Question: Question 10: Portfolio Performance Evaluation; International Diversification (a) Consider the following information regarding the performance of a portfolio manager and of a relevant benchmark in

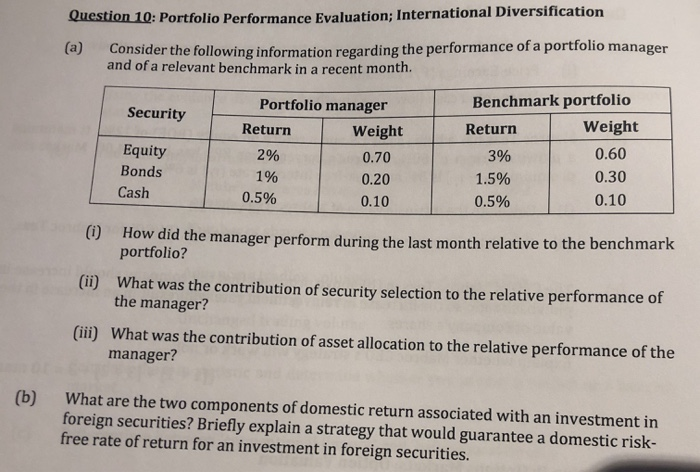

Question 10: Portfolio Performance Evaluation; International Diversification (a) Consider the following information regarding the performance of a portfolio manager and of a relevant benchmark in a recent month. Benchmark portfolio Portfolio manager Security Weight Return Return Weight Equity 0.60 2% 3% 0.70 Bonds 1% 0.30 1.5% 0.20 Cash 0.5% 0.10 0.10 0.5% (i How did the manager perform during the last month relative to the benchmark portfolio? (ii) What was the contribution of security selection to the relative performance of the manager? (iii) What was the contribution of asset allocation to the relative performance of the manager? (b) What are the two components of domestic return associated with an investment in foreign securities? Briefly explain a strategy that would guarantee a domestic risk- free rate of return for an investment in foreign securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts