Question: question 10.11 and 7 Question 10 (1 point) Calculated the supplies used during the year: Supplies on hand, beginning of year $170 Supplies purchased during

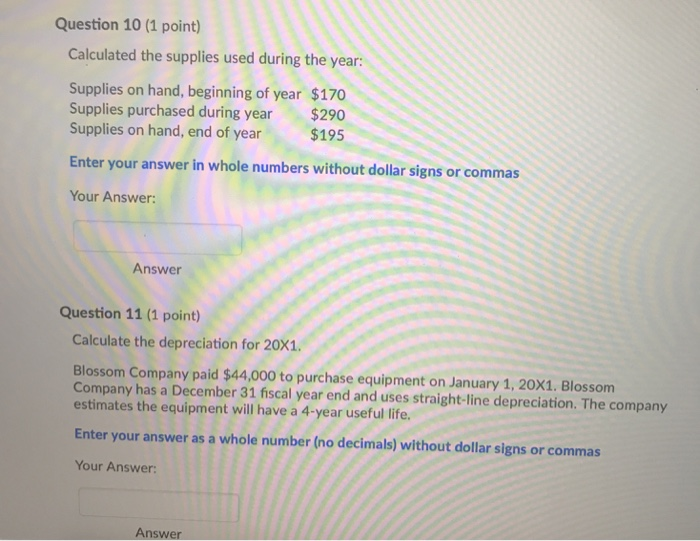

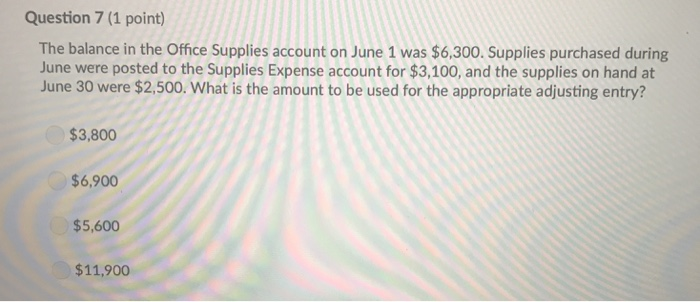

Question 10 (1 point) Calculated the supplies used during the year: Supplies on hand, beginning of year $170 Supplies purchased during year $290 Supplies on hand, end of year $195 Enter your answer in whole numbers without dollar signs or commas Your Answer: Answer Question 11 (1 point) Calculate the depreciation for 20X1. Blossom Company paid $44,000 to purchase equipment on January 1, 20X1. Blossom Company has a December 31 fiscal year end and uses straight-line depreciation. The company estimates the equipment will have a 4-year useful life. Enter your answer as a whole number (no decimals) without dollar signs or commas Your Answer Answer Question 7 (1 point) The balance in the Office Supplies account on June 1 was $6,300. Supplies purchased during June were posted to the Supplies Expense account for $3,100, and the supplies on hand at June 30 were $2,500. What is the amount to be used for the appropriate adjusting entry? $3,800 $6,900 $5,600 $11,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts