete combined portfolio as Ca and investor B's complete combined portfolio as CB. (Note these will be approximate.) (3pts) (3) Suppose everything about the stocks in the economy was the same, but we had new investors that all had much higher risk aversion. How would this plot change? You can describe in words or draw on the picture. (Hint: What will happen to the expected return on the market? What does that mean about the expected return for each the stocks in the investment opportunity set?) (3pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts