Question: QUESTION 10 Over/UnderValued When you use the dividend discount model to estimate the value or stock, this value can be compared to the value trading

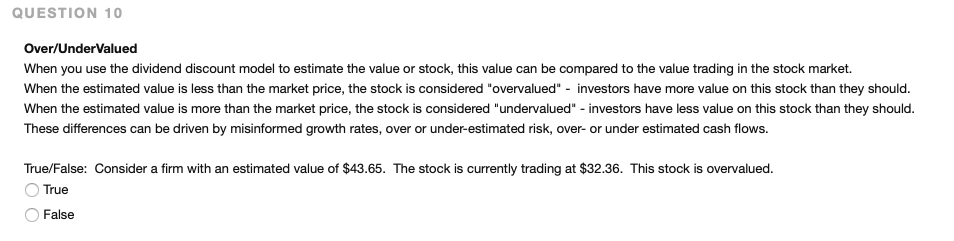

QUESTION 10 Over/UnderValued When you use the dividend discount model to estimate the value or stock, this value can be compared to the value trading in the stock market. When the estimated value is less than the market price, the stock is considered "overvalued" - investors have more value on this stock than they should. When the estimated value is more than the market price, the stock is considered undervalued" - investors have less value on this stock than they should. These differences can be driven by misinformed growth rates, over or under-estimated risk, over- or under estimated cash flows. True/False: Consider a firm with an estimated value of $43.65. The stock is currently trading at $32.36. This stock is overvalued. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts