Question: Question 10 Assume a $1,000 face value bond has a coupon rate of 7.7 percent paid semiannually and has an eight-year life. (a) If investors

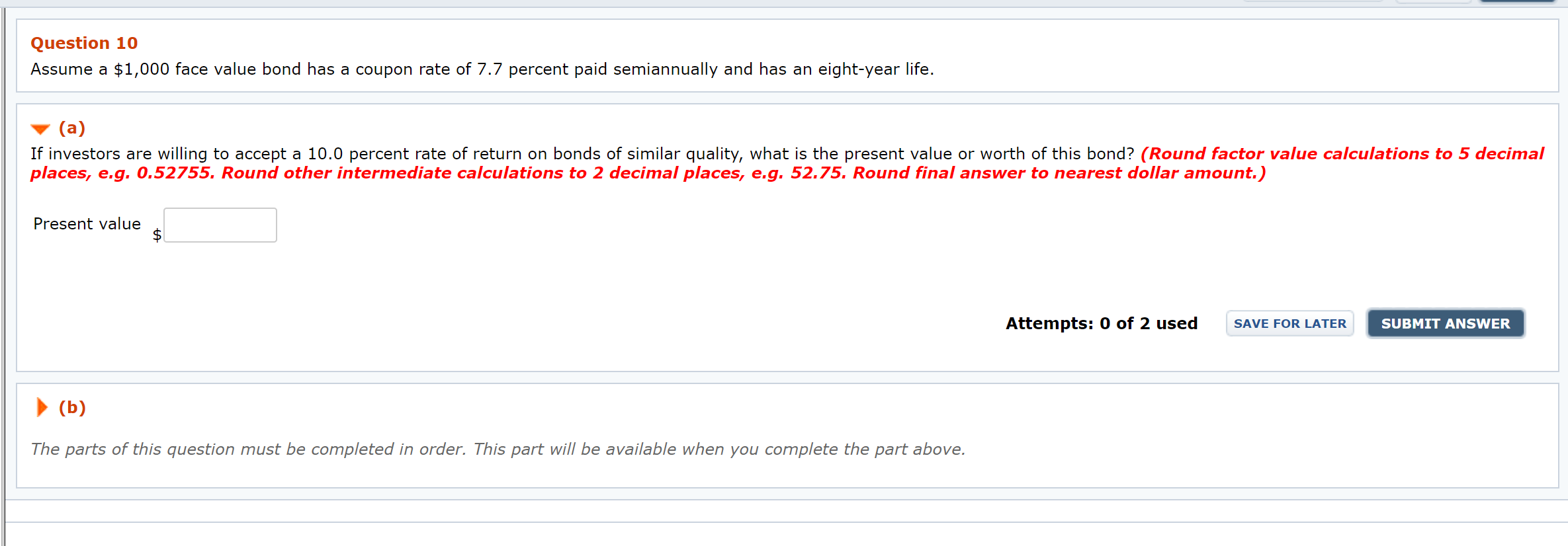

Question 10 Assume a $1,000 face value bond has a coupon rate of 7.7 percent paid semiannually and has an eight-year life. (a) If investors are willing to accept a 10.0 percent rate of return on bonds of similar quality, what is the present value or worth of this bond? (Round factor value calculations to 5 decimal places, e.g. 0.52755. Round other intermediate calculations to 2 decimal places, e.g. 52.75. Round final answer to nearest dollar amount.) Present value $ Attempts: 0 of 2 used SAVE FOR LATER SUBMIT ANSWER (b) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts